Time Warner Cable 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

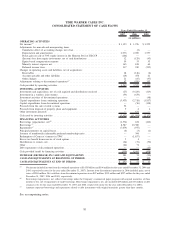

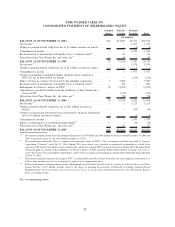

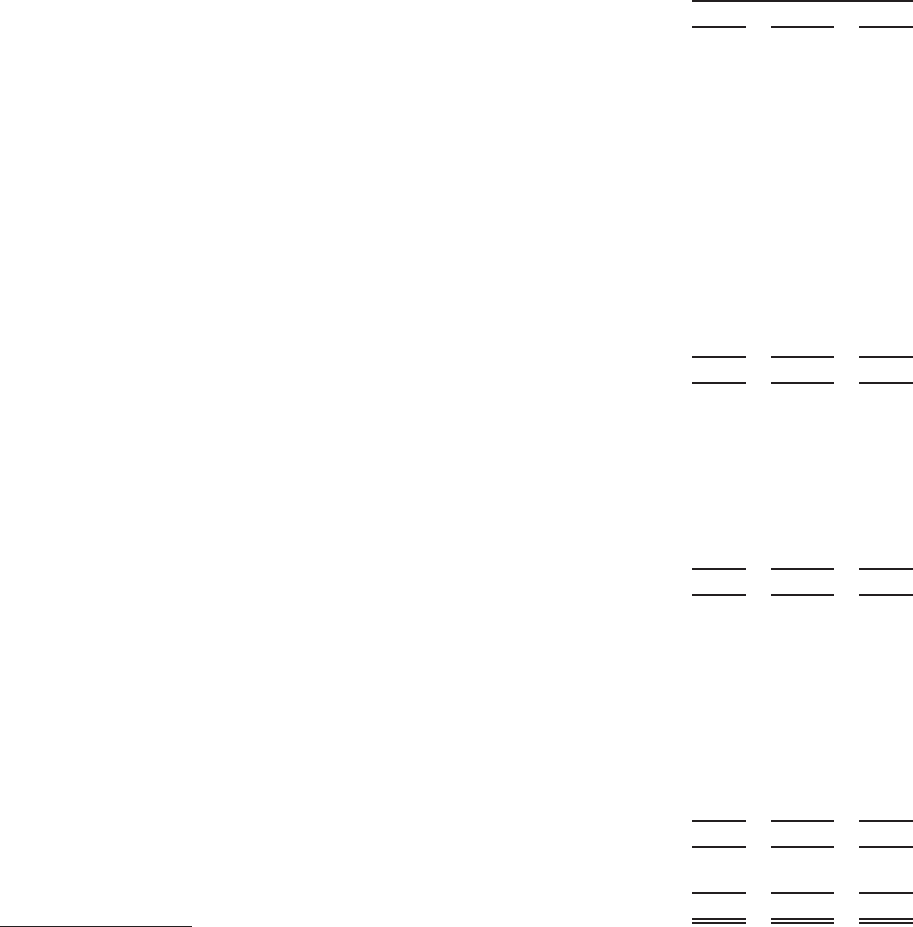

TIME WARNER CABLE INC.

CONSOLIDATED STATEMENT OF CASH FLOWS

2007 2006 2005

Years Ended December 31,

(in millions)

OPERATING ACTIVITIES

Net income

(a)

........................................................ $1,123 $ 1,976 $ 1,253

Adjustments for noncash and nonoperating items:

Cumulative effect of accounting change, net of tax . . . . ......................... — (2) —

Depreciation and amortization ........................................... 2,976 2,050 1,537

Pretax gain on sale of 50% equity interest in the Houston Pool of TKCCP ............. (146) — —

(Income) loss from equity investments, net of cash distributions . . .................. 12 (129) (43)

Equity-based compensation expense . . ..................................... 59 33 53

Minority interest expense, net............................................ 165 108 64

Deferred income taxes. . . . . ............................................ 317 240 (395)

Changes in operating assets and liabilities, net of acquisitions:

Receivables . ....................................................... 18 (146) (6)

Accounts payable and other liabilities . ..................................... (29) 456 41

Other changes ...................................................... 21 (65) (97)

Adjustments relating to discontinued operations

(a)

................................ 47 (926) 133

Cash provided by operating activities . . . ..................................... 4,563 3,595 2,540

INVESTING ACTIVITIES

Investments and acquisitions, net of cash acquired and distributions received . ............ (27) (9,229) (113)

Investment in a wireless joint venture . . . ..................................... (33) (633) —

Investment activities of discontinued operations . . ............................... — — (48)

Capital expenditures from continuing operations . . ............................... (3,433) (2,718) (1,837)

Capital expenditures from discontinued operations ............................... — (56) (138)

Proceeds from the sale of cable systems . ..................................... 52 — —

Proceeds from disposal of property, plant and equipment . . ......................... 9 6 4

Other investment proceeds . . . ............................................ — 631 —

Cash used by investing activities ........................................... (3,432) (11,999) (2,132)

FINANCING ACTIVITIES

Borrowings (repayments), net

(b)

............................................ (1,574) 634 (422)

Borrowings

(c)

........................................................ 8,387 10,300 —

Repayments

(c)

........................................................ (7,679) (975) —

Principal payments on capital leases . . . . ..................................... (4) (3) (1)

Issuance of mandatorily redeemable preferred membership units ...................... — 300 —

Redemption of Comcast’s interest in TWC .................................... — (1,857) —

Excess tax benefit from exercise of stock options . ............................... 5 4 —

Distributions to owners, net . . . ............................................ (24) (31) (30)

Other . . . . . . . . . . . ................................................... (61) 71 —

Debt repayments of discontinued operations.................................... — — (45)

Cash provided (used) by financing activities ................................... (950) 8,443 (498)

INCREASE (DECREASE) IN CASH AND EQUIVALENTS ...................... 181 39 (90)

CASH AND EQUIVALENTS AT BEGINNING OF PERIOD...................... 51 12 102

CASH AND EQUIVALENTS AT END OF PERIOD ............................ $ 232 $ 51 $ 12

(a)

Net income included income from discontinued operations of $1.038 billion and $104 million for the years ended December 31, 2006 and

2005, respectively (none for the year ended December 31, 2007). Income from discontinued operations in 2006 included gains, net of

taxes, of $965 million. Net cash flows from discontinued operations were $47 million, $112 million and $237 million for the years ended

December 31, 2007, 2006 and 2005, respectively.

(b)

Borrowings (repayments), net, reflects borrowings under the Company’s commercial paper program with original maturities of three

months or less, net of repayments of such borrowings. Borrowings (repayments), net, also included $29 million and $17 million of debt

issuance costs for the years ended December 31, 2007 and 2006, respectively (none for the year ended December 31, 2005).

(c)

Amounts represent borrowings and repayments related to debt instruments with original maturities greater than three months.

See accompanying notes.

81