US Airways 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

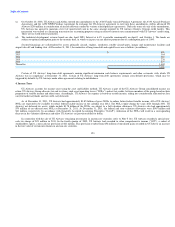

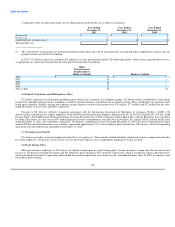

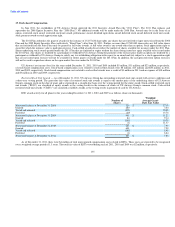

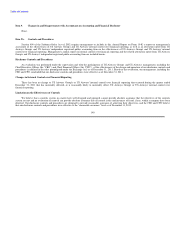

9. Other Comprehensive Income (Loss)

US Airways' other comprehensive income (loss) consisted of the following (in millions):

Year Ended December 31,

2011 2010 2009

Net income (loss) $ 180 $ 599 $ (140)

Reversal of tax provision in other comprehensive income 21 — —

Reversal of net unrealized gains on sale of available-for-sale securities (3) — —

Recognition of net realized gains on sale of available-for-sale securities — (52) —

Net unrealized gains (losses) on available-for-sale securities, net of tax expense of $21 million in 2009 — (1) 35

Other postretirement benefits (16) (21) (19)

Total comprehensive income (loss) $ 182 $ 525 $ (124)

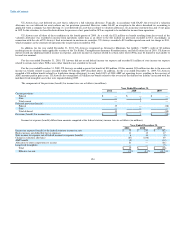

The components of accumulated other comprehensive income were as follows (in millions):

December 31, December 31,

2011 2010

Other postretirement benefits $ 22 $ 38

Available-for-sale securities — (18)

Accumulated other comprehensive income $ 22 $ 20

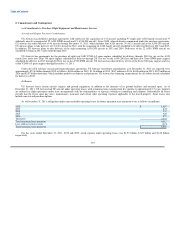

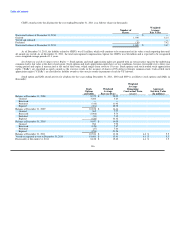

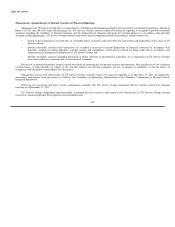

10. Supplemental Cash Flow Information

Supplemental disclosure of cash flow information and non-cash investing and financing activities are as follows (in millions):

Year Ended December 31,

2011 2010 2009

Non-cash transactions:

Interest payable converted to debt $ 31 $ 40 $ 40

Note payables issued for aircraft purchases — 118 333

Net unrealized loss (gain) on available-for-sale securities — 1 (58)

Prepayment applied to equipment purchase deposits — (38) —

Deposit applied to principal repayment on debt — (31) —

Forgiveness of intercompany payable to US Airways Group — — 600

Debt extinguished from sale of aircraft — — (251)

Maintenance payable converted to debt — — 8

Cash transactions:

Interest paid, net of amounts capitalized 147 164 145

Income taxes paid — 1 —

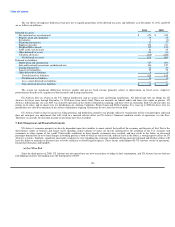

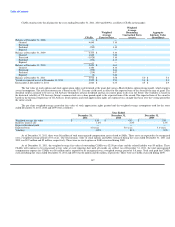

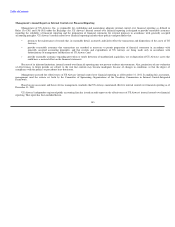

11. Related Party Transactions

The following represents net payable balances to related parties (in millions):

December 31,

2011 2010

US Airways Group $ 514 $ 571

US Airways Group's wholly owned subsidiaries 87 55

$ 601 $ 626

(a) Parent Company

US Airways Group has the ability to move funds freely between its operating subsidiaries to support operations. These transfers are recognized as

intercompany transactions.

US Airways recorded interest expense for the years ended December 31, 2011, 2010 and 2009 of $6 million, $9 million and $27 million, respectively,

related to its intercompany payable balance to US Airways Group. Interest is calculated at market rates, which are reset quarterly.

133