Time Warner Cable 2007 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

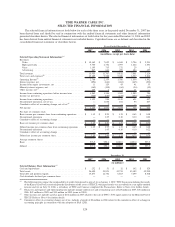

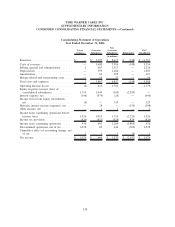

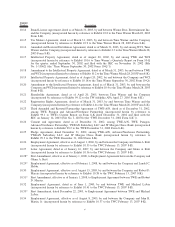

Consolidating Statement of Cash Flows

Year Ended December 31, 2005

Parent

Company

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

(in millions)

OPERATING ACTIVITIES

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,253 $ 664 $ 1,371 $ (2,035) $ 1,253

Adjustments for noncash and nonoperating items:

Depreciation and amortization . . . . . . . . . . . . . . . . — 589 948 — 1,537

Excess (deficiency) of distributions over equity in

pretax income of consolidated subsidiaries . . . . . . (1,371) (794) 99 2,066 —

Income from equity investments . . . . . . . . . . . . . . . — — (43) — (43)

Minority interest (income) expense . . . . . . . . . . . . . — (17) — 81 64

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . (393) (184) (186) 368 (395)

Equity-based compensation . . . . . . . . . . . . . . . . . . — 50 3 — 53

Changes in operating assets and liabilities, net of

acquisitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 229 (194) (103) (62)

Adjustments relating to discontinued operations . . . . . . (100) 110 (83) 206 133

Cash provided (used) by operating activities . . . . . . . . (605) 647 1,915 583 2,540

INVESTING ACTIVITIES

Investments and acquisitions, net of cash acquired . . . . — (36) (77) — (113)

Capital expenditures from continuing operations . . . . . — (653) (1,184) — (1,837)

Capital expenditures from discontinued operations . . . . — (68) (70) — (138)

Proceeds from disposal of property, plant and

equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 1 3 — 4

Investments and acquisitions from discontinued

operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (48) — (48)

Cash used by investing activities . . . . . . . . . . . . . . . . — (756) (1,376) — (2,132)

FINANCING ACTIVITIES

Borrowings (repayments), net . . . . . . . . . . . . . . . . . . 163 — — (585) (422)

Changes in due (to) from parent and investment in

subsidiary. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 410 665 (493) (582) —

Principal payments on capital leases . . . . . . . . . . . . . . — — (1) — (1)

Distributions to owners, net . . . . . . . . . . . . . . . . . . . . — (30) — — (30)

Debt repayments of discontinued operations . . . . . . . . — — (45) — (45)

Cash provided (used) by financing activities . . . . . . . . 573 635 (539) (1,167) (498)

INCREASE (DECREASE) IN CASH AND

EQUIVALENTS . . . . . . . . . . . . . . . . . . . . . . . . . (32) 526 — (584) (90)

CASH AND EQUIVALENTS AT BEGINNING OF

PERIOD . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44 347 — (289) 102

CASH AND EQUIVALENTS AT END OF

PERIOD . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12 $ 873 $ — $ (873) $ 12

134

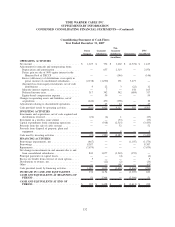

TIME WARNER CABLE INC.

SUPPLEMENTARY INFORMATION

CONDENSED CONSOLIDATING FINANCIAL STATEMENTS—(Continued)