US Airways 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

7. Employee Pension and Benefit Plans

Substantially all of US Airways' employees meeting certain service and other requirements are eligible to participate in various pension, medical,

dental, life insurance, disability and survivorship plans.

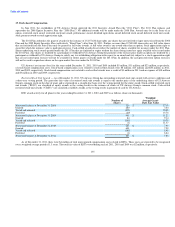

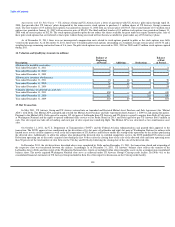

(a) Other Postretirement Benefits Plan

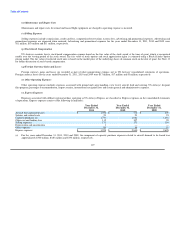

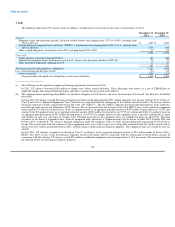

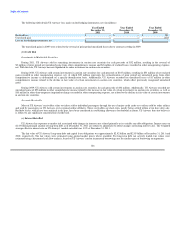

The following table sets forth changes in the fair value of plan assets, benefit obligations and the funded status of the plans and the amounts recognized

in US Airways' consolidated balance sheets as of December 31, 2011 and 2010 (in millions).

Year Ended Year Ended

December 31, December 31,

2011 2010

Fair value of plan assets at beginning of period $ — $ —

Actual return on plan assets — —

Employer contributions 8 14

Plan participants' contributions 16 16

Gross benefits paid (24) (30)

Fair value of plan assets at end of period — —

Benefit obligation at beginning of period 155 142

Service cost 3 3

Interest cost 8 8

Plan participants' contributions 16 16

Actuarial loss 13 16

Gross benefits paid (24) (30)

Benefit obligation at end of period 171 155

Funded status of the plan $ (171) $ (155)

Liability recognized in the consolidated balance sheet $ (171) $ (155)

Net actuarial gain recognized in accumulated other comprehensive income $ 22 $ 38

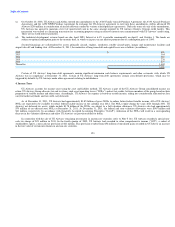

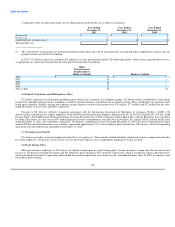

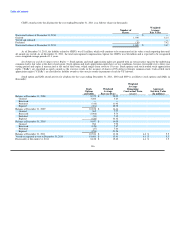

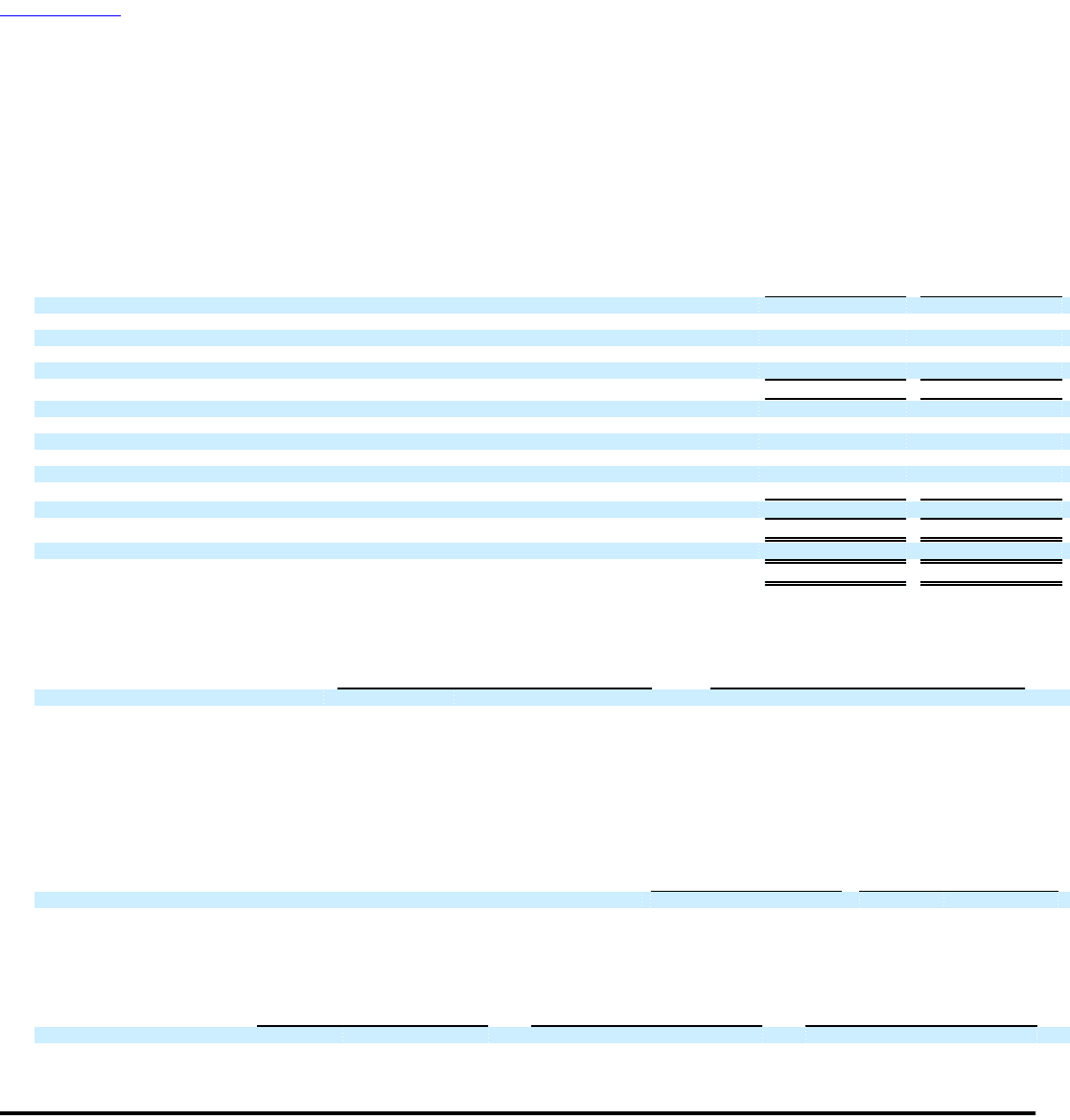

The following table presents the weighted average assumptions used to determine benefit obligations:

Year Ended Year Ended

December 31, December 31,

2011 2010

Discount rate 4.13% 4.93%

US Airways assumed discount rates for measuring its other postretirement benefit obligations, based on a hypothetical portfolio of high quality

corporate bonds denominated in U.S. currency (Aa rated, non-callable or callable with make-whole provisions), for which the timing and cash outflows

approximate the estimated benefit payments of the other postretirement benefit plans.

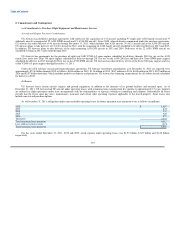

As of December 31, 2011, the assumed health care cost trend rates are 8.5% in 2012 and 8% in 2013, decreasing to 5% in 2019 and thereafter. As of

December 31, 2010, the assumed health care cost trend rates were 9% in 2011 and 8.5% in 2012, decreasing to 5% in 2019 and thereafter. The assumed health

care cost trend rates could have a significant effect on amounts reported for retiree health care plans. A one-percentage point change in the health care cost

trend rates would have the following effects on other postretirement benefits as of December 31, 2011 (in millions):

1% Increase 1% Decrease

Effect on total service and interest costs $ 1 $ (1)

Effect on postretirement benefit obligation 16 (12)

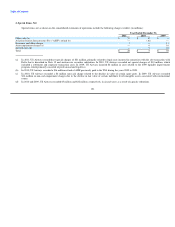

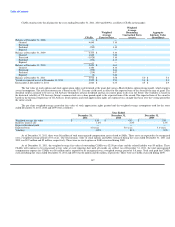

Weighted average assumptions used to determine net periodic benefit cost were as follows:

Year Ended Year Ended Year Ended

December 31, December 31, December 31,

2011 2010 2009

Discount rate 4.93% 5.51% 5.98%

128