Time Warner Cable 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149

|

|

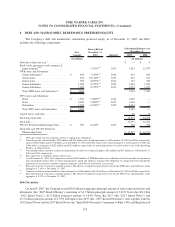

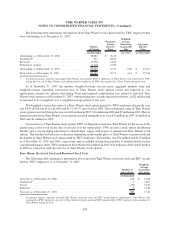

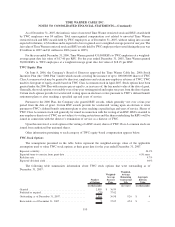

is expected to be $259 million in 2008, $257 million in 2009, $163 million in 2010, $13 million in 2011 and

$8 million in 2012. These amounts may vary as acquisitions and dispositions occur in the future and as purchase

price allocations are finalized.

7. INVESTMENTS AND JOINT VENTURES

The Company had investments of $735 million and $2.072 billion as of December 31, 2007 and 2006,

respectively. These investments are comprised almost entirely of equity-method investees.

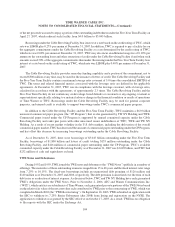

As of December 31, 2007, investments accounted for using the equity method, and the respective ownership

percentage held by TWC, primarily consisted of SpectrumCo, LLC, a wireless joint venture with several other cable

companies (the “Wireless Joint Venture”) (27.8% owned) to which TWC contributed $33 million in 2007. The

Company’s recorded investment for the Wireless Joint Venture approximates the Company’s equity interests in the

underlying net assets of this equity-method investment.

As of December 31, 2006, investments accounted for using the equity method primarily consisted of TKCCP

(50% owned, and TWC began consolidating the results of the Kansas City Pool of TKCCP on January 1, 2007) and

the Wireless Joint Venture to which TWC contributed $633 million in 2006. Refer to Note 4 for further details

regarding the dissolution of TKCCP.

101

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)