Time Warner Cable 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

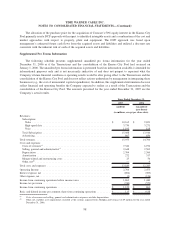

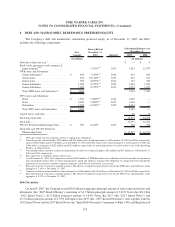

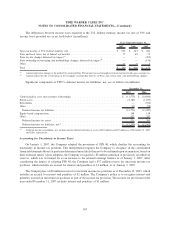

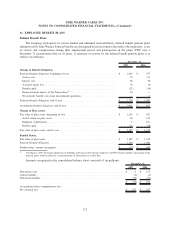

8. DEBT AND MANDATORILY REDEEMABLE PREFERRED EQUITY

The Company’s debt and mandatorily redeemable preferred equity, as of December 31, 2007 and 2006,

includes the following components:

Face

Amount

Interest Rate at

December 31,

2007 Maturity 2007 2006

Outstanding Balance as of

December 31,

(in millions) (in millions)

Debt due within one year

(a)

............. $ — $ 4

Bank credit agreements and commercial

paper program

(b)(c)

. . . . . . . . . . . . . . . . . 5.391%

(d)

2011 5,256 11,077

TWE notes and debentures:

Senior debentures

(e)

. . . . . . . . . . . . . . . . $ 600 7.250%

(f)

2008 601 602

Senior notes. . . . . . . . . . . . . . . . . . . . . . 250 10.150%

(f)

2012 267 271

Senior notes. . . . . . . . . . . . . . . . . . . . . . 350 8.875%

(f)

2012 365 369

Senior debentures . . . . . . . . . . . . . . . . . . 1,000 8.375%

(f)

2023 1,040 1,043

Senior debentures . . . . . . . . . . . . . . . . . . 1,000 8.375%

(f)

2033 1,053 1,055

Total TWE notes and debentures

(g)

. . . . . . $ 3,200 3,326 3,340

TWC notes and debentures:

Notes . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,500 5.400%

(h)

2012 1,498 —

Notes . . . . . . . . . . . . . . . . . . . . . . . . . . 2,000 5.850%

(h)

2017 1,996 —

Debentures . . . . . . . . . . . . . . . . . . . . . . 1,500 6.550%

(h)

2037 1,491 —

Total TWC notes and debentures . . . . . . . $ 5,000 4,985 —

Capital leases and other . . . . . . . . . . . . . . . 10 11

Total long-term debt. . . . . . . . . . . . . . . . . . 13,577 14,428

Total debt . . . . . . . . . . . . . . . . . . . . . . . . . 13,577 14,432

TW NY Preferred Membership Units . . . . . . $ 300 8.210% 2013 300 300

Total debt and TW NY Preferred

Membership Units . . . . . . . . . . . . . . . . . $ 13,877 $ 14,732

(a)

Debt due within one year primarily relates to capital lease obligations.

(b)

Unused capacity, which includes $232 million and $51 million in cash and equivalents as of December 31, 2007 and 2006, respectively,

equals $3.881 billion and $2.798 billion as of December 31, 2007 and 2006, respectively. Unused capacity as of December 31, 2007 and

2006 reflects a reduction of $135 million and $159 million, respectively, for outstanding letters of credit backed by the Cable Revolving

Facility, as defined below.

(c)

Outstanding balance amounts exclude an unamortized discount on commercial paper of $5 million and $17 million as of December 31,

2007 and 2006, respectively.

(d)

Rate represents a weighted-average interest rate.

(e)

As of December 31, 2007, the Company has classified $601 million of TWE debentures due within the next twelve months as long-term in

the consolidated balance sheet to reflect management’s intent and ability to refinance the obligation on a long-term basis through the

utilization of the unused committed capacity under the Cable Revolving Facility, if necessary.

(f)

Rate represents the stated rate at original issuance. The effective weighted-average interest rate for the TWE notes and debentures in the

aggregate is 7.64% at December 31, 2007.

(g)

Amounts include an unamortized fair value adjustment of $126 million and $140 million as of December 31, 2007 and 2006, respectively.

(h)

Rate represents the stated rate at original issuance. The effective weighted-average interest rate for the TWC notes and debentures in the

aggregate is 5.97% at December 31, 2007.

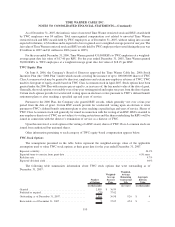

Debt Securities

On April 9, 2007, the Company issued $5.0 billion in aggregate principal amount of senior unsecured notes and

debentures (the “2007 Bond Offering”) consisting of $1.5 billion principal amount of 5.40% Notes due 2012 (the

“2012 Initial Notes”), $2.0 billion principal amount of 5.85% Notes due 2017 (the “2017 Initial Notes”) and

$1.5 billion principal amount of 6.55% Debentures due 2037 (the “2037 Initial Debentures” and, together with the

2012 Initial Notes and the 2017 Initial Notes, the “Initial Debt Securities”) pursuant to Rule 144A and Regulation S

102

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)