US Airways 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

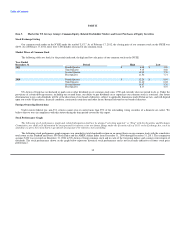

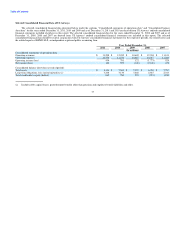

(a) Percentage of reported flight operations arriving on time as defined by the DOT.

(b) Percentage of scheduled flight operations completed.

(c) Rate of mishandled baggage reports per 1,000 passengers.

(d) Rate of customer complaints filed with the DOT per 100,000 passengers.

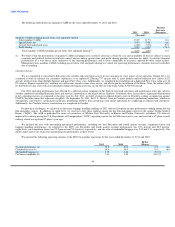

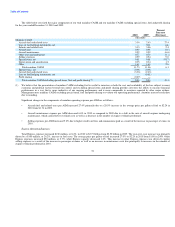

Liquidity Position

We maintained our liquidity position during 2011 despite extraordinarily high fuel costs. As of December 31, 2011, our total cash, cash equivalents,

investments in marketable securities and restricted cash was $2.31 billion, of which $365 million was restricted which was up slightly from $2.28 billion, of

which $364 million was restricted as of December 31, 2010.

December 31, December 31,

2011 2010

(In millions)

Cash and cash equivalents $ 1,947 $ 1,859

Long-term restricted cash 365 364

Investments in marketable securities — 57

Total cash, cash equivalents, investments in marketable securities and restricted cash $ 2,312 $ 2,280

Long-term restricted cash primarily includes cash collateral to secure workers' compensation claims and credit card processing holdback requirements

for advance ticket sales for which US Airways has not yet provided air transportation.

As of December 31, 2010, our investments in marketable securities included $57 million of auction rate securities. During 2011 these investments were

liquidated for proceeds of $52 million. See the notes to the consolidated financial statements included in Part II, Items 8A and 8B, respectively of this report

for additional information on these transactions.

2012 Outlook

Looking forward it is difficult to predict the price of oil, the strength of the economy or the capacity actions of other airlines. Over the past few years we

have taken significant actions to maintain capacity that is in line with demand, realign our network to focus on key markets, introduce new revenue streams,

control costs and continue our commitment to exceptional operating reliability. We intend to continue to maintain our cost and capacity discipline in light of

fuel prices, the state of the economy and general industry conditions.

41