US Airways 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

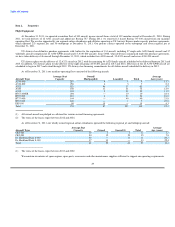

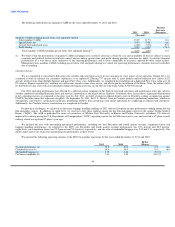

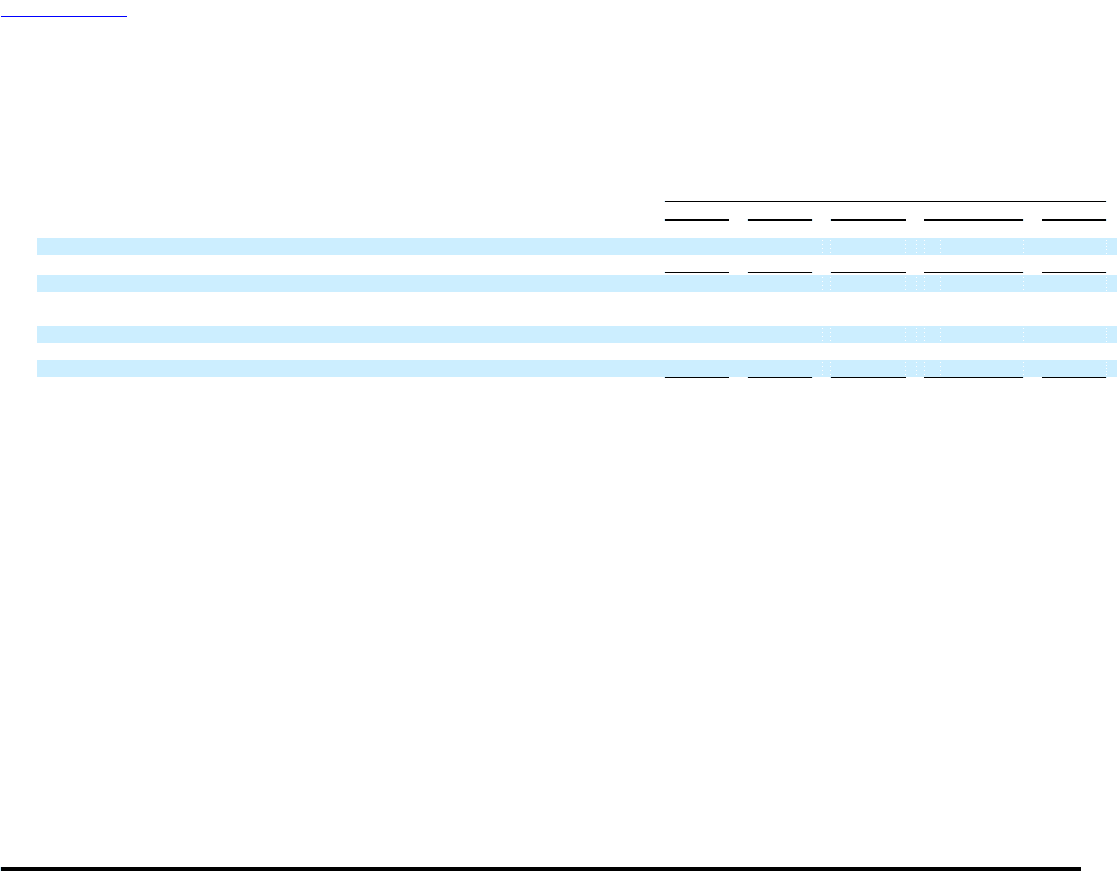

Reconciliation of GAAP to non-GAAP financial measures

We are providing disclosure of the reconciliation of reported non-GAAP financial measures to their comparable financial measures on a GAAP basis.

We believe that the non-GAAP financial measures provide investors the ability to measure financial performance excluding special items, which is more

indicative of our ongoing performance and is more comparable to measures reported by other major airlines.

Year Ended December 31,

2011 2010 2009 2008 2007

(In millions)

Operating income (loss) — GAAP $ 426 $ 781 $ 118 $ (1,800) $ 533

Operating special items, net (a) 26 4 (317) 1,194 (5)

Operating income (loss) excluding special items 452 785 (199) (606) 528

Net income (loss) — GAAP 71 502 (205) (2,215) 423

Operating special items, net (a) 26 4 (317) 1,194 (5)

Nonoperating special items, net (b) (7) (59) 61 213 11

Income tax special items (c) 21 — (38) — 7

Net income (loss) excluding special items $ 111 $ 447 $ (499) $ (808) $ 436

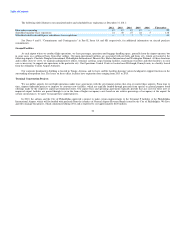

(a) Includes the following operating special charges (credits):

The 2011 period included $21 million in legal costs incurred in connection with the Delta Slot transaction and auction rate securities arbitration,

$3 million in severance costs and $2 million in Express other special charges.

The 2010 period included a $6 million non-cash charge related to the decline in value of certain spare parts, $5 million in aircraft costs related to

capacity reductions and other net special charges of $10 million, which included a settlement and corporate transaction costs. These costs were offset in

part by a $16 million refund of ASIF and a $1 million refund of ASIF for our Express subsidiaries previously paid to the TSA during the years 2005 to

2009.

The 2009 period included $375 million of net unrealized gains on fuel hedging instruments, offset in part by $22 million in aircraft costs as a result of

capacity reductions, $16 million in non-cash impairment charges due to the decline in fair value of certain indefinite lived intangible assets associated

with international routes, $11 million in severance and other charges, $6 million in costs incurred related to the 2009 liquidity improvement program

and $3 million in non-cash charges related to the decline in value of certain Express spare parts.

The 2008 period included a $622 million non-cash charge to write off all of the goodwill created by the merger of US Airways Group and America

West Holdings in September 2005, as well as $496 million of net unrealized losses on fuel hedging instruments. In addition, the 2008 period included

$35 million of merger-related transition expenses, $18 million in non-cash charges related to the decline in fair value of certain spare parts associated

with our Boeing 737 aircraft fleet and, as a result of capacity reductions, $14 million in aircraft costs and $9 million in severance charges.

The 2007 period included $187 million of net unrealized gains on fuel hedging instruments, $7 million in tax credits due to an IRS rule change allowing

us to recover certain fuel usage tax amounts for years 2003-2006, $9 million of insurance settlement proceeds related to business interruption and

property damages incurred as a result of Hurricane Katrina in 2005 and a $5 million Piedmont pilot pension curtailment gain related to the FAA-

mandated pilot retirement age change. These credits were offset in part by $99 million of merger-related transition expenses, a $99 million charge for

an increase to long-term disability obligations for US Airways' pilots as a result of the FAA-mandated pilot retirement age change and $5 million in

charges related to reduced flying from Pittsburgh.

35