Time Warner Cable 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Adelphia Acquisition and Related Transactions

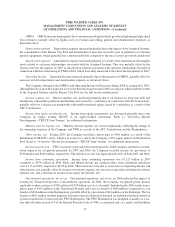

As discussed further in Note 4 to the accompanying consolidated financial statements, on July 31, 2006,

TW NY and Comcast completed their respective acquisitions of assets comprising in the aggregate substantially all

of the cable assets of Adelphia (the “Adelphia Acquisition”). Additionally, on July 31, 2006, immediately before the

closing of the Adelphia Acquisition, Comcast’s interests in TWC and Time Warner Entertainment Company, L.P.

(“TWE”), a subsidiary of TWC, were redeemed (the “TWC Redemption” and the “TWE Redemption,”

respectively, and, collectively, the “Redemptions”). Following the Redemptions and the Adelphia Acquisition,

on July 31, 2006, TW NYand Comcast swapped certain cable systems, most of which were acquired from Adelphia,

in order to enhance TWC’s and Comcast’s respective geographic clusters of subscribers (the “Exchange” and,

together with the Adelphia Acquisition and the Redemptions, the “Transactions”). As a result of the closing of the

Transactions, on July 31, 2006, TWC acquired systems with approximately 4.0 million basic video subscribers and

disposed of the Transferred Systems (as defined below), with approximately 0.8 million basic video subscribers, for

a net gain of approximately 3.2 million basic video subscribers. In addition, on July 28, 2006, American Television

and Communications Corporation (“ATC”), a subsidiary of Time Warner, contributed its 1% common equity

interest and $2.4 billion preferred equity interest in TWE to TW NY Cable Holding Inc. (“TW NY Holding”), a

subsidiary of TWC and the parent of TW NY, in exchange for a 12.43% non-voting common stock interest in

TW NY Holding (the “ATC Contribution”).

The results of the systems acquired in connection with the Transactions have been included in the

accompanying consolidated statement of operations since the closing of the Transactions. The systems

previously owned by TWC that were transferred to Comcast in connection with the Redemptions and the

Exchange (the “Transferred Systems”) have been reflected as discontinued operations in the accompanying

consolidated financial statements for all periods presented (Note 4).

On February 13, 2007, Adelphia’s Chapter 11 reorganization plan became effective and, under applicable

securities law regulations and provisions of the U.S. bankruptcy code, TWC became a public company subject to

the requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under the terms of the

reorganization plan, during 2007, substantially all of the 155,913,430 shares of TWC’s Class A common stock that

Adelphia received in the Adelphia Acquisition (representing approximately 16% of TWC’s outstanding common

stock) were distributed to Adelphia’s creditors. The remaining shares are expected to be distributed as the remaining

disputes are resolved by the bankruptcy court. As of December 31, 2007, Time Warner owned approximately 84.0%

of TWC’s outstanding common stock (including 82.7% of the outstanding shares of TWC’s Class A common stock

and all outstanding shares of TWC’s Class B common stock, representing a 90.6% voting interest), as well as a

12.43% non-voting common stock interest in TW NY Holding. On March 1, 2007, TWC’s Class A common stock

began trading on the New York Stock Exchange under the symbol “TWC” (Note 4).

FINANCIAL STATEMENT PRESENTATION

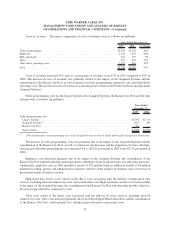

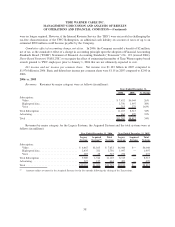

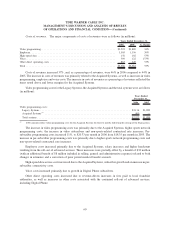

Revenues

The Company’s revenues consist of Subscription and Advertising revenues. Subscription revenues consist of

revenues from video, high-speed data and voice services.

Video revenues include monthly fees for basic, standard and digital services from both residential and

commercial subscribers. Video revenues from digital services, or digital video revenues, include revenues from

digital tiers, digital pay channels, pay-per-view, video-on-demand, subscription-video-on-demand and digital video

recorders. Video revenues also include related equipment rental charges, installation charges and franchise fees

collected on behalf of local franchising authorities. Several ancillary items are also included within video revenues,

such as commissions earned on the sale of merchandise by home shopping services and rental income earned on the

leasing of antenna attachments on the Company’s transmission towers. In each period presented, these ancillary

items constitute less than 2% of video revenues.

50

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)