US Airways 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

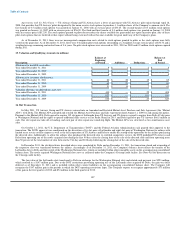

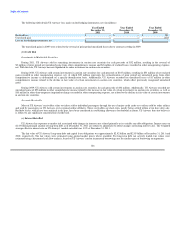

The liability for outstanding mileage credits is valued based on the estimated incremental cost of carrying one additional passenger. Incremental cost

includes unit costs incurred for fuel, credit card fees, insurance, denied boarding compensation, food and beverages as well as fees incurred when travel

awards are redeemed on partner airlines. In addition, US Airways also includes in the determination of incremental cost the amount of certain fees related to

redemptions expected to be collected from Dividend Miles members. These redemption fees reduce incremental cost. No profit or overhead margin is

included in the accrual of incremental cost.

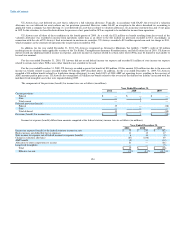

As of December 31, 2011 and 2010, the incremental cost liability for outstanding mileage credits expected to be redeemed for future travel awards

accrued on the consolidated balance sheets within other accrued expenses was $164 million, representing 133.5 billion mileage credits, and $149 million,

representing 132.4 billion mileage credits, respectively.

US Airways also sells frequent flyer program mileage credits to participating airline partners and non-airline business partners. Sales of mileage credits

to business partners is comprised of two components, transportation and marketing. US Airways uses the residual method of accounting to determine the

values of each component. The transportation component represents the fair value of future travel awards and is determined based on the equivalent value of

purchased tickets that have similar restrictions as frequent traveler awards. The determination of the transportation component requires estimates and

assumptions that require management judgment. Significant estimates and assumptions include:

• the number of awards expected to be redeemed on US Airways;

• the number of awards expected to be redeemed on partner airlines;

• the class of service for which the award is expected to be redeemed; and

• the geographic region of travel for which the award is expected to be redeemed.

These estimates and assumptions are based on historical program experience. The transportation component is deferred and amortized into passenger

revenue on a straight-line basis over the period in which the mileage credits are expected to be redeemed for travel, which is currently estimated to be

36 months.

Under the residual method, the total mileage sale proceeds less the transportation component is the marketing component. The marketing component

represents services provided by US Airways to its business partners and relates primarily to the use of US Airways' logo and trademarks along with access to

US Airways' list of Dividend Miles members. The marketing services are provided periodically, but no less than monthly. Accordingly, the marketing

component is considered earned and recognized in other revenues in the period of the mileage sale.

As of December 31, 2011 and 2010, US Airways had $196 million and $178 million, respectively, in deferred revenue from the sale of mileage credits

included in other accrued expenses on the consolidated balance sheets. For the years ended December 31, 2011, 2010 and 2009, the marketing component of

mileage sales recognized at the time of sale in other revenues was approximately $133 million, $144 million and $112 million, respectively.

US Airways adopted Accounting Standards Update ("ASU") No. 2009-13, "Revenue Recognition (Topic 605) — Multiple-Deliverable Revenue

Arrangements," on January 1, 2011, and its application has had no material impact on US Airways' consolidated financial statements. See Note 1(t) for more

information on recent accounting pronouncements.

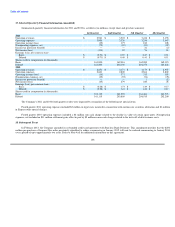

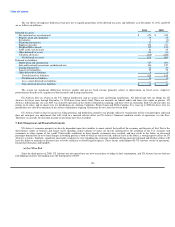

(k) Derivative Instruments

Since the third quarter of 2008, US Airways has not entered into any new transactions to hedge its fuel consumption, and US Airways has not had any

fuel hedging contracts outstanding since the third quarter of 2009. US Airways' fuel hedging instruments did not qualify for hedge accounting. Accordingly,

the derivative hedging instruments were recorded as an asset or liability on the balance sheet at fair value and any changes in fair value were recorded in the

period of change as gains or losses on fuel hedging instruments, net in operating expenses in the accompanying consolidated statements of operations. See

Note 5(a) for additional information on US Airways' fuel hedging instruments.

(l) Deferred Gains and Credits, Net

Included within deferred gains and credits, net are amounts deferred and amortized into future periods associated with the sale and leaseback of

property and equipment, the adjustment of leases to fair value in connection with prior period fresh-start and purchase accounting and certain vendor

incentives.

117