US Airways 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

13. Stock-based Compensation

In June 2011, the stockholders of US Airways Group approved the 2011 Incentive Award Plan (the "2011 Plan"). The 2011 Plan replaces and

supersedes the 2008 Equity Incentive Plan (the "2008 Plan"). No additional awards will be made under the 2008 Plan. Awards may be in the form of an

option, restricted stock award, restricted stock unit award, performance award, dividend equivalents award, deferred stock award, deferred stock unit award,

stock payment award or stock appreciation right.

The 2011 Plan authorizes the grant of awards for the issuance of 15,157,626 shares plus any shares that are forfeited or lapse unexercised from the 2008

Plan and the 2005 Equity Incentive Plan (collectively "Prior Plans") after June 10, 2011. Further, no more than 12,500,000 shares plus any full value shares

that are forfeited from the Prior Plans may be granted as full value awards. A full value award is any award other than an option, stock appreciation right or

award for which the intrinsic value is paid upon exercise. Cash-settled awards do not reduce the number of shares available for issuance under the 2011 Plan.

Shares underlying stock awards granted under the 2011 Plan that are forfeited or expire without the shares being issued are again available to be issued under

the 2011 Plan. Any shares (i) tendered by a participant or withheld by US Airways Group for payment of the exercise price under an option (ii) tendered by a

participant or withheld by US Airways Group to satisfy any tax withholding obligation with respect to an award and (iii) subject to a stock appreciation right

that are not issued upon exercise will not be available for future grants of awards under the 2011 Plan. In addition, the cash proceeds from option exercises

will not be used to repurchase shares on the open market for reuse under the 2011 Plan.

US Airways' net income (loss) for the years ended December 31, 2011, 2010 and 2009 included $5 million, $31 million and $23 million, respectively,

of stock-based compensation costs. Stock-based compensation costs related to stock-settled awards were $8 million, $13 million and $20 million in 2011,

2010 and 2009, respectively. Stock-based compensation costs related to cash-settled awards were a credit of $3 million in 2011 and an expense of $18 million

and $3 million in 2010 and 2009, respectively.

Restricted Stock Unit Awards — As of December 31, 2011, US Airways Group has outstanding restricted stock unit awards with service conditions and

a three-year vesting period. The grant-date fair value of restricted stock unit awards is equal to the market price of the underlying shares of US Airways

Group's common stock on the date of grant and is expensed on a straight-line basis over the vesting period for the entire award. Stock-settled restricted stock

unit awards ("RSUs") are classified as equity awards as the vesting results in the issuance of shares of US Airways Group's common stock. Cash-settled

restricted stock unit awards ("CRSUs") are classified as liability awards as the vesting results in payment of cash by US Airways.

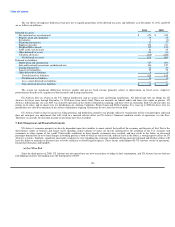

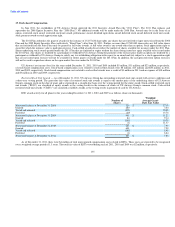

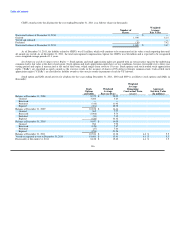

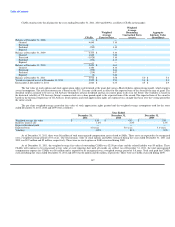

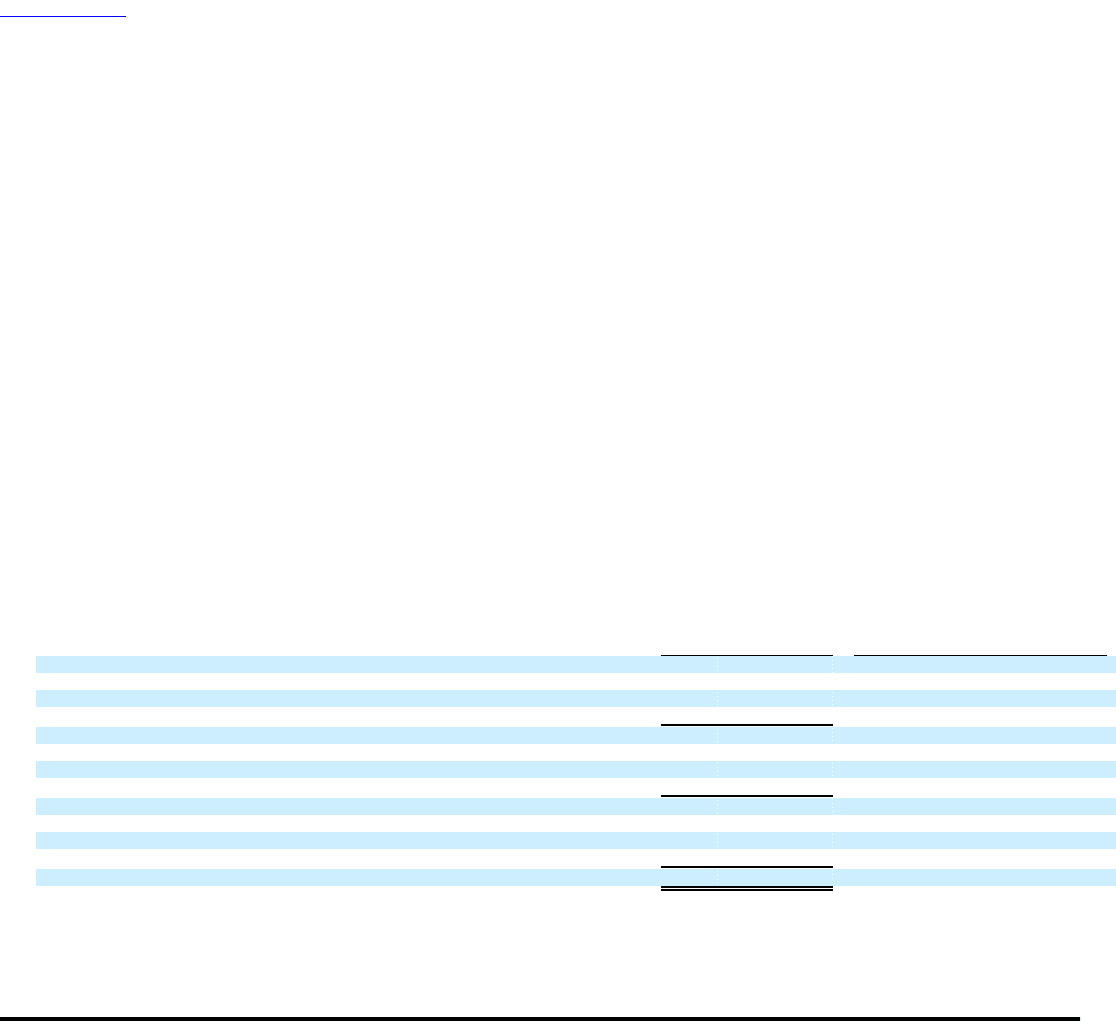

RSU award activity for all plans for the years ending December 31, 2011, 2010 and 2009 is as follows (shares in thousands):

Weighted

Number of Average Grant-

Shares Date Fair Value

Nonvested balance at December 31, 2008 724 $ 17.10

Granted 280 3.44

Vested and released (512) 15.03

Forfeited (29) 15.76

Nonvested balance at December 31, 2009 463 $ 11.22

Granted 84 9.14

Vested and released (303) 15.35

Forfeited (1) 11.37

Nonvested balance at December 31, 2010 243 $ 7.99

Granted 601 7.99

Vested and released (188) 8.40

Forfeited (1) 8.84

Nonvested balance at December 31, 2011 655 $ 7.88

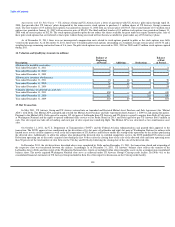

As of December 31, 2011, there were $4 million of total unrecognized compensation costs related to RSUs. These costs are expected to be recognized

over a weighted average period of 1.3 years. The total fair value of RSUs vested during each of 2011, 2010 and 2009 was $2 million, respectively.

135