Time Warner Cable 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On February 13, 2007, Adelphia’s Chapter 11 reorganization plan became effective and, under applicable

securities law regulations and provisions of the U.S. bankruptcy code, TWC became a public company subject to

the requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under the terms of the

reorganization plan, during 2007, substantially all of the 155,913,430 shares of TWC’s Class A common stock that

Adelphia received in the Adelphia Acquisition (representing approximately 16% of TWC’s outstanding common

stock) were distributed to Adelphia’s creditors. The remaining shares are expected to be distributed as the remaining

disputes are resolved by the bankruptcy court. As of December 31, 2007, Time Warner owned approximately 84.0%

of TWC’s outstanding common stock (including 82.7% of the outstanding shares of TWC’s Class A common stock

and all outstanding shares of TWC’s Class B common stock, representing a 90.6% voting interest), as well as a

12.43% non-voting common stock interest in TW NY Holding. On March 1, 2007, TWC’s Class A common stock

began trading on the New York Stock Exchange under the symbol “TWC.”

TKCCP Joint Venture

TKCCP was a 50-50 joint venture between TWE-A/N, which is a consolidated subsidiary of TWC, and

Comcast. In accordance with the terms of the TKCCP partnership agreement, on July 3, 2006, Comcast notified

TWC of its election to trigger the dissolution of the partnership and its decision to allocate all of TKCCP’s debt,

which totaled approximately $2 billion, to the pool of assets consisting of the Houston cable systems (the “Houston

Pool”). On August 1, 2006, TWC notified Comcast of its election to receive the Kansas City Pool. On October 2,

2006, TWC received approximately $630 million from Comcast due to the repayment of debt owed by TKCCP to

TWE-A/N that had been allocated to the Houston Pool. From July 1, 2006 through December 31, 2006, TWC was

entitled to 100% of the economic interest in the Kansas City Pool (and recognized such interest pursuant to the

equity method of accounting), and it was not entitled to any economic benefits of ownership from the Houston Pool.

On January 1, 2007, TKCCP distributed its assets to TWC and Comcast. TWC received the Kansas City Pool,

which served 788,000 basic video subscribers as of December 31, 2006, and Comcast received the Houston Pool,

which served 795,000 basic video subscribers as of December 31, 2006. TWC began consolidating the results of the

Kansas City Pool on January 1, 2007. TKCCP was formally dissolved on May 15, 2007.

For accounting purposes, the Company has treated the distribution of TKCCP’s assets as a sale of the

Company’s 50% equity interest in the Houston Pool and as an acquisition of Comcast’s 50% equity interest in the

Kansas City Pool. As a result of the sale of the Company’s 50% equity interest in the Houston Pool, the Company

recorded a pretax gain of $146 million in the first quarter of 2007, which is included as a component of other

income, net, in the consolidated statement of operations for the year ended December 31, 2007.

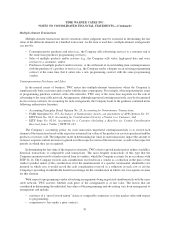

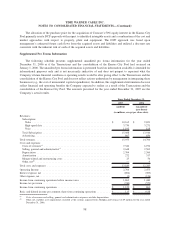

The acquisition of Comcast’s 50% equity interest in the Kansas City Pool on January 1, 2007 was treated as a

step-acquisition and accounted for as a purchase business combination. The consideration paid to acquire the 50%

equity interest in the Kansas City Pool was the fair value of the 50% equity interest in the Houston Pool transferred

to Comcast. The estimated fair value of TWC’s 50% interest in the Houston Pool of $880 million was determined

using a DCF analysis and was reduced by debt assumed by Comcast. The purchase price allocation is as follows as

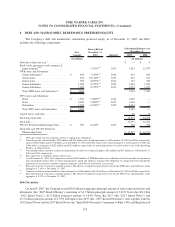

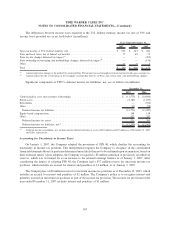

of December 31, 2007 (in millions):

Depreciation/

Amortization

Periods

Intangible assets not subject to amortization (cable franchise rights) . . . . . . . . . . . . $ 612 non-amortizable

Intangible assets subject to amortization (primarily customer relationships) . . . . . . . 66 4 years

Property, plant and equipment (primarily cable television equipment) . . . . . . . . . . . 183 1-20 years

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67 not applicable

Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (48) not applicable

Total purchase price. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 880

97

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)