Time Warner Cable 2007 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

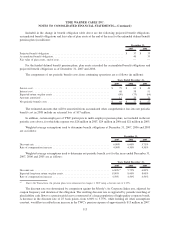

and 2006 totaled $299 million and $328 million, respectively. Payments under these arrangements are required only

in the event of nonperformance. TWC does not expect that these contingent commitments will result in any amounts

being paid in the foreseeable future.

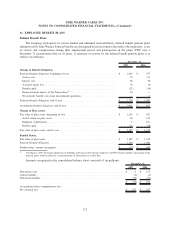

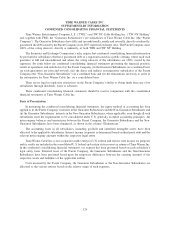

Contractual Obligations

The Company has obligations under certain contractual arrangements to make future payments for goods and

services. These contractual obligations secure the future rights to various assets and services to be used in the

normal course of operations. For example, the Company is contractually committed to make certain minimum lease

payments for the use of property under operating lease agreements. In accordance with applicable accounting rules,

the future rights and obligations pertaining to firm commitments, such as operating lease obligations and certain

purchase obligations under contracts, are not reflected as assets or liabilities in the consolidated balance sheet.

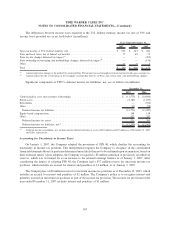

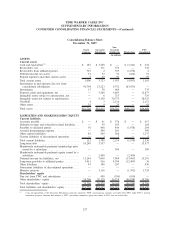

The following table summarizes the Company’s aggregate contractual obligations at December 31, 2007,

excluding obligations related to long-term debt and preferred equity that are discussed in Note 8, and the estimated

timing and effect that such obligations are expected to have on the Company’s liquidity and cash flows in future

periods. TWC expects to fund these obligations with cash provided by operating activities generated in the ordinary

course of business.

2008

2009-

2010

2011-

2012

2013 and

thereafter Total

(in millions)

Programming purchases

(a)

. . . . . . . . . . . . . . . . . . . . . . $ 2,955 $ 4,574 $ 2,964 $ 812 $ 11,305

Facility leases

(b)

............................. 101 174 143 324 742

Data processing services . . . . . . . . . . . . . . . . . . . . . . . 47 93 83 6 229

High-speed data connectivity

(c)

................... 49 39 4 20 112

Digital Phone connectivity

(d)

.................... 314 616 232 — 1,162

Set-top box and modem purchases . . . . . . . . . . . . . . . . 71 — — — 71

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74 60 4 8 146

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,611 $ 5,556 $ 3,430 $ 1,170 $ 13,767

(a)

Programming purchases represent contracts that the Company has with cable television networks to provide programming services to its

subscribers. Typically, these arrangements provide that the Company purchase cable television programming for a certain number of

subscribers as long as the Company is providing cable services to such number of subscribers. There is generally no obligation to purchase

these services if the Company is not providing cable services. Programming fees represent a significant portion of its costs of revenues.

Future fees under such contracts are based on numerous variables, including number and type of customers. The amounts included above

represent estimates of future programming costs based on subscriber numbers at December 31, 2007 applied to the per-subscriber

contractual rates contained in the contracts that were in effect as of December 31, 2007, for which the Company does not have the right to

cancel the contract or for contracts with a guaranteed minimum commitment.

(b)

The Company has facility lease obligations under various operating leases including minimum lease obligations for real estate and

operating equipment.

(c)

High-speed data connectivity obligations are based on the contractual terms for bandwidth circuits that were in use at December 31, 2007.

(d)

Digital Phone connectivity obligations relate to transport, switching and interconnection services that allow for the origination and

termination of local and long-distance telephony traffic. These expenses also include related technical support services. There is generally

no obligation to purchase these services if the Company is not providing Digital Phone service. The amounts included above are based on

the number of Digital Phone subscribers at December 31, 2007 and the per-subscriber contractual rates contained in the contracts that

were in effect as of December 31, 2007.

The Company’s total rent expense, which primarily includes facility rental expense and pole attachment rental

fees, amounted to $182 million in 2007, $149 million in 2006 and $98 million in 2005.

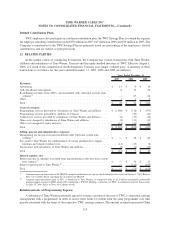

Legal Proceedings

On September 20, 2007, Brantley, et al. v. NBC Universal, Inc., et al. was filed in the U.S. District Court for the

Central District of California against the Company and Time Warner. The complaint, which also names as

defendants several other programming content providers (collectively, the “programmer defendants”) as well as

other cable and satellite providers (collectively, the “distributor defendants”), alleges violations of Sections 1 and 2

of the Sherman Antitrust Act. Among other things, the complaint alleges coordination between and among the

117

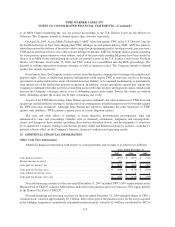

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)