Time Warner Cable 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

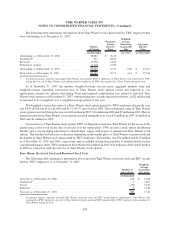

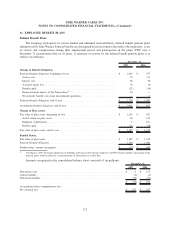

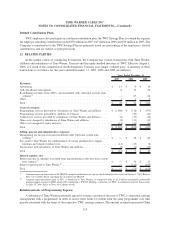

Defined Contribution Plans

TWC employees also participate in a defined contribution plan, the TWC Savings Plan, for which the expense

for employer matching contributions totaled $59 million in 2007, $47 million in 2006 and $39 million in 2005. The

Company’s contributions to the TWC Savings Plan are primarily based on a percentage of the employees’ elected

contributions and are subject to plan provisions.

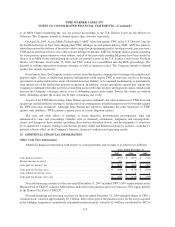

12. RELATED PARTIES

In the normal course of conducting its business, the Company has various transactions with Time Warner,

affiliates and subsidiaries of Time Warner, Comcast and the equity-method investees of TWC. Effective August 1,

2006, as a result of the completion of the Redemptions, Comcast is no longer a related party. A summary of these

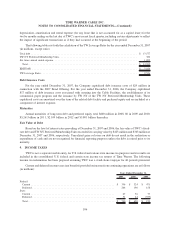

transactions is as follows for the years ended December 31, 2007, 2006 and 2005 (in millions):

2007 2006 2005

Years Ended December 31,

Revenues:

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 11 $ 9 $ 10

AOL broadband subscriptions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 19 26

Road Runner revenues from TWC’s unconsolidated cable television systems joint

ventures

(a)

.................................................. — 65 68

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1 2

Total........................................................ $ 20 $ 94 $ 106

Costs of revenues:

Programming services provided by subsidiaries of Time Warner and affiliates . . . . . $ (1,004) $ (718) $ (553)

Programming services provided by affiliates of Comcast . . . . . . . . . . . . . . . . . . . . — (29) (43)

Connectivity services provided by subsidiaries of Time Warner and affiliates . . . . . . (4) (39) (18)

Other costs charged by subsidiaries of Time Warner and affiliates . . . . . . . . . . . . . (4) (33) (12)

Other costs charged by equity investees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (12) (11) (11)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1,024) $ (830) $ (637)

Selling, general and administrative expenses:

Management fee income from unconsolidated cable television system joint

ventures

(a)

.................................................. $ — $ 28 $ 42

Fees paid to Time Warner for reimbursement of certain administrative support

functions and related overhead costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14) (13) (8)

Transactions with subsidiaries of Time Warner and affiliates . . . . . . . . . . . . . . . . . (2) (6) (10)

Total........................................................ $ (16) $ 9 $ 24

Interest expense, net:

Interest income on amounts receivable from unconsolidated cable television system

joint ventures

(a)

............................................... $ — $ 39 $ 35

Interest expense paid to Time Warner

(b)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (112) (193)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ (73) $ (158)

(a)

Amounts represent transactions with TKCCP, an equity-method investee, prior to the distribution of its assets on January 1, 2007. Refer to

Note 4 for further details regarding the dissolution of TKCCP.

(b)

Amounts represent interest paid to ATC, a subsidiary of Time Warner, in connection with its $2.4 billion mandatorily redeemable

preferred equity interest in TWE, which ATC contributed to TW NY Holding, a subsidiary of TWC, in connection with the Transactions

on July 28, 2006. Refer to Note 4 for further details.

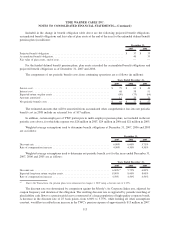

Reimbursements of Programming Expense

A subsidiary of Time Warner previously agreed to assume a portion of the cost of TWC’s contractual carriage

arrangements with a programmer in order to secure other forms of content from the same programmer over time

periods consistent with the terms of the respective TWC carriage contract. The amount assumed represented Time

115

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)