Time Warner Cable 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.products. The standard costing models are reviewed annually and adjusted prospectively, if necessary, based on

comparisons to actual costs incurred.

TWC generally capitalizes expenditures for tangible fixed assets having a useful life of greater than one year.

Types of capitalized expenditures include: customer premise equipment, scalable infrastructure, line extensions,

plant upgrades and rebuilds and support capital. For set-top boxes and modems, useful life is generally 3 to 5 years

and for distribution plant, useful life is up to 16 years. In connection with the Transactions, TW NY acquired

significant amounts of property, plant and equipment, which were recorded at their estimated fair values. The

remaining useful lives assigned to such assets were generally shorter than the useful lives assigned to comparable

new assets, to reflect the age, condition and intended use of the acquired property, plant and equipment.

Programming Agreements

The Company exercises significant judgment in estimating programming expense associated with certain

video programming contracts. The Company’s policy is to record video programming costs based on the

Company’s contractual agreements with its programming vendors, which are generally multi-year agreements

that provide for the Company to make payments to the programming vendors at agreed upon rates, which represent

fair market value, based on the number of subscribers to which the Company provides the service. If a programming

contract expires prior to the parties’ entry into a new agreement, management estimates the programming costs

during the period there is no contract in place. Management considers the previous contractual rates, inflation and

the status of the negotiations in determining its estimates. When the programming contract terms are finalized, an

adjustment to programming expense is recorded, if necessary, to reflect the terms of the new contract. Management

also makes estimates in the recognition of programming expense related to other items, such as the accounting for

free periods and service interruptions, as well as the allocation of consideration exchanged between the parties in

multiple-element transactions. Additionally, judgments are also required by management when the Company

purchases multiple services from the same cable programming vendor. In these scenarios, the total consideration

provided to the programming vendor is required to be allocated to the various services received based upon their

respective fair values. Because multiple services from the same programming vendor are often received over

different contractual periods and often have different contractual rates, the allocation of consideration to the

individual services will have an impact on the timing of the Company’s expense recognition.

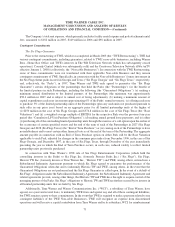

Income Taxes

From time to time, the Company engages in transactions in which the tax consequences may be subject to

uncertainty. Examples of such transactions include business acquisitions and dispositions, including those designed

to be tax free, issues related to consideration paid or received, and certain financing transactions. Significant

judgment is required in assessing and estimating the tax consequences of these transactions. The Company prepares

and files tax returns based on interpretation of tax laws and regulations. In the normal course of business, the

Company’s tax returns are subject to examination by various taxing authorities. Such examinations may result in

future tax and interest assessments by these taxing authorities. In determining the Company’s tax provision for

financial reporting purposes, the Company establishes a reserve for uncertain tax positions unless such positions are

determined to be “more likely than not” of being sustained upon examination, based on their technical merits. That

is, for financial reporting purposes, the Company only recognizes tax benefits taken on the tax return that it believes

are “more likely than not” of being sustained. There is considerable judgment involved in determining whether

positions taken on the tax return are “more likely than not” of being sustained.

The Company adjusts its tax reserve estimates periodically because of ongoing examinations by, and

settlements with, the various taxing authorities, as well as changes in tax laws, regulations and interpretations.

The consolidated tax provision of any given year includes adjustments to prior year income tax accruals that are

considered appropriate and any related estimated interest.

77

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)