Time Warner Cable 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

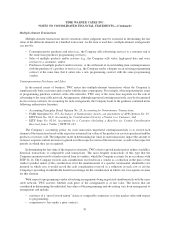

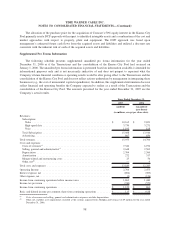

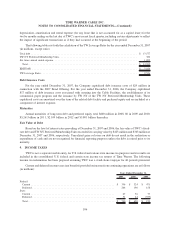

The purchase price allocation for the Adelphia Acquisition and the Exchange is as follows (in millions):

Depreciation/

Amortization

Periods

(a)

Intangible assets not subject to amortization (cable franchise rights) . . . . . . . . . . . . . . . . . . $10,487 non-amortizable

Intangible assets subject to amortization (primarily customer relationships) . . . . . . . . . . . . . 882 4 years

Property, plant and equipment (primarily cable television equipment) . . . . . . . . . . . . . . . . . 2,426 1-20 years

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 162 not applicable

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,114 non-amortizable

Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (219) not applicable

Total purchase price. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $14,852

(a)

Intangible assets and goodwill associated with the Adelphia Acquisition are deductible over a 15-year period for tax purposes and would

reduce net cash tax payments by more than $300 million per year, assuming the following: (i) straight-line amortization deductions over

15 years, (ii) sufficient taxable income to utilize the amortization deductions and (iii) a 40% effective tax rate.

The allocation of the purchase price for the Adelphia Acquisition and the Exchange primarily used a DCF

approach with respect to identified intangible assets and a combination of the cost and market approaches with

respect to property, plant and equipment. The DCF approach was based upon management’s estimated future cash

flows from the acquired assets and liabilities and utilized a discount rate consistent with the inherent risk of each of

the acquired assets and liabilities.

The systems acquired in connection with the Transactions have been included in the consolidated financial

statements since the closing of the Transactions. The systems previously owned by TWC that were transferred to

Comcast in connection with the Redemptions and the Exchange (the “Transferred Systems”) have been reflected as

discontinued operations in the consolidated financial statements for all periods presented.

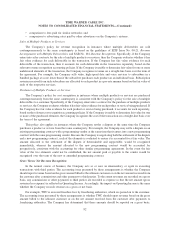

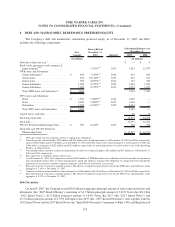

Financial data for the Transferred Systems included in discontinued operations for the years ended

December 31, 2006 and 2005 is as follows (in millions, except per share data):

2006 2005

Years Ended December 31,

Totalrevenues...................................................... $ 457 $ 686

Pretax income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 285 $ 163

Income tax benefit (provision) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 753 (59)

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,038 $ 104

Basic and diluted net income per common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.05 $ 0.10

Average basic and diluted common shares outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . 990.4 1,000.0

Included in discontinued operations for the year ended December 31, 2006 were a pretax gain of $165 million

on the Transferred Systems and a net tax benefit of $800 million comprised of a tax benefit of $814 million on the

Redemptions, partially offset by a provision of $14 million on the Exchange. The tax benefit of $814 million

resulted primarily from the reversal of historical deferred tax liabilities (included in noncurrent liabilities of

discontinued operations) that had existed on systems transferred to Comcast in the TWC Redemption. The TWC

Redemption was designed to qualify as a tax-free split-off under section 355 of the Tax Code, and as a result, such

liabilities were no longer required. However, if the Internal Revenue Service were successful in challenging the tax-

free characterization of the TWC Redemption, an additional cash liability on account of taxes of up to an estimated

$900 million could become payable by the Company.

As a result of the closing of the Transactions, on July 31, 2006, TWC acquired systems with approximately

4.0 million basic video subscribers and disposed of the Transferred Systems, with approximately 0.8 million basic

video subscribers, for a net gain of approximately 3.2 million basic video subscribers.

96

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)