Time Warner Cable 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

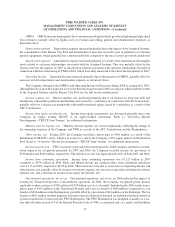

were no longer required. However, if the Internal Revenue Service (the “IRS”) were successful in challenging the

tax-free characterization of the TWC Redemption, an additional cash liability on account of taxes of up to an

estimated $900 million could become payable by the Company.

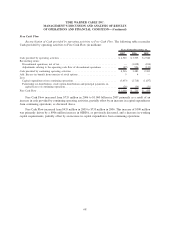

Cumulative effect of accounting change, net of tax. In 2006, the Company recorded a benefit of $2 million,

net of tax, as the cumulative effect of a change in accounting principle upon the adoption of Financial Accounting

Standards Board (“FASB”) Statement of Financial Accounting Standards (“Statement”) No. 123 (revised 2004),

Share-Based Payment (“FAS 123R”) to recognize the effect of estimating the number of Time Warner equity-based

awards granted to TWC employees prior to January 1, 2006 that are not ultimately expected to vest.

Net income and net income per common share. Net income was $1.123 billion in 2007 compared to

$1.976 billion in 2006. Basic and diluted net income per common share were $1.15 in 2007 compared to $2.00 in

2006.

2006 vs. 2005

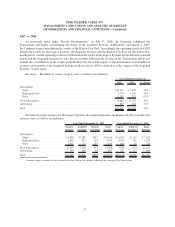

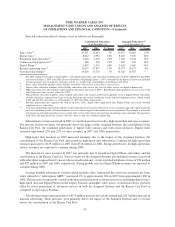

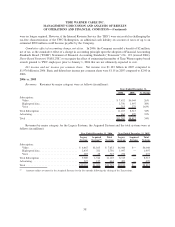

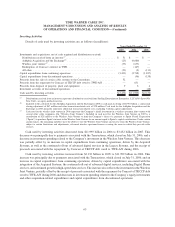

Revenues. Revenues by major category were as follows (in millions):

2006 2005 % Change

Years Ended December 31,

Subscription:

Video . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7,632 $6,044 26%

High-speed data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,756 1,997 38%

Voice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 715 272 163%

Total Subscription . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,103 8,313 34%

Advertising. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 664 499 33%

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $11,767 $8,812 34%

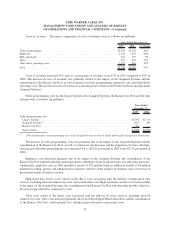

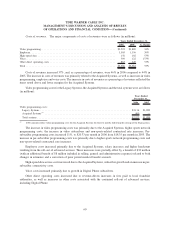

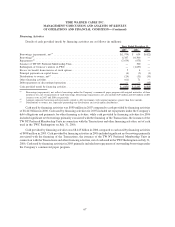

Revenues by major category for the Legacy Systems, the Acquired Systems and the total systems were as

follows (in millions):

Legacy

Systems

Acquired

Systems

(a)

Total

Systems

Legacy

Systems

Acquired

Systems

Total

Systems

Year Ended December 31, 2006 Year Ended December 31, 2005

Subscription:

Video . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,467 $1,165 $ 7,632 $6,044 $— $6,044

High-speed data . . . . . . . . . . . . . . . . . . . . . . . . . 2,435 321 2,756 1,997 — 1,997

Voice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 687 28 715 272 — 272

Total Subscription . . . . . . . . . . . . . . . . . . . . . . . . . 9,589 1,514 11,103 8,313 — 8,313

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 527 137 664 499 — 499

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $10,116 $1,651 $11,767 $8,812 $— $8,812

(a)

Amounts reflect revenues for the Acquired Systems for the five months following the closing of the Transactions.

58

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)