Time Warner Cable 2007 Annual Report Download - page 57

Download and view the complete annual report

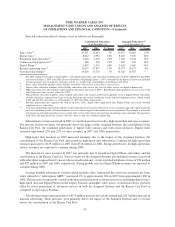

Please find page 57 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.revenues in the Company’s business. To compensate for this limitation, management evaluates the investments in

such tangible and intangible assets through other financial measures, such as capital expenditure budget variances,

investment spending levels and return on capital analyses. Another limitation of this measure is that it does not

reflect the significant costs borne by the Company for income taxes, debt servicing costs, the share of OIBDA

related to the minority ownership, the results of the Company’s equity investments or other non-operational income

or expense. Management compensates for this limitation through other financial measures such as a review of net

income and earnings per share.

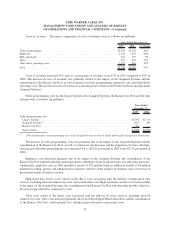

Free Cash Flow is a non-GAAP financial measure. The Company defines Free Cash Flow as cash provided by

operating activities (as defined under GAAP) plus excess tax benefits from the exercise of stock options, less cash

provided by (used by) discontinued operations, capital expenditures, partnership distributions and principal

payments on capital leases. Management uses Free Cash Flow to evaluate the Company’s business. The

Company believes this measure is an important indicator of its liquidity, including its ability to reduce net debt

and make strategic investments, because it reflects the Company’s operating cash flow after considering the

significant capital expenditures required to operate its business. A limitation of this measure, however, is that it does

not reflect payments made in connection with investments and acquisitions, which reduce liquidity. To compensate

for this limitation, management evaluates such expenditures through other financial measures such as return on

investment analyses.

Both OIBDA and Free Cash Flow should be considered in addition to, not as a substitute for, the Company’s

Operating Income, net income and various cash flow measures (e.g., cash provided by operating activities), as well

as other measures of financial performance and liquidity reported in accordance with GAAP, and may not be

comparable to similarly titled measures used by other companies. A reconciliation of OIBDA to Operating Income

is presented under “Results of Operations.” A reconciliation of Free Cash Flow to cash provided by operating

activities is presented under “Financial Condition and Liquidity.”

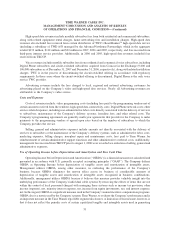

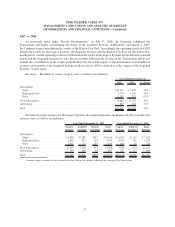

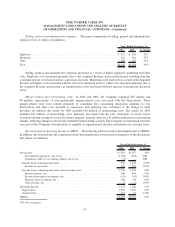

RESULTS OF OPERATIONS

Changes in Basis of Presentation

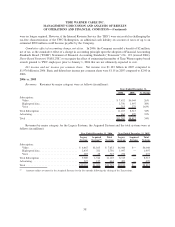

Consolidation of Kansas City Pool

On January 1, 2007, the Company began consolidating the results of the Kansas City Pool it received upon the

distribution of the assets of TKCCP to TWC and Comcast. Prior to January 1, 2007, the Company accounted for

TKCCP as an equity-method investment. The results of operations for the Kansas City Pool have been presented

below separately from the results of the Legacy Systems.

Discontinued Operations

The Company has reflected the results of operations and financial condition of the Transferred Systems as

discontinued operations for all periods presented. See Note 4 to the accompanying consolidated financial

statements for additional information regarding the discontinued operations.

Reclassifications

Certain reclassifications have been made to the prior years’ financial information to conform to the

December 31, 2007 presentation.

Recent Accounting Standards

See Note 2 to the accompanying consolidated financial statements for a discussion of the accounting standards

adopted in 2007 and recent accounting standards not yet adopted.

52

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)