Time Warner Cable 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

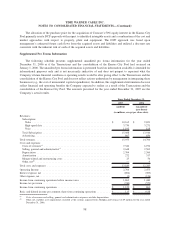

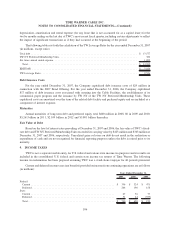

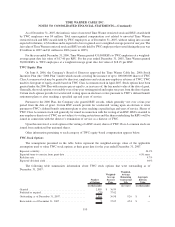

A rollforward of the Company’s uncertain income tax positions, excluding the related accrual for interest and

penalties, for the year ended December 31, 2007 is presented below (in millions):

Balance as of January 1, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 16

Reductions based on tax positions related to prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1)

Additions based on tax positions related to the current year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Balance as of December 31, 2007. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 18

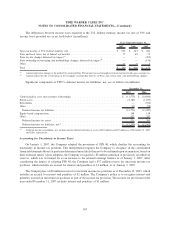

The Company does not currently anticipate that its existing reserves related to uncertain income tax positions

as of December 31, 2007 will significantly increase or decrease during the twelve-month period ending

December 31, 2008; however, various events could cause the Company’s current expectations to change in the

future. These uncertain tax positions, if ever recognized in the financial statements, would be recorded in the

statement of operations as part of the income tax provision.

With few exceptions, periods ending after March 31, 2003 are subject to U.S., state and local income tax

examinations by tax authorities.

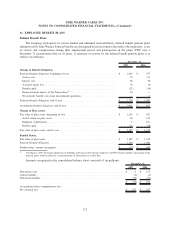

10. EQUITY-BASED COMPENSATION

Time Warner Equity Plans

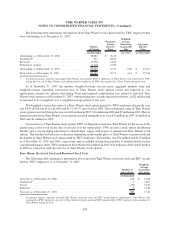

Prior to 2007, Time Warner granted options to purchase Time Warner common stock and shares of Time

Warner common stock (“restricted stock”) or restricted stock units (“RSUs”) under its equity plans (collectively, the

“Time Warner Equity Awards”) to employees of TWC. Time Warner has not made any equity awards under its

equity plans to employees of TWC since TWC Class A common stock began to trade publicly in March 2007. In

addition, employees of Time Warner who become employed by TWC retain their Time Warner Equity Awards

pursuant to their terms and TWC records equity-based compensation expense from the date of transfer through the

end of the applicable vesting period. The stock options granted by Time Warner to employees of TWC were granted

with exercise prices equal to, or in excess of, the fair market value of a share of Time Warner common stock at the

date of grant. Generally, the stock options vest ratably over a four-year vesting period and expire ten years from the

date of grant. The awards of restricted stock or RSUs generally vest between three to five years from the date of

grant. Holders of Time Warner restricted stock and RSU awards are generally entitled to receive cash dividends or

dividend equivalents, respectively, paid by Time Warner during the period of time that the restricted stock or RSU

awards are unvested. Certain Time Warner stock options and RSU awards provide for accelerated vesting upon an

election to retire pursuant to TWC’s defined benefit retirement plans or after reaching a specified age and years of

service.

Upon the exercise of a stock option, the vesting of a RSU award or the grant of restricted stock, shares of Time

Warner common stock are issued from authorized but unissued shares or from treasury stock.

Other information pertaining to each category of Time Warner equity-based compensation appears below.

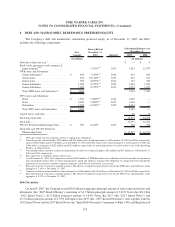

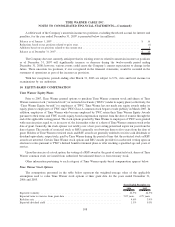

Time Warner Stock Options

The assumptions presented in the table below represent the weighted-average value of the applicable

assumption used to value Time Warner stock options at their grant date for the years ended December 31,

2006 and 2005.

2006 2005

Years Ended December 31,

Expected volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.3% 24.5%

Expected term to exercise from grant date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.07 years 4.79 years

Risk-free rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.6% 3.9%

Expected dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.1% 0.1%

108

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)