US Airways 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

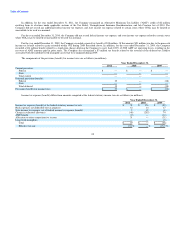

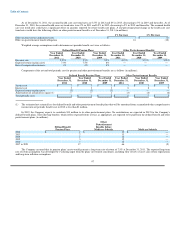

Secured financings are collateralized by assets, primarily aircraft, engines, simulators, rotable aircraft parts, hangar and maintenance facilities and

airport take-off and landing slots. At December 31, 2011, the maturities of long-term debt and capital leases are as follows (in millions):

2012 $ 436

2013 380

2014 1,761

2015 376

2016 275

Thereafter 1,504

$ 4,732

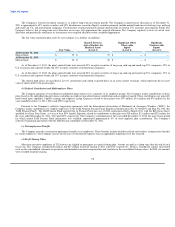

Certain of the Company's long-term debt agreements contain significant minimum cash balance requirements and other covenants with which the

Company was in compliance at December 31, 2011. Certain of the Company's long-term debt agreements contain cross-default provisions, which may be

triggered by defaults by US Airways or US Airways Group under other agreements relating to indebtedness.

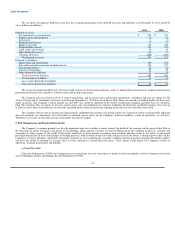

5. Income Taxes

The Company accounts for income taxes using the asset and liability method. The Company files a consolidated federal income tax return with its

wholly owned subsidiaries. The Company and its wholly owned subsidiaries allocate tax and tax items, such as net operating losses ("NOLs") and net tax

credits, between members of the group based on their proportion of taxable income and other items. Accordingly, the Company's tax expense is based on

taxable income, taking into consideration allocated tax loss carryforwards/carrybacks and tax credit carryforwards.

As of December 31, 2011, the Company had approximately $1.95 billion of gross NOLs to reduce future federal taxable income. All of the Company's

NOLs are expected to be available to reduce federal taxable income in the calendar year 2012. The NOLs expire during the years 2024 through 2031. The

Company's net deferred tax assets, which include $1.87 billion of the NOLs, are subject to a full valuation allowance. The Company also had approximately

$82 million of tax-effected state NOLs at December 31, 2011. At December 31, 2011, the federal and state valuation allowances were $347 million and

$61 million, respectively. In accordance with Generally Accepted Accounting Principles ("GAAP"), utilization of the NOLs will result in a corresponding

decrease in the valuation allowance and offset the Company's tax provision dollar for dollar.

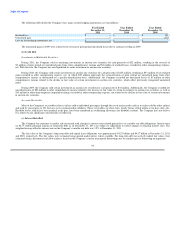

In connection with the sale of the Company's remaining investments in auction rate securities (refer to Note 6(b)), the Company recorded a special non-

cash tax charge of $21 million in 2011. In the fourth quarter of 2009, the Company had recorded in other comprehensive income ("OCI"), a subset of

stockholders' equity, a non-cash tax provision of $21 million. This provision resulted from $56 million of unrealized gains recorded in OCI due to an increase

in the fair value of certain investments in auction rate securities.

The Company has a net deferred tax asset that is subject to a full valuation allowance. Typically, in accordance with GAAP, the reversal of a valuation

allowance on a net deferred tax asset reduces any tax provision generated. However, under GAAP, an exception to the above described tax accounting is

applicable when a company has the following: (1) a net deferred tax asset that is subject to valuation allowance, (2) an income statement loss and (3) net gains

in OCI. In this situation, tax benefits derived from the presence of net gains held in OCI are required to be included in income from operations.

The Company met all three of these conditions in the fourth quarter of 2009. As a result, the $21 million tax benefit resulting from the reversal of the

valuation allowance was recorded in income from operations rather than as an offset to the $21 million tax provision recorded in OCI. Accordingly, in

connection with the sale of the Company's final investments in auction rate securities, the Company recorded a $21 million special non-cash tax charge in

2011, which recognizes in the statement of operations the tax provision recorded in OCI.

91