US Airways 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways has a net deferred tax asset that is subject to a full valuation allowance. Typically, in accordance with GAAP, the reversal of a valuation

allowance on a net deferred tax asset reduces any tax provision generated. However, under GAAP, an exception to the above described tax accounting is

applicable when a company has the following: (1) a net deferred tax asset that is subject to valuation allowance, (2) an income statement loss and (3) net gains

in OCI. In this situation, tax benefits derived from the presence of net gains held in OCI are required to be included in income from operations.

US Airways met all three of these conditions in the fourth quarter of 2009. As a result, the $21 million tax benefit resulting from the reversal of the

valuation allowance was recorded in income from operations rather than as an offset to the $21 million tax provision recorded in OCI. Accordingly, in

connection with the sale of US Airways' final investments in auction rate securities, US Airways recorded a $21 million special non-cash tax charge in 2011,

which recognizes in the statement of operations the tax provision recorded in OCI.

In addition, for the year ended December 31, 2011, US Airways recognized an Alternative Minimum Tax liability ("AMT") credit of $2 million

resulting from its elections under applicable sections of the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. US Airways

did not record any additional federal income tax expense, and state income tax expense related to certain states where NOLs may be limited or unavailable to

be used was nominal.

For the year ended December 31, 2010, US Airways did not record federal income tax expense and recorded $1 million of state income tax expense

related to certain states where NOLs were either limited or not available to be used.

For the year ended December 31, 2009, US Airways recorded a special tax benefit of $38 million. Of this amount, $21 million was due to the non-cash

income tax benefit related to gains recorded within OCI during 2009 described above. In addition, for the year ended December 31, 2009, US Airways

recorded a $14 million benefit related to a legislation change allowing it to carry back 100% of 2008 AMT net operating losses, resulting in the recovery of

AMT amounts paid in prior years. US Airways also recognized a $3 million tax benefit related to the reversal of the deferred tax liability associated with the

indefinite lived intangible assets that were impaired during 2009.

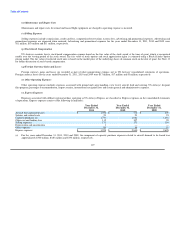

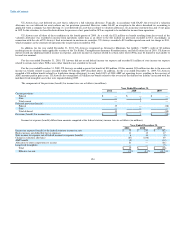

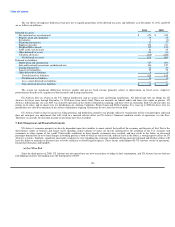

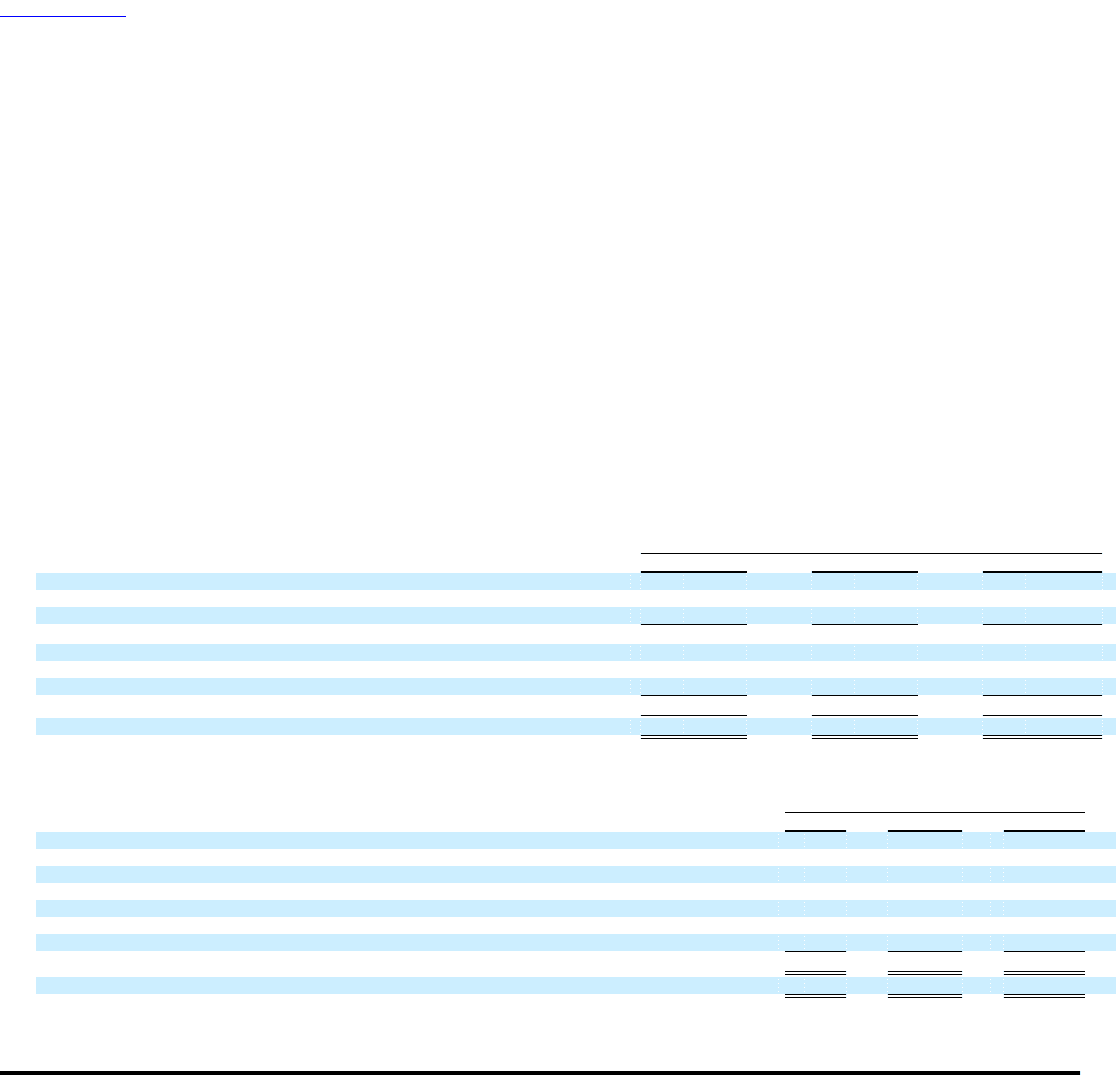

The components of the provision (benefit) for income taxes are as follows (in millions):

Year Ended December 31,

2011 2010 2009

Current provision:

Federal $ — $ — $ —

State — 1 —

Total current — 1 —

Deferred provision (benefit):

Federal 19 — (38)

State — — —

Total deferred 19 — (38)

Provision (benefit) for income taxes $ 19 $ 1 $ (38)

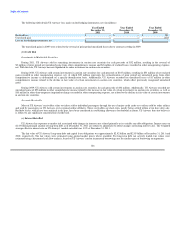

Income tax expense (benefit) differs from amounts computed at the federal statutory income tax rate as follows (in millions):

Year Ended December 31,

2011 2010 2009

Income tax expense (benefit) at the federal statutory income tax rate $ 70 $ 210 $ (62)

Book expenses not deductible for tax purposes 11 13 17

State income tax expense, net of federal income tax expense (benefit) 6 16 (4)

Change in valuation allowance (87) (238) 49

AMT benefit (2) — (14)

Allocation to other comprehensive income 21 — (21)

Long-lived intangibles — — (3)

Total $ 19 $ 1 $ (38)

Effective tax rate 9.7% 0.1% (21.5)%

124