US Airways 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(p) Stock-based Compensation

The Company accounts for its stock-based compensation expense based on the fair value of the stock award at the time of grant, which is recognized

ratably over the vesting period of the stock award. The fair value of stock options and stock appreciation rights is estimated using a Black-Scholes option

pricing model. The fair value of restricted stock units is based on the market price of the underlying shares of common stock on the date of grant. See Note 14

for further discussion of stock-based compensation.

(q) Foreign Currency Gains and Losses

Foreign currency gains and losses are recorded as part of other nonoperating expense, net in the Company's consolidated statements of operations.

Foreign currency losses for the years ended December 31, 2011, 2010 and 2009 were $17 million, $17 million and $3 million, respectively.

(r) Other Operating Expenses

Other operating expenses includes expenses associated with ground and cargo handling, crew travel, aircraft food and catering, US Airways' frequent

flier program, passenger reaccommodation, airport security, international navigation fees and certain general and administrative expenses.

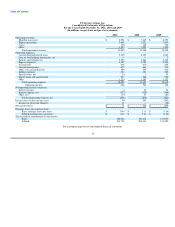

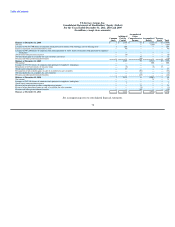

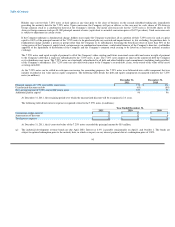

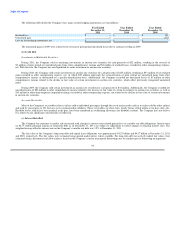

(s) Express Expenses

Expenses associated with the Company's wholly owned regional airlines and affiliate regional airlines operating as US Airways Express are classified

as Express expenses on the consolidated statements of operations. Express expenses consist of the following (in millions):

Year Ended Year Ended Year Ended

December 31, December 31, December 31,

2011 2010 2009

Aircraft fuel and related taxes $ 1,056 $ 769 $ 609

Salaries and related costs 274 257 246

Capacity purchases (a) 1,029 1,065 1,059

Aircraft rent 51 51 51

Aircraft maintenance 188 89 81

Other rent and landing fees 139 129 121

Selling expenses 175 173 154

Special items, net 2 (1) 3

Depreciation and amortization 25 25 25

Other expenses 188 172 170

Express expenses $ 3,127 $ 2,729 $ 2,519

(a) For the years ended December 31, 2011, 2010 and 2009, the component of capacity purchase expenses related to aircraft deemed to be leased was

approximately $300 million, $320 million and $330 million, respectively.

84