US Airways 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

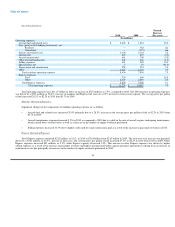

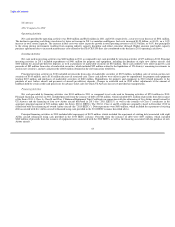

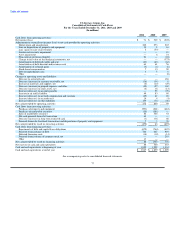

Contractual Obligations

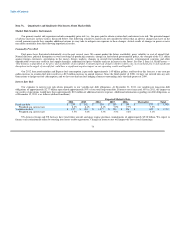

The following table provides details of our future cash contractual obligations as of December 31, 2011 (in millions):

Payments Due by Period

2012 2013 2014 2015 2016 Thereafter Total

US Airways Group (1)

Debt (2) $ 16 $ 16 $ 1,376 $ 100 $ — $ 35 $ 1,543

Interest obligations (3) 57 56 32 5 3 20 173

US Airways (4)

Debt and capital lease obligations (5) (6) 420 364 385 276 275 1,469 3,189

Interest obligations (3) (6) 171 148 123 102 136 268 948

Aircraft purchase and operating lease commitments (7) 1,663 2,002 1,668 1,076 679 4,307 11,395

Regional capacity purchase agreements (8) 1,062 997 995 854 526 741 5,175

Other US Airways Group subsidiaries (9) 11 8 6 1 — — 26

Total $ 3,400 $ 3,591 $ 4,585 $ 2,414 $ 1,619 $ 6,840 $ 22,449

(1) These commitments represent those entered into by US Airways Group.

(2) Excludes $95 million of unamortized debt discount as of December 31, 2011.

(3) For variable-rate debt, future interest obligations are shown above using interest rates in effect as of December 31, 2011.

(4) These commitments represent those entered into by US Airways.

(5) Excludes $71 million of unamortized debt discount as of December 31, 2011.

(6) Includes $1.28 billion of future principal payments and $513 million of future interest payments as of December 31, 2011, respectively, related to pass

through trust certificates or EETCs associated with mortgage financings for the purchase of certain aircraft as described under "Off-Balance Sheet

Arrangements" and in Note 9(c) to US Airways Group's and Note 8(c) to US Airways' consolidated financial statements in Item 8A and 8B of this

report, respectively.

(7) Includes $2.67 billion of future minimum lease payments related to EETC leveraged leased financings of certain aircraft as of December 31, 2011, as

described under "Off-Balance Sheet Arrangements" and in Note 9(c) to US Airways Group's and Note 8(c) to US Airways' consolidated financial

statements in Item 8A and 8B of this report, respectively.

(8) Represents minimum payments under capacity purchase agreements with third-party Express carriers. These commitments are estimates of costs based

on assumed minimum levels of flying under the capacity purchase agreements and our actual payments could differ materially.

(9) Represents operating lease commitments entered into by US Airways Group's other airline subsidiaries, Piedmont and PSA.

In light of our significant financial commitments related to, among other things, new aircraft and the servicing and amortization of existing debt and

equipment leasing arrangements, we regularly consider and enter into negotiations related to capital raising activity, which may include the entry into leasing

transactions and future issuances of secured or unsecured debt obligations or additional equity securities, in public or private offerings or otherwise. The cash

available to us from operations and these sources, however, may not be sufficient to cover these cash obligations because economic factors may reduce the

amount of cash generated by operations or increase our costs. For instance, an economic downturn or general global instability caused by military actions,

terrorism, disease outbreaks and natural disasters could reduce the demand for air travel, which would reduce the amount of cash generated by operations. An

increase in our costs, either due to an increase in borrowing costs caused by a reduction in our credit rating or a general increase in interest rates or due to an

increase in the cost of fuel, maintenance, aircraft and aircraft engines and parts, could decrease the amount of cash available to cover the cash obligations.

Moreover, the Citicorp credit facility, our amended credit card agreement with Barclays Bank Delaware and certain of our other financing arrangements

contain significant minimum cash balance requirements. As a result, we cannot use all of our available cash to fund operations, capital expenditures and cash

obligations without violating these requirements.

69