US Airways 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

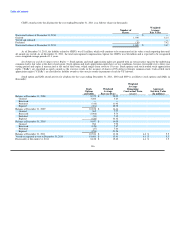

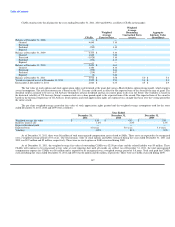

Agreements with the Pilot Union — US Airways Group and US Airways have a letter of agreement with US Airways' pilot union through April 18,

2008, that provides that US Airways' pilots designated by the union receive stock options to purchase 1.1 million shares of US Airways Group's common

stock. The first tranche of 0.5 million stock options was granted on January 31, 2006 with an exercise price of $33.65. The second tranche of 0.3 million stock

options was granted on January 31, 2007 with an exercise price of $56.90. The third and final tranche of 0.3 million stock options was granted on January 31,

2008 with an exercise price of $12.50. The stock options granted to pilots do not reduce the shares available for grant under any equity incentive plan. Any of

these pilot stock options that are forfeited or that expire without being exercised will not become available for grant under any of US Airways' plans.

As of December 31, 2011, there were no unrecognized compensation costs related to stock options granted to pilots as the stock options were fully

vested on the grant date. As of December 31, 2011, there were 0.6 million pilot stock options outstanding at a weighted average exercise price of $34.70 and a

weighted average remaining contractual term of 0.6 years. No pilot stock options were exercised in 2011, 2010 or 2009 and 0.2 million stock options expired

during 2011.

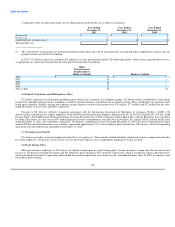

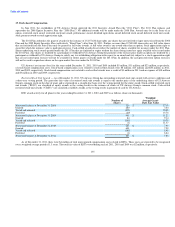

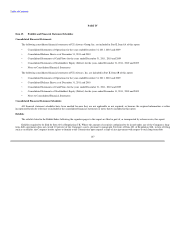

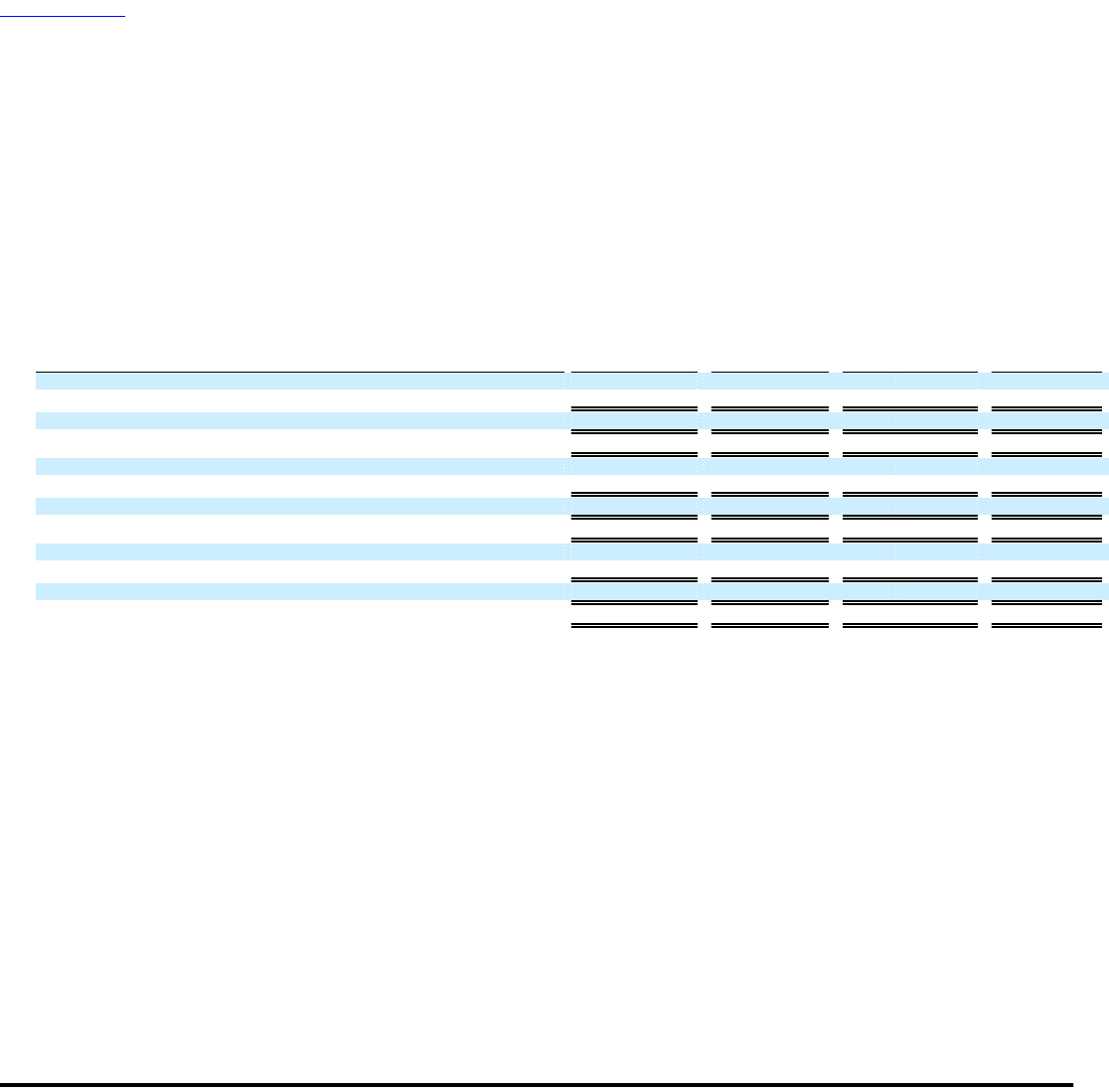

14. Valuation and Qualifying Accounts (in millions)

Balance at Balance

Beginning at End

Description of Period Additions Deductions of Period

Allowance for doubtful receivables:

Year ended December 31, 2011 $ 9 $ 1 $ 2 $ 8

Year ended December 31, 2010 $ 8 $ 4 $ 3 $ 9

Year ended December 31, 2009 $ 6 $ 7 $ 5 $ 8

Allowance for inventory obsolescence:

Year ended December 31, 2011 $ 74 $ 16 $ 12 $ 78

Year ended December 31, 2010 $ 58 $ 18 $ 2 $ 74

Year ended December 31, 2009 $ 48 $ 12 $ 2 $ 58

Valuation allowance on deferred tax asset, net:

Year ended December 31, 2011 $ 450 $ — $ 40 $ 410

Year ended December 31, 2010 $ 653 $ — $ 203 $ 450

Year ended December 31, 2009 $ 643 $ 29 $ 19 $ 653

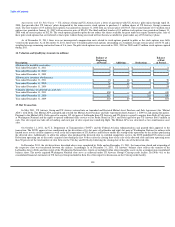

15. Slot Transaction

In May 2011, US Airways Group and US Airways entered into an Amended and Restated Mutual Asset Purchase and Sale Agreement (the "Mutual

APA") with Delta. The Mutual APA amended and restated the Mutual Asset Purchase and Sale Agreement dated August 11, 2009 by and among the parties.

Pursuant to the Mutual APA, Delta agreed to acquire 132 slot pairs at LaGuardia from US Airways and US Airways agreed to acquire from Delta 42 slot pairs

at Washington National and the rights to operate additional daily service to Sao Paulo, Brazil in 2015, and Delta agreed to pay US Airways $66.5 million in

cash. One slot equals one take-off or landing, and each pair of slots equals one round-trip flight. The Mutual APA was structured as two simultaneous asset

sales.

On October 11, 2011, the U.S. Department of Transportation ("DOT") and the Federal Aviation Administration each granted their approval to the

transaction. The DOT's approval was conditioned on the divestiture of 16 slot pairs at LaGuardia and eight slot pairs at Washington National to airlines with

limited or no service at those airports as well as the full cooperation of US Airways and Delta to enable the startup of the operations by the airlines purchasing

the divested slots. Additionally, to allow the airlines who purchased the divested slots to establish competitive service, the DOT prohibited US Airways and

Delta from operating any of the newly acquired slots during the first 90 days after the closing date of the sale of the divested slots and from operating more

than 50 percent of the total number of slots between the 91st day and 210th day following the closing date of the sale of the divested slots.

In December 2011, the slot divestitures described above were completed by Delta and on December 13, 2011, the transaction closed and ownership of

the respective slots was transferred between the airlines. Accordingly as of December 31, 2011, US Airways' balance sheet reflects the transfer of the

LaGuardia slots to Delta and the receipt of the Washington National slots, which are included within other intangible assets on the accompanying consolidated

balance sheet. The newly acquired Washington National slots serve as collateral under US Airways Group's Citicorp credit facility. See Note 4(a) to the

consolidated financial statements of US Airways Group included in Item 8A of this report for discussion on the Citicorp credit facility.

138