US Airways 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

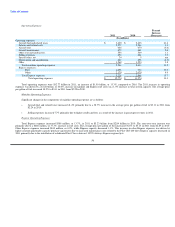

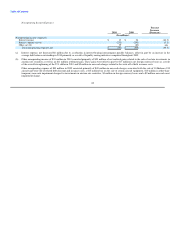

2011 EETC Financing Transactions

In June 2011, US Airways created three pass-through trusts which issued approximately $471 million aggregate face amount of Series 2011-1 Class A,

Class B and Class C Enhanced Equipment Trust Certificates in connection with the refinancing of five Airbus aircraft owned by US Airways and the

financing of four new Airbus aircraft delivered in 2011 (the "2011 EETCs"). The 2011 EETCs represent fractional undivided interests in the respective pass-

through trusts and are not obligations of US Airways. The net proceeds from the issuance of the 2011 EETCs were used to purchase equipment notes issued

by US Airways in three series: Series A equipment notes in an aggregate principal amount of $294 million bearing interest at 7.125% per annum, Series B

equipment notes in an aggregate principal amount of $94 million bearing interest at 9.75% per annum and Series C equipment notes in an aggregate principal

amount of $83 million bearing interest at 10.875% per annum. Interest on the equipment notes is payable semiannually in April and October of each year and

began in October 2011. Principal payments on the equipment notes are scheduled to begin in April 2012. The final payments on the Series A equipment notes,

Series B equipment notes and Series C equipment notes will be due in October 2023, October 2018 and October 2014, respectively. US Airways' payment

obligations under the equipment notes are fully and unconditionally guaranteed by US Airways Group. The net proceeds from the issuance of these equipment

notes were used to repay the existing debt associated with five Airbus aircraft and to finance four new Airbus aircraft delivered in 2011, with the balance used

for general corporate purposes. The equipment notes are secured by liens on aircraft.

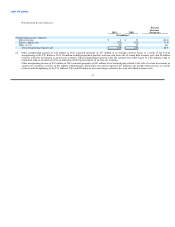

In July 2011, US Airways completed an offering of Class C certificates in the aggregate principal amount of $53 million under its Series 2010-1

EETCs. The 2010-1 Class A and B certificates originally closed in December 2010 in connection with the refinancing of owned Airbus aircraft. In connection

with this offering, US Airways issued $53 million in additional equipment notes bearing interest at 11% per annum. The net proceeds from the offering will

be used for general corporate purposes.

2011 Other Financing Transactions

In 2011, US Airways borrowed $168 million to finance new Airbus aircraft deliveries. These financings bear interest at a rate of LIBOR plus an

applicable margin and contain default provisions and other covenants that are typical in the industry.

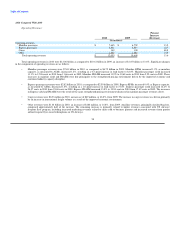

2012 Barclays Amendment

In February 2012, US Airways Group amended its co-branded credit card agreement with Barclays Bank Delaware. This amendment provides that the

$200 million pre-purchase of frequent flier miles previously scheduled to reduce commencing in January 2012 will now be reduced commencing in January

2014 over a period of up to approximately two years. Refer to Note 4(d) to US Airways Group's consolidated financial statements in Item 8A of this report for

additional information on this agreement.

Credit Card Processing Agreements

We have agreements with companies that process customer credit card transactions for the sale of air travel and other services. Credit card processors

have financial risk associated with tickets purchased for travel because, although the processor generally forwards the cash related to the purchase to us soon

after the purchase is completed, the air travel generally occurs after that time, and the processor may have liability if we do not ultimately provide the air

travel. Our agreements allow these processing companies, under certain conditions, to hold an amount of our cash (referred to as a "holdback") equal to a

portion of advance ticket sales that have been processed by that company, but for which we have not yet provided the air transportation. These holdback

requirements can be modified at the discretion of the processing companies, up to the estimated liability for future air travel purchased with the respective

credit cards, upon the occurrence of specified events, including material adverse changes in our financial condition. The amount that the processing

companies may withhold also varies as a result of changes in financial risk due to seasonal fluctuations in ticket volume. Additional holdback requirements

will reduce our liquidity in the form of unrestricted cash by the amount of the holdbacks. These holdback amounts are reflected on our consolidated balance

sheet as restricted cash.

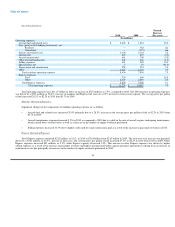

Aircraft and Engine Purchase Commitments

US Airways has definitive purchase agreements with Airbus for the acquisition of 134 aircraft, including 97 single-aisle A320 family aircraft and 37

widebody aircraft (comprised of 22 A350 XWB aircraft and 15 A330-200 aircraft). Since 2008, when deliveries commenced under the purchase agreements,

US Airways has taken delivery of 46 aircraft through December 31, 2011, which includes four A320 aircraft, 35 A321 aircraft and seven A330-200 aircraft.

US Airways plans to take delivery of 12 A321 aircraft in 2012, with the remaining 46 A320 family aircraft scheduled to be delivered between 2013 and 2015.

In addition, US Airways plans to take delivery of the eight remaining A330-200 aircraft in 2013 and 2014. Deliveries of the 22 A350 XWB aircraft are

scheduled to begin in 2017 and extend through 2019.

US Airways has agreements for the purchase of eight new IAE V2500-A5 spare engines scheduled for delivery through 2014 for use on the A320

family fleet, three new Trent 700 spare engines scheduled for delivery through 2013 for use on the A330-200 fleet and three new Trent XWB spare engines

scheduled for delivery in 2017 through 2019 for use on the A350 XWB aircraft. US Airways has taken delivery of two of the Trent 700 spare engines and two

of the V2500-A5 spare engines through December 31, 2011.

66