Time Warner Cable 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

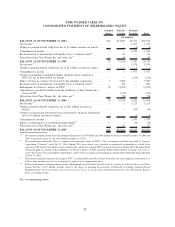

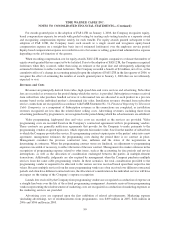

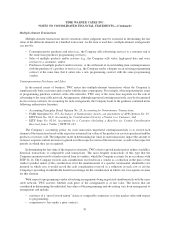

As of December 31, 2007 and 2006, the Company’s property, plant and equipment and related accumulated

depreciation included the following (in millions):

2007 2006

Estimated

Useful Lives

December 31,

Land, buildings and improvements

(a)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,070 $ 910 10-20 years

Distribution systems . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,940 10,531 3-25 years

(b)

Converters and modems . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,488 3,630 3-5 years

Vehicles and other equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,267 1,835 3-10 years

Construction in progress . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 425 637

21,190 17,543

Less: accumulated depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8,317) (5,942)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12,873 $ 11,601

(a)

Land, buildings and improvements includes $147 million and $139 million of land as of December 31, 2007 and 2006, respectively, which

is not depreciated.

(b)

Weighted-average useful lives for distribution systems are approximately 12 years.

Capitalized Software Costs

TWC capitalizes certain costs incurred for the development of internal use software. These costs, which

include the costs associated with coding, software configuration, upgrades and enhancements, are included in

property, plant and equipment in the consolidated balance sheet. Such costs are depreciated on a straight-line basis

over 3 to 5 years. These costs, net of accumulated depreciation, totaled $457 million and $371 million as of

December 31, 2007 and 2006, respectively. Amortization of capitalized software costs was $115 million in 2007,

$81 million in 2006 and $54 million in 2005.

Intangible Assets

TWC has a significant number of intangible assets, including customer relationships and cable franchises.

Customer relationships and cable franchises acquired in business combinations are recorded at fair value on the

Company’s consolidated balance sheet. Other costs incurred to negotiate and renew cable franchise agreements are

capitalized as incurred. Customer relationships acquired are amortized on a straight-line basis over their estimated

useful life (4 years) and other costs incurred to gain access to sell services to a particular property and to negotiate

and renew cable franchise agreements are amortized over the term of such franchise agreements.

Asset Impairments

Investments

TWC’s investments are primarily accounted for using the equity method of accounting. A subjective aspect of

accounting for investments involves determining whether an other-than-temporary decline in value of the

investment has been sustained. If it has been determined that an investment has sustained an other-than-

temporary decline in its value, the investment is written down to its fair value by a charge to earnings. This

evaluation is dependent on the specific facts and circumstances. For investments accounted for using the cost or

equity method of accounting, TWC evaluates information (e.g. budgets, business plans, financial statements, etc.)

in determining whether an other-than-temporary decline in value exists. Factors indicative of an other-than-

temporary decline include recurring operating losses, credit defaults and subsequent rounds of financing at an

amount below the cost basis of the Company’s investment. This list is not exhaustive and the Company weighs all

known quantitative and qualitative factors in determining if an other-than-temporary decline in the value of an

investment has occurred.

87

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)