Time Warner Cable 2007 Annual Report Download - page 121

Download and view the complete annual report

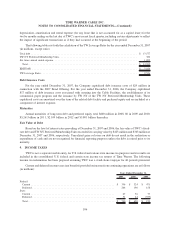

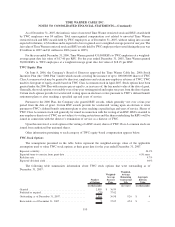

Please find page 121 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Warner’s best estimate of the fair value of the other content acquired by the Time Warner subsidiary at the time the

agreements were executed. Under this arrangement, the Time Warner subsidiary makes periodic payments to TWC

that are classified as a reduction of programming costs in the consolidated statement of operations. Payments

received or receivable under this agreement totaled $35 million in 2007, $36 million in 2006 and $30 million in 2005.

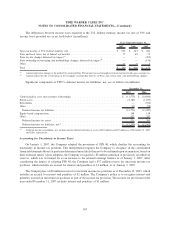

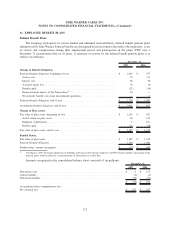

13. SHAREHOLDERS’ EQUITY

TWC is authorized to issue up to 20 billion shares of Class A common stock, par value $0.01 per share, and

5 billion shares of Class B common stock, par value $0.01 per share. As of December 31, 2007, 902 million shares of

Class A common stock and 75 million shares of Class B common stock were issued and outstanding. TWC is also

authorized to issue up to 1 billion shares of preferred stock, par value $0.01 per share; however, no preferred shares

have been issued, nor does the Company have any current plans to issue any preferred shares.

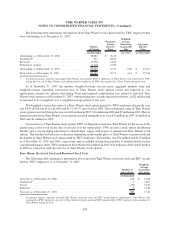

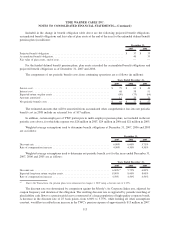

Prior to the closing of the Transactions, Comcast held 179 million shares of TWC’s Class A common stock, of

which 43 million shares were classified as mandatorily redeemable as a result of an agreement with Comcast

entered into in 2004 that under certain circumstances would have required TWC to redeem such shares. As a result

of the closing of the Redemptions, the requirement terminated and such shares were reclassified to shareholders’

equity before ultimately being redeemed on July 31, 2006, in connection with the TWC Redemption discussed

below.

On July 31, 2006, in connection with the TWC Redemption, Comcast’s 17.9% interest in TWC’s outstanding

Class A common stock was redeemed, and in connection with the Adelphia Acquisition, shares representing 17.3%

of TWC’s outstanding Class A common stock were issued to Adelphia for the assets TWC acquired, both of which

are discussed more fully in Note 4.

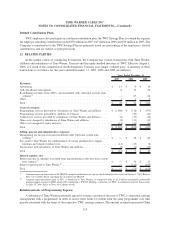

Each share of Class A common stock votes as a single class with respect to the election of Class A directors,

which are required to represent not less than one-sixth of the Company’s directors and not more than one-fifth of the

Company’s directors. Each share of the Company’s Class B common stock votes as a single class with respect to the

election of Class B directors, which are required to represent not less than four-fifths of the Company’s directors.

Each share of Class B common stock issued and outstanding generally has ten votes on any matter submitted to a

vote of the stockholders, and each share of Class A common stock issued and outstanding has one vote on any matter

submitted to a vote of stockholders. Except for the voting rights characteristics described above, there are no

differences between the Class A and Class B common stock. The Class A common stock and the Class B common

stock will generally vote together as a single class on all matters submitted to a vote of the stockholders, except with

respect to the election of directors. The Class B common stock is not convertible into the Company’s Class A

common stock. As a result of its shareholdings, Time Warner has the ability to cause the election of all Class A and

Class B directors.

As of December 31, 2007, Time Warner holds an 84.0% economic interest TWC (representing a 90.6% voting

interest), through ownership of 82.7% of TWC’s Class A common stock and all of the outstanding shares of TWC’s

Class B common stock.

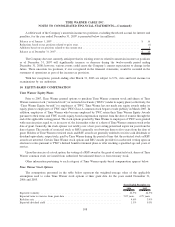

14. COMMITMENTS AND CONTINGENCIES

Prior to the TWE Restructuring, TWE had various contingent commitments, including guarantees, related to

the TWE non-cable businesses. In connection with the TWE Restructuring, some of these commitments were not

transferred with their applicable non-cable business and they remain contingent commitments of TWE. Time

Warner and its subsidiary, WCI, have agreed, on a joint and several basis, to indemnify TWE from and against any

and all of these contingent liabilities, but TWE remains a party to these commitments.

TWC has cable franchise agreements containing provisions requiring the construction of cable plant and the

provision of services to customers within the franchise areas. In connection with these obligations under existing

franchise agreements, TWC obtains surety bonds or letters of credit guaranteeing performance to municipalities and

public utilities and payment of insurance premiums. Such surety bonds and letters of credit as of December 31, 2007

116

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)