Time Warner Cable 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

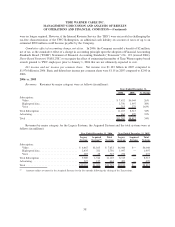

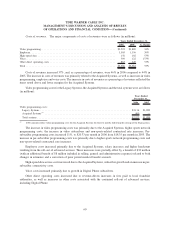

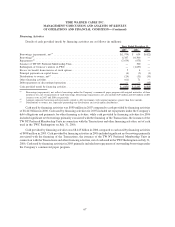

Investing Activities

Details of cash used by investing activities are as follows (in millions):

2007 2006 2005

Years Ended December 31,

Investments and acquisitions, net of cash acquired and distributions received:

Distributions received from an investee

(a)

................................. $ 51 $ — $ —

Adelphia Acquisition and the Exchange

(b)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (25) (9,080) —

Wireless joint venture

(c)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (33) (633) —

Redemption of Comcast’s interest in TWE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (147) —

All other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (53) (2) (113)

Capital expenditures from continuing operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,433) (2,718) (1,837)

Capital expenditures from discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (56) (138)

Proceeds from the sale of certain cable systems to the Consortium . . . . . . . . . . . . . . . . . 52 — —

Proceeds from the repayment by Comcast of TKCCP debt owed to TWE-A/N . . . . . . . . — 631 —

Proceeds from disposal of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . 9 6 4

Investment activities of discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (48)

Cash used by investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(3,432) $(11,999) $(2,132)

(a)

Distributions received from an investee represents distributions received from Sterling Entertainment Enterprises, LLC (d/b/a SportsNet

New York), an equity-method investee.

(b)

Included in the cash used for the Adelphia Acquisition and the Exchange in 2006 is cash paid at closing of $8.935 billion, a contractual

closing adjustment of $67 million and other transaction-related costs of $78 million. Cash used for the Adelphia Acquisition and the

Exchange in 2007 primarily represents additional transaction-related costs, including working capital adjustments.

(c)

Cash used for the wireless joint venture in 2006 represents the Company’s initial investment in a wireless spectrum joint venture with

several other cable companies (the “Wireless Joint Venture”). Included in cash used for the Wireless Joint Venture in 2007 is a

contribution of $28 million to the Wireless Joint Venture to fund the Company’s share of a payment to Sprint Nextel Corporation

(“Sprint”) to purchase Sprint’s interest in the Wireless Joint Venture for an amount equal to Sprint’s capital contributions. Under certain

circumstances, the remaining members have the ability to exit the Wireless Joint Venture and receive from the Wireless Joint Venture,

subject to certain limitations and adjustments, advanced wireless spectrum licenses covering the areas in which they provide cable

services.

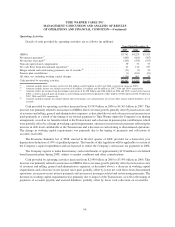

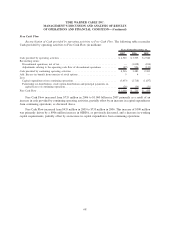

Cash used by investing activities decreased from $11.999 billion in 2006 to $3.432 billion in 2007. This

decrease was principally due to payments associated with the Transactions, which closed on July 31, 2006, and a

decrease in investment spending related to the Company’s investment in the Wireless Joint Venture. This decrease

was partially offset by an increase in capital expenditures from continuing operations, driven by the Acquired

Systems, as well as the continued roll-out of advanced digital services in the Legacy Systems, and the receipt of

proceeds associated with the repayment by Comcast of TKCCP debt owed to TWE-A/N during 2006.

Cash used by investing activities increased from $2.132 billion in 2005 to $11.999 billion in 2006. This

increase was principally due to payments associated with the Transactions, which closed on July 31, 2006, and an

increase in capital expenditures from continuing operations, driven by capital expenditures associated with the

integration of the Acquired Systems, the continued roll-out of advanced digital services, including Digital Phone

services, and continued growth in high-speed data services. The increase also reflects the investment in the Wireless

Joint Venture, partially offset by the receipt of proceeds associated with the repayment by Comcast of TKCCP debt

owed to TWE-A/N during 2006 and decreases in investment spending related to the Company’s equity investments

and other acquisition-related expenditures and capital expenditures from discontinued operations.

65

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)