Time Warner Cable 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

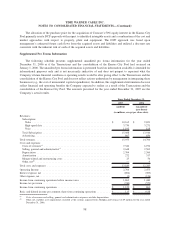

Income per Common Share

Basic income per common share is computed by dividing net income by the weighted average of common

shares outstanding during the period. Weighted-average common shares include shares of Class A common stock

and Class B common stock. Diluted income per common share adjusts basic income per common share for the

effects of stock options, restricted stock units and other potentially dilutive financial instruments, only in the periods

in which such effect is dilutive. Set forth below is a reconciliation of basic and diluted income per common share

from continuing operations (in millions, except per share data):

2007 2006 2005

Years Ended December 31,

Income from continuing operations—basic and diluted . . . . . . . . . . . . . . . . . . . . . . . . . . $1,123 $ 936 $ 1,149

Average common shares outstanding—basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 976.9 990.4 1,000.0

Dilutive effect of equity awards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.3 — —

Average common shares outstanding—diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 977.2 990.4 1,000.0

Income per common share from continuing operations:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.15 $ 0.95 $ 1.15

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.15 $ 0.95 $ 1.15

Segments

FASB Statement No. 131, Disclosure about Segments of an Enterprise and Related Information, requires

public companies to disclose certain information about their reportable operating segments. Operating segments are

defined as components of an enterprise for which separate financial information is available and is evaluated on a

regular basis by the chief operating decision makers in deciding how to allocate resources to an individual segment

and in assessing performance of the segment. Since the Company’s continuing operations provide its services over

the same delivery system, the Company has only one reportable segment.

4. TRANSACTIONS WITH ADELPHIA AND COMCAST

Adelphia Acquisition and Related Transactions

On July 31, 2006, TW NY and Comcast completed their respective acquisitions of assets comprising in the

aggregate substantially all of the cable assets of Adelphia (the “Adelphia Acquisition”). At the closing of the

Adelphia Acquisition, TW NY paid approximately $8.9 billion in cash, after giving effect to certain purchase price

adjustments, and shares representing 17.3% of TWC’s Class A common stock (approximately 16% of TWC’s

outstanding common stock) valued at approximately $5.5 billion for the portion of the Adelphia assets it acquired.

The valuation of approximately $5.5 billion for the approximately 16% interest in TWC as of July 31, 2006 was

determined by management using a DCF and market comparable valuation model. The DCF valuation model was

based upon the Company’s estimated future cash flows derived from its business plan and utilized a discount rate

consistent with the inherent risk in the business. The 16% interest reflects 155,913,430 shares of TWC Class A

common stock issued to Adelphia, which were valued at $35.28 per share for purposes of the Adelphia Acquisition.

In addition, on July 28, 2006, American Television and Communications Corporation (“ATC”), a subsidiary of

Time Warner, contributed its 1% common equity interest and $2.4 billion preferred equity interest in Time Warner

Entertainment Company, L.P. (“TWE”) to TW NY Cable Holding Inc. (“TW NY Holding”), a newly created

subsidiary of TWC and the parent of TW NY, in exchange for a 12.43% non-voting common stock interest in TW

NY Holding having an equivalent fair value.

On July 31, 2006, immediately before the closing of the Adelphia Acquisition, Comcast’s interests in TWC

and TWE were redeemed. Specifically, Comcast’s 17.9% interest in TWC was redeemed in exchange for 100% of

the capital stock of a subsidiary of TWC holding both cable systems serving 589,000 basic video subscribers, with

an estimated fair value of $2.470 billion, as determined by management using a DCF and market comparable

94

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)