Time Warner Cable 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FCC Order Approving the Transactions

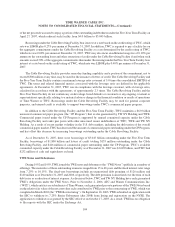

In its order approving the Adelphia Acquisition, the Federal Communications Commission (the “FCC”)

imposed conditions on TWC related to regional sports networks (“RSNs”), as defined in the order, and the

resolution of disputes pursuant to the FCC’s leased access regulations. In particular, the order provides that:

• neither TWC nor its affiliates may offer an affiliated RSN on an exclusive basis to any multichannel video

programming distributor (“MVPD”);

• TWC may not unduly or improperly influence:

• the decision of any affiliated RSN to sell programming to an unaffiliated MVPD; or

• the prices, terms and conditions of sale of programming by an affiliated RSN to an unaffiliated MVPD;

• if an MVPD and an affiliated RSN cannot reach an agreement on the terms and conditions of carriage, the

MVPD may elect commercial arbitration to resolve the dispute;

• if an unaffiliated RSN is denied carriage by TWC, it may elect commercial arbitration to resolve the dispute

in accordance with federal and FCC rules; and

• with respect to leased access, if an unaffiliated programmer is unable to reach an agreement with TWC, that

programmer may elect commercial arbitration to resolve the dispute, with the arbitrator being required to

resolve the dispute using the FCC’s existing rate formula relating to pricing terms.

The FCC has suspended this “baseball style” arbitration procedure as it relates to TWC’s carriage of

unaffiliated RSNs, although it will allow the arbitration of a claim brought by the Mid-Atlantic Sports

Network because the claim was brought prior to the suspension. Any arbitrator’s award is subject to de novo

review at the FCC as well as judicial review.

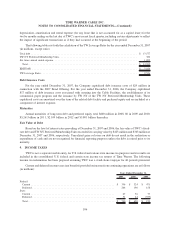

Sale of Certain North Carolina Cable Systems

The closing of the transactions with Adelphia, which included the Company’s acquisition from Adelphia of

certain cable systems in Mooresville, Cornelius, Davidson and unincorporated Mecklenburg County, North

Carolina, triggered a right of first refusal under the franchise agreements covering these systems. These

municipalities (“the Consortium”) exercised their right to acquire these systems. As a result, on December 19,

2007, these cable systems, serving approximately 14,000 basic video subscribers and approximately 30,000

revenue generating units as of the closing date, were sold for $52 million. The sale of these systems did not have a

material impact on the Company’s results of operations or cash flows.

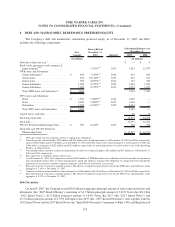

5. MERGER-RELATED AND RESTRUCTURING COSTS

Merger-related Costs

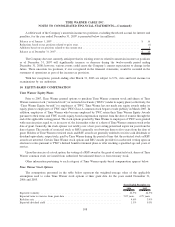

Cumulatively, through December 31, 2007, the Company expensed non-capitalizable merger-related costs

associated with the Transactions of $56 million, of which $10 million and $38 million was incurred during the years

ended December 31, 2007 and 2006, respectively.

As of December 31, 2007, payments of $56 million have been made against this accrual, of which $14 million

and $38 million were made during the years ended December 31, 2007 and 2006, respectively.

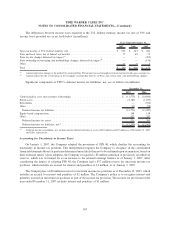

Restructuring Costs

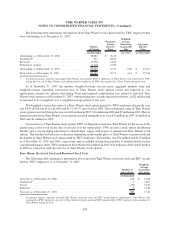

Cumulatively, through December 31, 2007, the Company incurred restructuring costs of $65 million as part of

its broader plans to simplify its organizational structure and enhance its customer focus, and payments of

$49 million have been made against this accrual. Of the remaining $16 million liability, $9 million is

classified as a current liability, with the remaining $7 million classified as a noncurrent liability in the

consolidated balance sheet as of December 31, 2007. Amounts are expected to be paid through 2011.

99

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)