Time Warner Cable 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

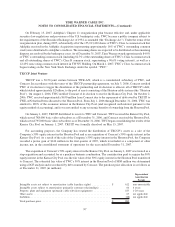

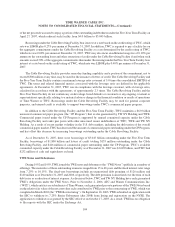

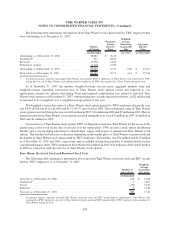

Information relating to the restructuring costs is as follows (in millions):

Employee

Terminations

Other

Exit Costs Total

Remaining liability as of December 31, 2005 . . . . . . . . . . . . . . . . . . . . . $ 23 $ 3 $ 26

Accruals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 10 18

Cash paid. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (13) (8) (21)

Remaining liability as of December 31, 2006 . . . . . . . . . . . . . . . . . . . . . 18 5 23

Accruals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 6 13

Cash paid. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (12) (8) (20)

Remaining liability as of December 31, 2007 . . . . . . . . . . . . . . . . . . . . . $ 13 $ 3 $ 16

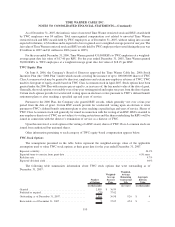

6. GOODWILL AND INTANGIBLE ASSETS

TWC has a significant number of intangible assets, including customer relationships and cable franchises.

Goodwill and intangible assets are tested annually for impairment during the fourth quarter, or earlier upon the

occurrence of certain events or substantive changes in circumstances. The Company determined during its annual

impairment reviews that no impairments existed as of December 31, 2007, 2006 or 2005, respectively.

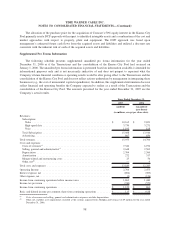

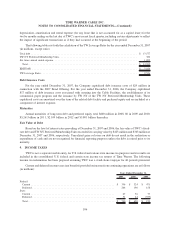

A summary of changes in the Company’s goodwill for the years ended December 31, 2007 and 2006 is as

follows (in millions):

Balance as of December 31, 2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,769

Acquisitions and dispositions related to the Transactions

(a)

................................... 312

Other ........................................................................ (22)

Balance as of December 31, 2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,059

Purchase price adjustments related to the Adelphia Acquisition and the Exchange . . . . . . . . . . . . . . . . . . . 64

Other ........................................................................ (6)

Balance as of December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,117

(a)

Includes goodwill recorded as a result of the preliminary purchase price allocation for the Adelphia Acquisition and the Exchange of

$1.050 billion, partially offset by a $738 million adjustment to goodwill related to the excess of the carrying value of the Comcast

minority interests in TWC and TWE acquired over the total fair value of the Redemptions. Of the $738 million adjustment to goodwill,

$719 million is associated with the TWC Redemption and $19 million is associated with the TWE Redemption. Refer to Note 4 for

additional information regarding the Transactions.

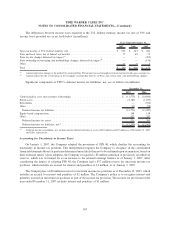

As of December 31, 2007 and 2006, the Company’s intangible assets and related accumulated amortization

consisted of the following (in millions):

Gross

Accumulated

Amortization Net Gross

Accumulated

Amortization Net

December 31, 2007 December 31, 2006

Intangible assets subject to amortization:

Customer relationships . . . . . . . . . . . . . . . . . $ 954 $ (330) $ 624 $ 1,128 $ (323) $ 805

Renewal of cable franchise and access rights . . 242 (153) 89 207 (139) 68

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38 (32) 6 29 (26) 3

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,234 $ (515) $ 719 $ 1,364 $ (488) $ 876

Intangible assets not subject to amortization:

Cable franchise rights . . . . . . . . . . . . . . . . . $ 40,312 $ (1,390) $ 38,922 $ 39,342 $ (1,294) $ 38,048

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 — 3 3 — 3

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 40,315 $ (1,390) $ 38,925 $ 39,345 $ (1,294) $ 38,051

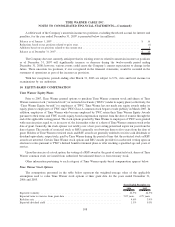

The Company recorded amortization expense of $272 million in 2007, $167 million in 2006 and $72 million in

2005. Based on the current amount of intangible assets subject to amortization, the estimated amortization expense

100

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)