Time Warner Cable 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

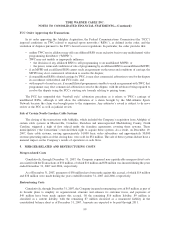

TWC’s policy is that, in instances where the fees are being assessed directly to the Company, amounts paid to the

governmental authorities and amounts received from the customers are recorded on a gross basis. That is, amounts

paid to the governmental authorities are recorded as costs of revenues and amounts received from the customer are

recorded as Subscription revenues. The amount of such franchise fees recorded on a gross basis was $495 million in

2007, $392 million in 2006 and $284 million in 2005.

Income Taxes

TWC is not a separate taxable entity for U.S. federal and various state income tax purposes and its results are

included in the consolidated U.S. federal and certain state income tax returns of Time Warner. The income tax

benefits and provisions, related tax payments, and current and deferred tax balances have been prepared as if TWC

operated as a stand-alone taxpayer for all periods presented in accordance with the tax sharing arrangement between

TWC and Time Warner. Under the tax sharing arrangement, TWC is obligated to make tax sharing payments to

Time Warner as if it were a separate payer. Income taxes are provided using the asset and liability method prescribed

by FASB Statement No. 109, Accounting for Income Taxes. Under this method, income taxes (i.e., deferred tax

assets, deferred tax liabilities, taxes currently payable/refunds receivable and tax expense) are recorded based on

amounts refundable or payable in the current year and include the results of any difference between GAAP and tax

reporting. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amount of

assets and liabilities for financial statement and income tax purposes, as determined under enacted tax laws and

rates. The financial effect of changes in tax laws or rates is accounted for in the period of enactment.

The Company made cash tax payments to Time Warner of $263 million in 2007, $444 million in 2006 and

$496 million in 2005.

As previously discussed under “Recent Accounting Standards—Accounting Standards Adopted in 2007,” on

January 1, 2007, the Company adopted the provisions of FIN 48, which clarifies the accounting for uncertainty in

income tax positions. This interpretation requires the Company to recognize in the consolidated financial

statements those tax positions determined to be “more likely than not” of being sustained upon examination,

based on their technical merits.

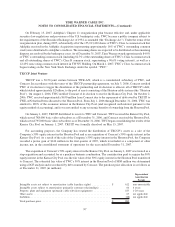

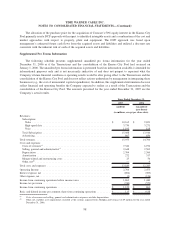

Comprehensive Income (Loss)

Comprehensive income (loss) is reported in the consolidated statement of shareholders’ equity as a component

of retained earnings and consists of net income (loss) and other gains and losses affecting shareholders’ equity that,

under GAAP, are excluded from net income (loss). For TWC, such items consist of gains and losses on certain

derivative financial instruments and changes in unfunded benefit plan obligations. The following summary sets

forth the components of other comprehensive income (loss), net of tax, accumulated in shareholders’ equity (in

millions):

Net

Derivative

Financial

Instrument

Losses

Net

Change in

Unfunded

Benefit

Obligation

Net

Accumulated

Other

Comprehensive

Loss

Balance at December 31, 2004. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ (4) $ (4)

2005 activity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (3) (3)

Balance at December 31, 2005. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (7) (7)

2006 activity

(a)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (123) (123)

Balance at December 31, 2006. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (130) (130)

2007 activity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1) (43) (44)

Balance at December 31, 2007. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1) $ (173) $ (174)

(a)

2006 amount primarily reflects the adoption of FASB Statement No. 158, Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Benefits (“FAS 158”), on December 31, 2006. Specifically, as a result of adopting FAS 158, on December 31, 2006, the

Company reflected the funded status of its plans by reducing its net pension asset by $208 million to reflect actuarial and investment losses

that had been deferred pursuant to prior pension accounting rules and recording a corresponding deferred tax asset of $84 million and a net

after-tax charge of $124 million.

93

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)