Time Warner Cable 2007 Annual Report Download - page 78

Download and view the complete annual report

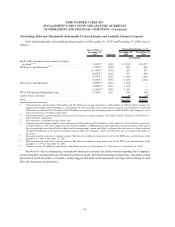

Please find page 78 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fixed-rate Debt and TW NY Preferred Membership Units

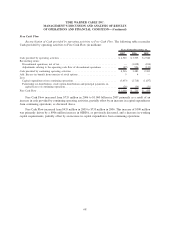

As of December 31, 2007, TWC had fixed-rate debt and TW NY Preferred Membership Units with an

outstanding balance of $8.611 billion, including an unamortized fair value adjustment of $126 million, and a fair

value of $9.034 billion. Based on TWC’s fixed-rate debt obligations outstanding at December 31, 2007, a 25 basis

point increase or decrease in the level of interest rates would, respectively, decrease or increase the fair value of the

fixed-rate debt by approximately $174 million. Such potential increases or decreases are based on certain

simplifying assumptions, including a constant level of fixed-rate debt and an immediate, across-the-board

increase or decrease in the level of interest rates with no other subsequent changes for the remainder of the period.

Equity Risk

Some of TWC’s employees have been granted options to purchase shares of Time Warner common stock in

connection with their past employment with subsidiaries and affiliates of Time Warner. TWC has agreed that, upon

the exercise by any of its officers or employees of any options to purchase Time Warner common stock, TWC will

reimburse Time Warner in an amount equal to the excess of the closing price of a share of Time Warner common

stock on the date of the exercise of the option over the aggregate exercise price paid by the exercising officer or

employee for each share of Time Warner common stock. At December 31, 2007, TWC had accrued $36 million of

stock option distributions payable to Time Warner. That amount, which is not payable until the underlying options

are exercised and then only subject to limitations on cash distributions in accordance with the senior unsecured

revolving credit facilities, will be adjusted in subsequent accounting periods based on changes in the quoted market

prices for Time Warner’s common stock. See Note 10 to the accompanying consolidated financial statements.

CRITICAL ACCOUNTING POLICIES

The SEC considers an accounting policy to be critical if it is important to the Company’s financial condition

and results of operations, and if it requires significant judgment and estimates on the part of management in its

application. The development and selection of these critical accounting policies have been determined by the

management of TWC and the related disclosures have been reviewed with the Audit Committee of the Board of

Directors of TWC. Due to the significant judgment involved in selecting certain of the assumptions used in these

areas, it is possible that different parties could choose different assumptions and reach different conclusions. For a

summary of all of the Company’s significant accounting policies, see Note 3 to the accompanying consolidated

financial statements.

Asset Impairments

Goodwill and Indefinite-lived Intangible Assets

Goodwill impairment is determined using a two-step process. The first step of the process is to compare the fair

value of a reporting unit with its carrying amount, including goodwill. In performing the first step, the Company

determines the fair value of a reporting unit by using two valuation techniques: a discounted cash flow (“DCF”)

analysis and a market-based approach. Determining fair value requires the exercise of significant judgments,

including judgments about appropriate discount rates, perpetual growth rates, relevant comparable company

earnings multiples and the amount and timing of expected future cash flows. The cash flows employed in the DCF

analyses are based on TWC’s budget and long-term business plan, and various growth rates have been assumed for

years beyond the long-term business plan period. Discount rate assumptions are based on an assessment of the risk

inherent in the future cash flows of the respective reporting units. In assessing the reasonableness of its determined

fair values, the Company evaluates its results against other value indicators such as comparable company public

trading values, research analyst estimates and values observed in private market transactions. If the fair value of a

reporting unit exceeds its carrying amount, goodwill of the reporting unit is not impaired and the second step of the

impairment test is not necessary. If the carrying amount of a reporting unit exceeds its fair value, the second step of

the goodwill impairment test is required to be performed to measure the amount of impairment loss, if any. The

second step of the goodwill impairment test compares the implied fair value of the reporting unit’s goodwill with the

73

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)