US Airways 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

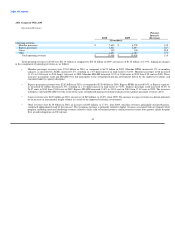

US Airways Group's Results of Operations

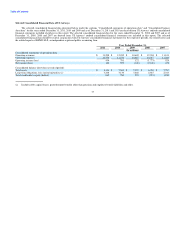

In 2011, we realized operating income of $426 million and income before income taxes of $90 million. We experienced higher revenues in 2011 due to

the strong pricing environment resulting from ongoing industry capacity discipline and robust consumer demand for air travel, which substantially offset a

significant increase in fuel costs. Our 2011 results were also impacted by recognition of $19 million in net special charges.

In 2010, we realized operating income of $781 million and income before income taxes of $502 million. We experienced growth in revenues in 2010

driven by higher yields as a result of the improved economy and industry capacity discipline. Our 2010 results were also impacted by recognition of

$55 million in net special credits.

In 2009, we realized operating income of $118 million and a loss before income taxes of $243 million. We experienced significant declines in revenues

in 2009 as a result of the global economic recession. Our 2009 results were also impacted by recognition of $256 million in net special credits.

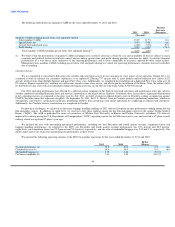

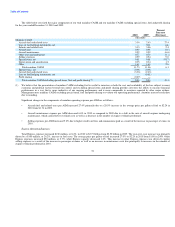

The table below presents our pre-tax special charges (credits) (in millions):

Year Ended December 31,

2011 2010 2009

Mainline operating special items, net (a) $ 24 $ 5 $ 55

Express operating special items, net 2 (1) 3

Unrealized mark-to-market gain on fuel hedging instruments, net — — (375)

Nonoperating special items, net (b) (7) (59) 61

Total $ 19 $ (55) $ (256)

(a) The 2011 period consisted of $21 million in legal costs incurred in connection with the Delta Slot transaction and auction rate securities arbitration as

well as $3 million in severance costs.

The 2010 period consisted of $6 million in non-cash charge related to the decline in value of certain spare parts, $5 million in aircraft costs related to

capacity reductions and other net special charges of $10 million, which included a settlement and corporate transaction costs. These costs were offset in

part by a $16 million refund of ASIF previously paid to the TSA during the years 2005 to 2009.

The 2009 period consisted of $22 million in aircraft costs as a result of capacity reductions, $16 million in non-cash impairment charges due to the

decline in fair value of certain indefinite lived intangible assets associated with international routes, $11 million in severance and other charges and

$6 million in costs incurred related to the 2009 liquidity improvement program.

(b) The 2011 period consisted of a $15 million credit in connection with an award received in an arbitration involving investments in auction rate

securities, offset in part by $6 million in debt prepayment penalties and non-cash write offs of certain debt issuance costs as well as $2 million of losses

related to investments in auction rate securities.

The 2010 period consisted of $53 million of net realized gains related to the sale of certain investments in auction rate securities as well as an

$11 million settlement gain, offset in part by $5 million in non-cash charges related to the write off of debt issuance costs.

The 2009 period consisted of $49 million in non-cash charges associated with the sale of 10 Embraer 190 aircraft and write off of related debt discount

and issuance costs, $10 million in other-than-temporary non-cash impairment charges for investments in auction rate securities and a $2 million non-

cash asset impairment charge.

At December 31, 2011, we had approximately $1.95 billion of gross NOLs to reduce future federal taxable income. All of our NOLs are expected to be

available to reduce federal taxable income in the calendar year 2012. The NOLs expire during the years 2024 through 2031. Our net deferred tax assets, which

include $1.87 billion of the NOLs, are subject to a full valuation allowance. We also had approximately $82 million of tax-effected state NOLs at

December 31, 2011. At December 31, 2011, the federal and state valuation allowances were $347 million and $61 million, respectively. In accordance with

generally accepted accounting principles, utilization of the NOLs will result in a corresponding decrease in the valuation allowance and offset our tax

provision dollar for dollar.

42