US Airways 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

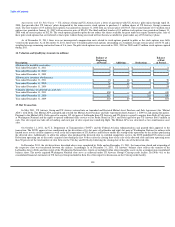

The fair value of the LaGuardia slots transferred to Delta in exchange for the Washington National slots and related cash payment was $223 million,

which resulted in a $147 million gain. Due to the DOT restrictions preventing operating use of the LaGuardia slots acquired by Delta, the gain was fully

deferred as of December 31, 2011 and is included within other current liabilities on the accompanying consolidated balance sheet. US Airways will recognize

the $147 million gain in the periods in which the DOT operating restrictions lapse. US Airways expects to recognize approximately $73 million of the gain in

the first quarter of 2012 and $74 million in the third quarter of 2012.

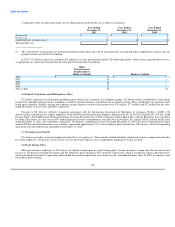

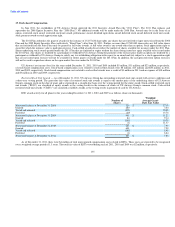

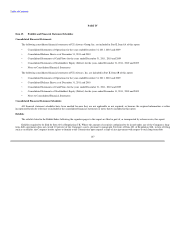

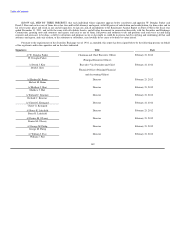

16. Selected Quarterly Financial Information (unaudited)

Summarized quarterly financial information for 2011 and 2010 is as follows (in millions):

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

2011

Operating revenues $ 2,994 $ 3,544 $ 3,476 $ 3,195

Operating expenses 3,024 3,365 3,299 3,087

Operating income (loss) (30) 179 177 108

Nonoperating expenses, net (53) (60) (56) (66)

Income tax provision (benefit) — — 21 (2)

Net income (loss) (83) 119 100 44

2010

Operating revenues $ 2,685 $ 3,209 $ 3,217 $ 2,944

Operating expenses 2,695 2,847 2,906 2,826

Operating income (loss) (10) 362 311 118

Nonoperating expenses, net (13) (67) (47) (54)

Income tax provision — — 1 —

Net income (loss) (23) 295 263 64

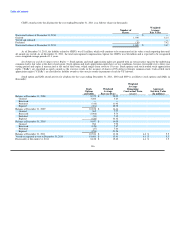

US Airways' 2011 and 2010 fourth quarter results were impacted by recognition of the following net special items:

Fourth quarter 2011 operating expenses included $2 million in legal costs incurred in connection with auction rate securities arbitration.

Fourth quarter 2010 operating expenses included a $6 million non-cash charge related to the decline in value of certain spare parts. Nonoperating

expenses, net included an $11 million settlement gain, offset in part by $5 million in non-cash charges related to the write off of debt issuance costs.

139