US Airways 2011 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

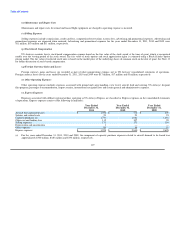

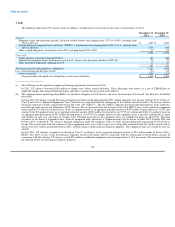

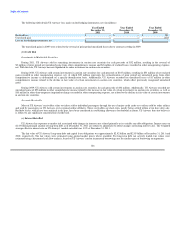

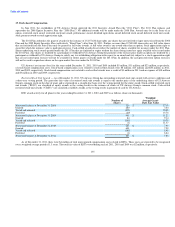

The following table details US Airways' loss (gain) on fuel hedging instruments, net (in millions):

Year Ended Year Ended Year Ended

December 31, December 31, December 31,

2011 2010 2009

Realized loss $ — $ — $ 382

Unrealized gain — — (375)

Loss on fuel hedging instruments, net $ — $ — $ 7

The unrealized gains in 2009 were related to the reversal of prior period unrealized losses due to contracts settling in 2009.

(b) Credit Risk

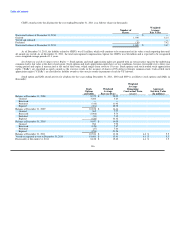

Investments in Marketable Securities

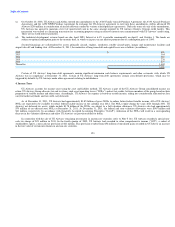

During 2011, US Airways sold its remaining investments in auction rate securities for cash proceeds of $52 million, resulting in the reversal of

$3 million of prior period net unrealized gains from other comprehensive income and $2 million of realized losses recorded in other nonoperating expense,

net. With this sale, US Airways has now liquidated its entire investment in auction rate securities.

During 2010, US Airways sold certain investments in auction rate securities for cash proceeds of $145 million, resulting in $53 million of net realized

gains recorded in other nonoperating expense, net, of which $52 million represents the reclassification of prior period net unrealized gains from other

comprehensive income as determined on a specific-identification basis. Additionally, US Airways recorded net unrealized losses of $1 million in other

comprehensive income related to the decline in fair value of certain investments in auction rate securities, which offset previously recognized unrealized

gains.

During 2009, US Airways sold certain investments in auction rate securities for cash proceeds of $32 million. Additionally, US Airways recorded net

unrealized gains of $58 million in other comprehensive income related to the increase in fair value of certain investments in auction rate securities, as well as

$10 million in other-than-temporary impairment charges recorded in other nonoperating expense, net related to the decline in fair value of certain investments

in auction rate securities.

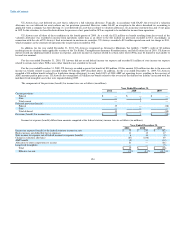

Accounts Receivable

Most of US Airways' receivables relate to tickets sold to individual passengers through the use of major credit cards or to tickets sold by other airlines

and used by passengers on US Airways or its regional airline affiliates. These receivables are short-term, mostly being settled within seven days after sale.

Bad debt losses, which have been minimal in the past, have been considered in establishing allowances for doubtful accounts. US Airways does not believe it

is subject to any significant concentration of credit risk.

(c) Interest Rate Risk

US Airways has exposure to market risk associated with changes in interest rates related primarily to its variable rate debt obligations. Interest rates on

$1.43 billion principal amount of long-term debt as of December 31, 2011 are subject to adjustment to reflect changes in floating interest rates. The weighted

average effective interest rate on US Airways' variable rate debt was 3.9% at December 31, 2011.

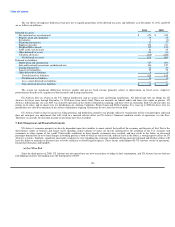

The fair value of US Airways' long-term debt and capital lease obligations was approximately $2.92 billion and $2.85 billion at December 31, 2011 and

2010, respectively. The fair values were estimated using quoted market prices where available. For long-term debt not actively traded, fair values were

estimated using a discounted cash flow analysis, based on US Airways' current incremental borrowing rates for similar types of borrowing arrangements.

126