Time Warner Cable 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

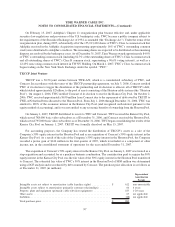

depreciation, amortization and rental expense (for any lease that is not accounted for as a capital lease) for the

twelve months ending on the last day of TWC’s most recent fiscal quarter, including certain adjustments to reflect

the impact of significant transactions as if they had occurred at the beginning of the period.

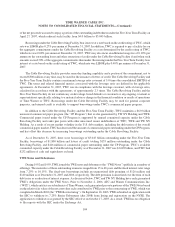

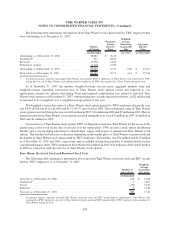

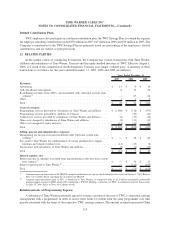

The following table sets forth the calculation of the TW Leverage Ratio for the year ended December 31, 2007

(in millions, except ratio):

Total debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 13,577

TW NY Preferred Membership Units . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 300

Six times annual rental expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,092

Total......................................................................... $ 14,969

EBITDAR ...................................................................... $ 5,924

TW Leverage Ratio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.53x

Debt Issuance Costs

For the year ended December 31, 2007, the Company capitalized debt issuance costs of $29 million in

connection with the 2007 Bond Offering. For the year ended December 31, 2006, the Company capitalized

$17 million of debt issuance costs associated with entering into the Cable Facilities, the establishment of its

commercial paper program and the issuance by TW NY of the TW NY Preferred Membership Units. These

capitalized costs are amortized over the term of the related debt facility and preferred equity and are included as a

component of interest expense.

Maturities

Annual maturities of long-term debt and preferred equity total $600 million in 2008, $0 in 2009 and 2010,

$5.261 billion in 2011, $2.109 billion in 2012 and $5.801 billion thereafter.

Fair Value of Debt

Based on the level of interest rates prevailing at December 31, 2007 and 2006, the fair value of TWC’s fixed-

rate debt and TW NY Preferred Membership Units exceeded its carrying value by $423 million and $363 million at

December 31, 2007 and 2006, respectively. Unrealized gains or losses on debt do not result in the realization or

expenditure of cash and are not recognized for financial reporting purposes unless the debt is retired prior to its

maturity.

9. INCOME TAXES

TWC is not a separate taxable entity for U.S. federal and various state income tax purposes and its results are

included in the consolidated U.S. federal and certain state income tax returns of Time Warner. The following

income tax information has been prepared assuming TWC was a stand-alone taxpayer for all periods presented.

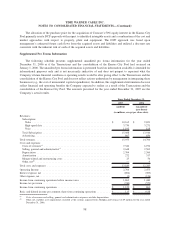

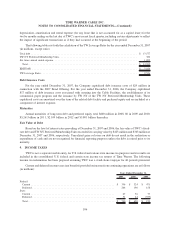

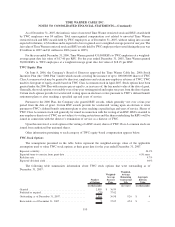

Current and deferred income taxes (tax benefits) provided on income from continuing operations are as follows

(in millions):

2007 2006 2005

Years Ended December 31,

Federal:

Current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 356 $ 324 $ 471

Deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 266 196 158

State:

Current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67 56 77

Deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51 44 (553)

Total.......................................................... $ 740 $ 620 $ 153

106

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)