Time Warner Cable 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

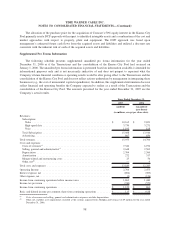

The allocation of the purchase price for the acquisition of Comcast’s 50% equity interest in the Kansas City

Pool primarily used a DCF approach with respect to identified intangible assets and a combination of the cost and

market approaches with respect to property, plant and equipment. The DCF approach was based upon

management’s estimated future cash flows from the acquired assets and liabilities and utilized a discount rate

consistent with the inherent risk of each of the acquired assets and liabilities.

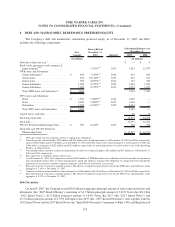

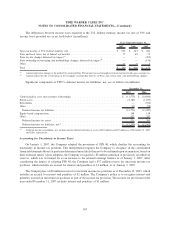

Supplemental Pro Forma Information

The following schedule presents supplemental unaudited pro forma information for the year ended

December 31, 2006 as if the Transactions and the consolidation of the Kansas City Pool had occurred on

January 1, 2006. The unaudited pro forma information is presented based on information available, is intended for

informational purposes only and is not necessarily indicative of and does not purport to represent what the

Company’s future financial condition or operating results would be after giving effect to the Transactions and the

consolidation of the Kansas City Pool and does not reflect actions undertaken by management in integrating these

businesses (e.g., the cost of incremental capital expenditures). In addition, this supplemental information does not

reflect financial and operating benefits the Company expected to realize as a result of the Transactions and the

consolidation of the Kansas City Pool. The amounts presented for the year ended December 31, 2007 are the

Company’s actual results.

2007 2006

Years Ended December 31,

(audited) (unaudited)

(pro forma)

(in millions, except per share data)

Revenues:

Subscription:

Video . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10,165 $ 9,821

High-speed data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,730 3,271

Voice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,193 818

Total Subscription . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,088 13,910

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 867 850

Total revenues. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,955 14,760

Costs and expenses:

Costs of revenues

(a)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,542 6,974

Selling, general and administrative

(a)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,648 2,569

Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,704 2,360

Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 272 317

Merger-related and restructuring costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 56

Other, net

(b)

.................................................. — 9

Total costs and expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,189 12,285

Operating Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,766 2,475

Interest expense, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (894) (909)

Other expense, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9) (126)

Income from continuing operations before income taxes . . . . . . . . . . . . . . . . . . . . 1,863 1,440

Income tax provision . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (740) (579)

Income from continuing operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,123 $ 861

Basic and diluted income per common share from continuing operations . . . . . . . . . $ 1.15 $ 0.88

(a)

Costs of revenues and selling, general and administrative expenses exclude depreciation.

(b)

Other, net, includes asset impairments recorded at the systems acquired from Adelphia and Comcast of $9 million for the year ended

December 31, 2006.

98

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)