US Airways 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

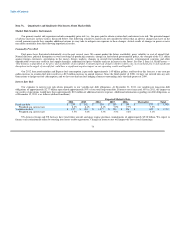

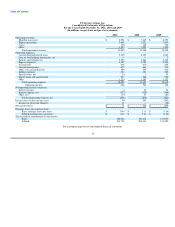

(i) Other Intangibles, Net

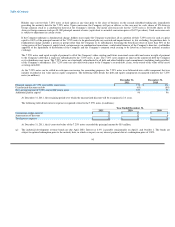

Other intangible assets consist primarily of trademarks, international route authorities, airport take-off and landing slots and airport gates. Intangible

assets with estimable useful lives are amortized over their respective estimated useful lives to their estimated residual values and reviewed for impairment

whenever events or changes in circumstances indicate that the carrying value may not be recoverable. The following table provides information relating to the

Company's intangible assets subject to amortization as of December 31, 2011 and 2010 (in millions):

2011 2010

Airport take-off and landing slots $ 561 $ 495

Airport gate leasehold rights 47 52

Accumulated amortization (134) (139)

Total $ 474 $ 408

In 2011, the Company completed a slot transaction with Delta Air Lines, Inc. ("Delta"). Refer to Note 16 for additional information on the accounting

for this transaction.

The intangible assets subject to amortization generally are amortized over 25 years for airport take-off and landing slots and over the term of the lease

for airport gate leasehold rights on a straight-line basis and are included in depreciation and amortization on the consolidated statements of operations. For the

years ended December 31, 2011, 2010 and 2009, the Company recorded amortization expense of $23 million, $26 million and $26 million, respectively,

related to its intangible assets. The Company expects to record annual amortization expense of $24 million in year 2012, $24 million in year 2013, $24 million

in year 2014, $24 million in year 2015, $23 million in year 2016 and $355 million thereafter related to these intangible assets.

Indefinite lived assets are not amortized but instead are reviewed for impairment annually and more frequently if events or circumstances indicate that

the asset may be impaired. As of December 31, 2011 and 2010, the Company had $39 million of international route authorities and $30 million of trademarks

on its balance sheets.

The Company performed the annual impairment test on its international route authorities and trademarks during the fourth quarter of 2011. The fair

values of international route authorities were assessed using the market approach. The market approach took into consideration relevant supply and demand

factors at the related airport locations as well as available market sale and lease data. For trademarks, the Company utilized a form of the income approach

known as the relief-from-royalty method. As a result of the Company's annual impairment test on international route authorities and trademarks, no

impairment was indicated. In 2009, the Company recorded $16 million in non-cash impairment charges related to the decline in fair value of certain

international routes. The Company will perform its next annual impairment test on October 1, 2012.

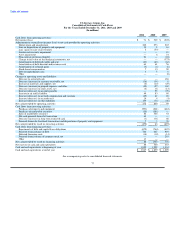

(j) Frequent Traveler Program

The Dividend Miles frequent traveler program awards mileage credits to passengers who fly on US Airways and Star Alliance carriers and certain other

partner airlines that participate in the program. Mileage credits can be redeemed for travel on US Airways or other participating partner airlines, in which case

the Company pays a fee. The Company uses the incremental cost method to account for the portion of the frequent traveler program liability related to

mileage credits earned by Dividend Miles members through purchased flights. The Company has an obligation to provide future travel when these mileage

credits are redeemed and therefore has recognized an expense and recorded a liability for mileage credits outstanding.

The liability for outstanding mileage credits earned by Dividend Miles members through purchased flights includes all mileage credits that are expected

to be redeemed, including mileage credits earned by members whose mileage account balances have not yet reached the minimum mileage credit level

required to redeem an award. Additionally, outstanding mileage credits are subject to expiration if unused. In calculating the liability, the Company estimates

how many mileage credits will never be redeemed for travel and excludes those mileage credits from the estimate of the liability. Estimates are also made for

the number of miles that will be used per award redemption and the number of travel awards that will be redeemed on partner airlines. These estimates are

based on historical program experience as well as consideration of enacted program changes, as applicable. Changes in the liability resulting from members

earning additional mileage credits or changes in estimates are recorded in the statement of operations.

81