US Airways 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In addition, separate labor contracts cover the pilots and the flight attendants employed by Piedmont and PSA. Each of those agreements is currently

amendable and is currently being negotiated. In November 2010, the Communications Workers of America was certified to represent the 3,100 passenger

service employees working for Piedmont, and negotiations for an initial collective bargaining agreement covering those employees are now underway.

There are few remaining unrepresented employee groups that could engage in organization efforts. We cannot predict the outcome of any future efforts

to organize those remaining employees or the terms of any future labor agreements or the effect, if any, on US Airways' operations or financial performance.

For more discussion, see Part I, Item 1A, Risk Factors — "Union disputes, employee strikes and other labor-related disruptions may adversely affect our

operations."

Aviation Fuel

The average cost of a gallon of aviation fuel for our mainline and Express operations increased 38.2% from 2010 to 2011, and our total mainline and

Express fuel expense increased $1.28 billion, or 40.5%, from 2010 to 2011. We estimate that a one cent per gallon increase in aviation fuel prices would result

in a $15 million increase in annual expense based on our 2012 forecasted mainline and Express fuel consumption.

Since the third quarter of 2008, we have not entered into any new transactions to hedge our fuel consumption, and we have not had any fuel hedging

contracts outstanding since the third quarter of 2009.

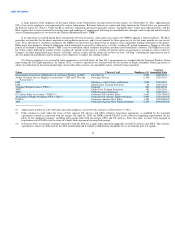

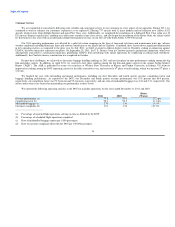

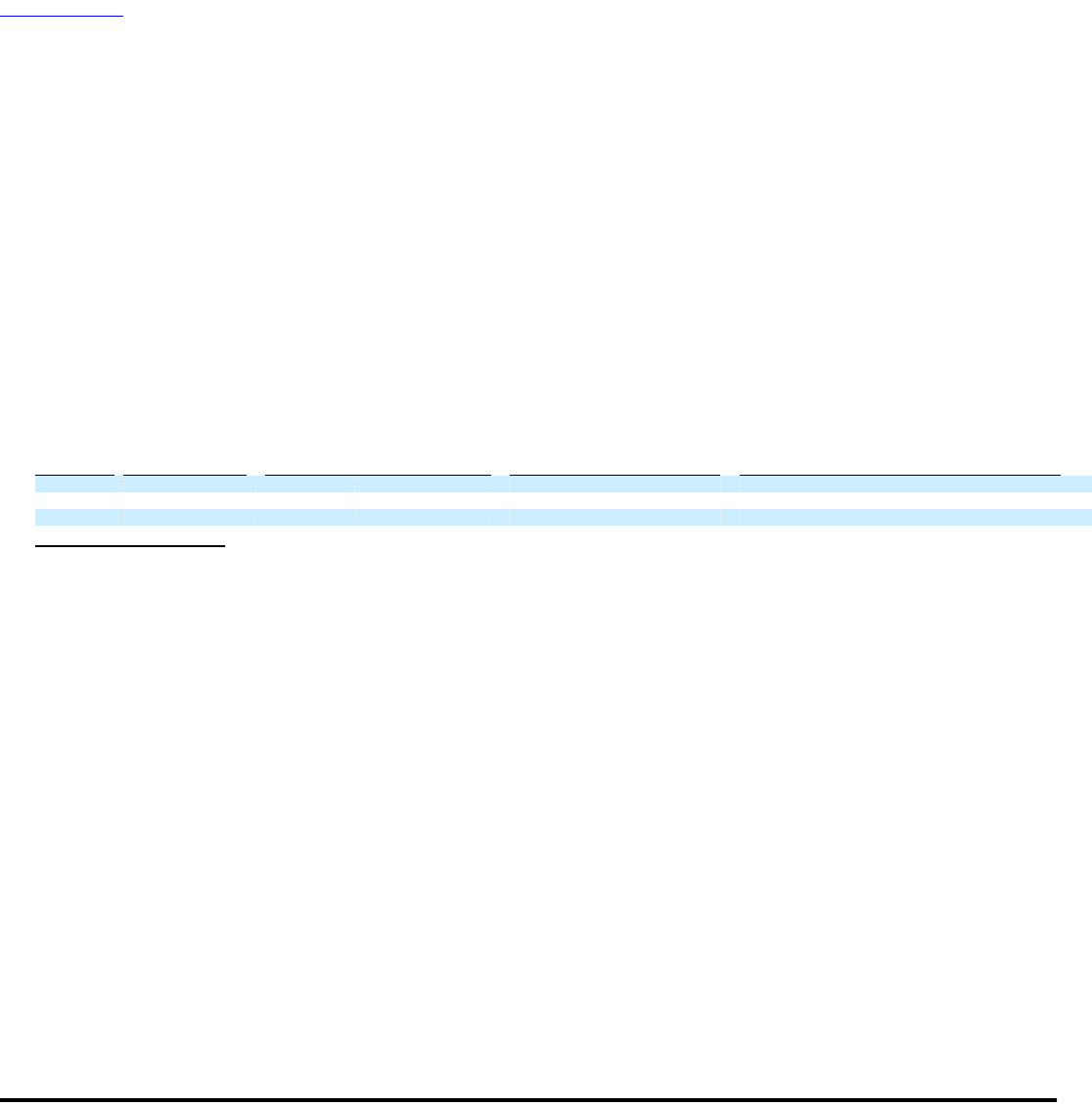

The following table shows annual aircraft fuel consumption and costs for our mainline operations for 2009 through 2011 (gallons and aircraft fuel

expense in millions):

Average Price Aircraft Fuel Percentage of Total

Year Gallons per Gallon (1) Expense (1) Operating Expenses

2011 1,095 $ 3.11 $ 3,400 35.8%

2010 1,073 2.24 2,403 28.6%

2009 1,069 1.74 1,863 23.8%

(1) Includes fuel taxes and excludes the impact of fuel hedges. The impact of fuel hedges for 2009 is described in Part II, Item 7 under "US Airways

Group's Results of Operations" and "US Airways' Results of Operations."

In addition, we incur fuel expenses related to our Express operations. Total fuel expenses for US Airways Group's wholly owned regional airlines and

affiliate regional airlines operating under capacity purchase agreements as US Airways Express for the years ended December 31, 2011, 2010 and 2009 were

$1.06 billion, $769 million and $609 million, respectively.

Fuel prices have fluctuated substantially over the past several years. We cannot predict the future availability, price volatility or cost of aircraft fuel.

Natural disasters, political disruptions or wars involving oil-producing countries, changes in fuel-related governmental policy, the strength of the U.S. dollar

against foreign currencies, speculation in the energy futures markets, changes in aircraft fuel production capacity, environmental concerns and other

unpredictable events may result in fuel supply shortages, additional fuel price volatility and cost increases in the future. See Part I, Item 1A, Risk Factors —

"Our business is dependent on the price and availability of aircraft fuel. Continued periods of high volatility in fuel costs, increased fuel prices and significant

disruptions in the supply of aircraft fuel could have a significant negative impact on our operating results and liquidity."

Insurance

We maintain insurance of the types that we believe are customary in the airline industry. Principal coverage includes liability for injury to members of

the public, including passengers, damage to property of US Airways Group, its subsidiaries and others, and loss of or damage to flight equipment, whether on

the ground or in flight. We also maintain other types of insurance such as workers' compensation and employer's liability, with limits and deductibles that we

believe are standard within the industry.

Since September 11, 2001, we and other airlines have been unable to obtain coverage for liability to persons other than employees and passengers for

claims resulting from acts of terrorism, war or similar events, which is called war risk coverage, at reasonable rates from the commercial insurance market.

US Airways, therefore, purchased its war risk coverage through a special program administered by the FAA, as have most other U.S. airlines. The Emergency

Wartime Supplemental Appropriations Act extended this insurance protection until August 2005. The program was subsequently extended, with the same

conditions and premiums, until September 30, 2012. If the federal insurance program terminates, we would likely face a material increase in the cost of war

risk coverage, and because of competitive pressures in the industry, our ability to pass this additional cost to passengers may be limited.

13