Virgin Media 2009 Annual Report Download - page 173

Download and view the complete annual report

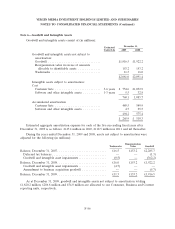

Please find page 173 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 2—Significant Accounting Policies (Continued)

Goodwill and other intangible assets with indefinite lives are allocated to various reporting units,

which are the operating segments. For purposes of performing the impairment test of goodwill during

the years ended December 31, 2008 and 2007, we established the following reporting units: Cable,

Mobile, Virgin Media TV and sit-up. We compared the fair value of the reporting unit to its carrying

amount on an annual basis to determine if there was potential goodwill impairment. We evaluated our

former Cable reporting unit for impairment on an annual basis as at December 31, while all other

reporting units were evaluated as at June 30.

During the first quarter of 2009, we realigned our internal reporting structure and the related

financial information utilized by the chief operating decision maker to assess the performance of our

business. As a result, three new operating segments and reporting units were established; Consumer,

Business and Content. Content, which consists of the former Virgin Media TV reporting unit, is

evaluated for impairment purposes as at June 30 while the Consumer and Business reporting units are

evaluated as at October 1 each year.

Intangible assets include trademark license agreements and customer lists. Trademark license

agreements represent the portion of purchase price allocated to agreements to license trademarks

acquired in business combinations. Trademark licenses are amortized over the period in which we

expect to derive benefits, which is principally five years. Customer lists represent the portion of the

purchase price allocated to the value of the customer base acquired in business combinations. Customer

lists are amortized on a straight-line basis over the period in which we expect to derive benefits, which

is principally three to six years.

Asset Retirement Obligations

We account for our obligations under the Waste Electrical and Electronic Equipment Directive

adopted by the European Union in accordance with the Asset Retirement and Environmental

Obligations Topic of the FASB ASC whereby we accrue the cost to dispose of certain of our customer

premises equipment at the time of acquisition.

Impairment of Long-Lived Assets

In accordance with the Property, Plant and Equipment Topic of the FASB ASC, long-lived assets,

including fixed assets and amortizable definite lived intangible assets, are reviewed for impairment

whenever events or changes in circumstances indicate that the carrying amount may not be recoverable.

We assess the recoverability of the carrying value of long-lived assets, by first grouping our long-lived

assets with other assets and liabilities at the lowest level for which identifiable cash flows are largely

independent of the cash flows of other assets and liabilities (the asset group) and, secondly, estimating

the undiscounted future cash flows that are directly associated with and expected to arise from the use

of and eventual disposition of such asset group. We estimate the undiscounted cash flows over the

remaining useful life of the primary asset within the asset group. If the carrying value of the asset

group exceeds the estimated undiscounted cash flows, we record an impairment charge to the extent

the carrying value of the long-lived asset exceeds its fair value. We determine fair value through quoted

market prices in active markets or, if quoted market prices are unavailable, through the performance of

internal analysis of discounted cash flows or external appraisals. The undiscounted and discounted cash

flow analyses are based on a number of estimates and assumptions, including the expected period over

which the asset will be utilized, projected future operating results of the asset group, discount rate and

long term growth rate.

F-77