Time Warner Cable 2007 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

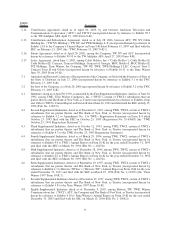

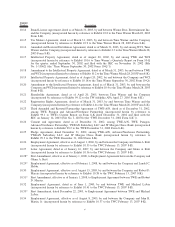

Exhibit

Number Description

4.9 Ninth Supplemental Indenture dated as of November 1, 2004, among Historic TW, TWE, Time Warner

NY Cable Inc., WCI, ATC, the Company and The Bank of New York, as Trustee (incorporated herein by

reference to Exhibit 4.1 to the Time Warner Quarterly Report on Form 10-Q for the quarter ended

September 30, 2004 (File No. 1-15062)).

4.10 Tenth Supplemental Indenture dated as of October 18, 2006, among Historic TW, TWE, TW NY Holding,

TW NY, the Company, WCI, ATC and the Bank of New York, as Trustee (incorporated herein by reference

to Exhibit 4.1 to Time Warner’s Current Report on Form 8-K dated October 18, 2006 (File No. 1-15062)).

4.11 Eleventh Supplemental Indenture dated as of November 2, 2006, among TWE, TW NY Holding, the

Company and the Bank of New York, as Trustee (incorporated herein by reference to Exhibit 99.1 to Time

Warner’s Current Report on Form 8-K dated November 2, 2006 (File No. 1-15062)).

4.12 $6.0 Billion Amended and Restated Five-Year Revolving Credit Agreement, dated as of December 9,

2003 and amended and restated as of February 15, 2006, among the Company as Borrower, the Lenders

from time to time party thereto, Bank of America, N.A., as Administrative Agent, Citibank, N.A. and

Deutsche Bank AG, New York Branch, as Co-Syndication Agents, and BNP Paribas and Wachovia Bank,

National Association, as Co-Documentation Agents, with associated Guarantees (incorporated herein by

reference to Exhibit 10.51 to Time Warner’s Annual Report on Form 10-K for the year ended

December 31, 2005 (File No. 1-15062) (the “Time Warner 2005 Form 10-K”)).

4.13 $4.0 Billion Five-Year Term Loan Credit Agreement, dated as of February 21, 2006, among the Company,

as Borrower, the Lenders from time to time party thereto, The Bank of Tokyo-Mitsubishi UFJ Ltd., New

York Branch, as Administrative Agent, The Royal Bank of Scotland plc and Sumitomo Mitsui Banking

Corporation, as Co-Syndication Agents, and Calyon New York Branch, HSBC Bank USA, N.A. and

Mizuho Corporate Bank, Ltd., as Co-Documentation Agents, with associated Guarantees (incorporated

herein by reference to Exhibit 10.52 to the Time Warner 2005 Form 10-K).

4.14 $4.0 Billion Three-Year Term Loan Credit Agreement, dated as of February 24, 2006, among the

Company, as Borrower, the Lenders from time to time party thereto, Wachovia Bank, National

Association, as Administrative Agent, ABN Amro Bank N.V. and Barclays Capital, as Co-

Syndication Agents, and Dresdner Bank AG New York and Grand Cayman Branches and The Bank

of Nova Scotia, as Co-Documentation Agents, with associated Guarantees (incorporated herein by

reference to Exhibit 10.53 to the Time Warner 2005 Form 10-K).

4.15 Amended and Restated Limited Liability Company Agreement of TW NY, dated as of July 28, 2006

(incorporated herein by reference to Exhibit 4.14 to the TWC February 13, 2007 8-K).

4.16 Indenture, dated as of April 9, 2007, among the Company, TW NY Holding, TWE and The Bank of New

York, as trustee (incorporated herein by reference to Exhibit 4.1 to the Company’s Current Report on

Form 8-K dated April 4, 2007 and filed with the SEC on April 9, 2007 (File No. 1-33335) (the “TWC

April 4, 2007 Form 8-K”)).

4.17 First Supplemental Indenture, dated as of April 9, 2007 (the “First Supplemental Indenture”), among the

Company, TW NY Holding, TWE and The Bank of New York, as trustee (incorporated herein by

reference to Exhibit 4.2 to the TWC April 4, 2007 Form 8-K).

4.18 Form of 5.40% Exchange Notes Due 2012 (included as Exhibit A to the First Supplemental Indenture

incorporated herein by reference to Exhibit 4.2 to the TWC April 4, 2007 Form 8-K).

4.19 Form of 5.85% Exchange Notes Due 2017 (included as Exhibit B to the First Supplemental Indenture

incorporated herein by reference to Exhibit 4.2 to the TWC April 4, 2007 Form 8-K).

4.20 Form of 6.55% Exchange Debentures Due 2037 (included as Exhibit C to the First Supplemental

Indenture incorporated herein by reference to Exhibit 4.2 to the TWC April 4, 2007 Form 8-K).

4.21 Registration Rights Agreement, dated as of April 9, 2007, among the Company, TW NY Holding, TWE

and ABN AMRO Incorporated, Citigroup Global Markets Inc., Deutsche Bank Securities Inc. and

Wachovia Capital Markets, LLC on behalf of themselves and the other initial purchasers named therein

(incorporated herein by reference to Exhibit 4.3 to the TWC April 4, 2007 Form 8-K).

iii