US Airways 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

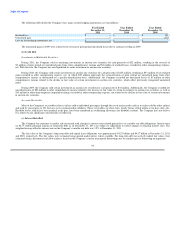

(e) Legal Proceedings

The Company is party to an arbitration proceeding relating to a grievance brought by its pilots union to the effect that, retroactive to January 1, 2010,

this work group was entitled to a significant increase in wages by operation of the applicable collective bargaining agreement. The arbitrator has issued a

decision in the Company's favor, and the union has requested an additional conference with the arbitrator regarding the decision which is scheduled for

March 6, 2012. The Company believes that the union's position is without merit and that the possibility of an adverse outcome is remote.

On April 21, 2011, US Airways filed an antitrust lawsuit against Sabre Holdings Corporation, Sabre Inc. and Sabre Travel International Limited

(collectively, "Sabre") in Federal District Court for the Southern District of New York. The lawsuit alleges, among other things, that Sabre has engaged in

anticompetitive practices that illegally restrain US Airways' ability to distribute its products to its customers. The lawsuit also alleges that these actions have

prevented US Airways from employing new competing technologies and have allowed Sabre to continue to charge US Airways supracompetitive fees. The

lawsuit seeks both injunctive relief and money damages. Sabre filed a motion to dismiss the case, which the court denied in part and granted in part in

September 2011 allowing two of the four counts in the complaint to proceed. The Company intends to pursue these claims vigorously, but there can be no

assurance of the outcome of this litigation.

The Company and/or its subsidiaries are defendants in various other pending lawsuits and proceedings, and from time to time are subject to other

claims arising in the normal course of its business, many of which are covered in whole or in part by insurance. The outcome of those matters cannot be

predicted with certainty at this time, but the Company, having consulted with outside counsel, believes that the ultimate disposition of these contingencies will

not materially affect its consolidated financial position or results of operations.

(f) Guarantees and Indemnifications

US Airways guarantees the payment of principal and interest on certain special facility revenue bonds issued by municipalities to build or improve

certain airport and maintenance facilities which are leased to US Airways. Under such leases, US Airways is required to make rental payments through 2023,

sufficient to pay maturing principal and interest payments on the related bonds. As of December 31, 2011, the remaining lease payments guaranteeing the

principal and interest on these bonds are $113 million, of which $27 million of these obligations is accounted for as a capital lease and reflected as debt in the

accompanying consolidated balance sheet.

US Airways assigned to Delta a lease agreement with the Port Authority of New York and New Jersey related to the East End Terminal at LaGuardia

airport. A portion of the rental payments under the lease are used to repay special revenue bonds issued by the Port Authority. The revenue bonds have a final

scheduled maturity in 2015 and had an outstanding principal amount of approximately $79 million at December 31, 2011. Pursuant to the terms of the lease

assignment, US Airways remains contingently liable for Delta's obligations, as assignee, under the lease agreement in the event Delta fails to perform such

obligations including, without limitation, the payment of all rentals and other amounts due under the lease agreement. US Airways has the right to cure any

failure by Delta to perform its obligations under the lease agreement and, in addition, US Airways has the right to reoccupy the terminal if it so chooses to

cure any such default.

The Company enters into real estate leases in substantially all cities that it serves. It is common in such commercial lease transactions for the Company

as the lessee to agree to indemnify the lessor and other related third parties for tort liabilities that arise out of or relate to the use or occupancy of the leased

premises. In some cases, this indemnity extends to related liabilities arising from the negligence of the indemnified parties, but usually excludes any liabilities

caused by their gross negligence or willful misconduct. With respect to certain special facility bonds, the Company agreed to indemnify the municipalities for

any claims arising out of the issuance and sale of the bonds and use or occupancy of the concourses financed by these bonds. Additionally, the Company

typically indemnifies such parties for any environmental liability that arises out of or relates to its use or occupancy of the leased premises.

The Company is the lessee under many aircraft financing agreements (including leveraged lease financings of aircraft under pass through trusts). It is

common in such transactions for the Company as the lessee to agree to indemnify the lessor and other related third parties for the manufacture, design,

ownership, financing, use, operation and maintenance of the aircraft, and for tort liabilities that arise out of or relate to the Company's use or occupancy of the

leased asset. In some cases, this indemnity extends to related liabilities arising from the negligence of the indemnified parties, but usually excludes any

liabilities caused by their gross negligence or willful misconduct. In aircraft financing agreements structured as leveraged leases, the Company typically

indemnifies the lessor with respect to adverse changes in U.S. tax laws.

101