Time Warner Cable 2007 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

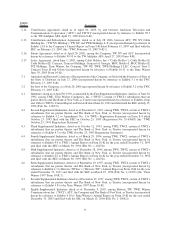

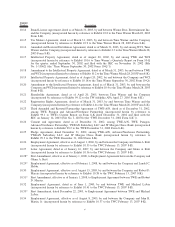

Exhibit

Number Description

10.1 Restructuring Agreement, dated as of August 20, 2002, by and among TWE, AT&T Corp. (“AT&T”),

MediaOne of Colorado, Inc. (“MediaOne of Colorado”), MediaOne TWE Holdings, Inc. (“MOTH”),

Comcast, AT&T Comcast Corporation, Time Warner, TWI Cable Inc. (“TWI Cable”), WCI and ATC

(incorporated herein by reference to Exhibit 99.1 to Time Warner’s Current Report on Form 8-K dated

August 21, 2002 and filed with the SEC on August 21, 2002 (File No. 1-15062) (the “Time Warner

August 21, 2002 Form 8-K”)).

10.2 Amendment No. 1 to the Restructuring Agreement, dated as of March 31, 2003, by and among TWE,

Comcast of Georgia, the Company, Comcast Holdings Corporation, Comcast, Time Warner, TWI Cable,

WCI, ATC, Comcast Trust I, Comcast Trust II, and TWE Holdings III Trust (“Comcast Trust III”)

(incorporated herein by reference to Exhibit 2.2 to Time Warner’s Current Report on Form 8-K dated

March 28, 2003 and filed with the SEC on April 14, 2003 (File No. 1-15062) (the “Time Warner March 28,

2003 Form 8-K”)).

10.3 Amended and Restated Contribution Agreement, dated as of March 31, 2003, by and among WCI, Time

Warner and the Company (incorporated herein by reference to Exhibit 2.4 to the Time Warner March 28,

2003 Form 8-K).

10.4 Amended and Restated Agreement of Limited Partnership of TWE, dated as of March 31, 2003, by and

among the Company, Comcast Trust I, ATC, Comcast and Time Warner (incorporated herein by reference

to Exhibit 3.3 to the Time Warner March 28, 2003 Form 8-K).

10.5 Contribution Agreement, dated as of September 9, 1994, among TWE, Advance Publications, Inc.

(“Advance Publications”), Newhouse Broadcasting Corporation (“Newhouse”), Advance/Newhouse

Partnership and Time Warner Entertainment-Advance/Newhouse Partnership (“TWE-A/N”)

(incorporated herein by reference to Exhibit 10(a) to TWE’s Current Report on Form 8-K dated

September 9, 1994 and filed with the SEC on September 21, 1994 (File No. 1-12878)).

10.6 Amended and Restated Transaction Agreement, dated as of October 27, 1997, among Advance

Publications, Advance/Newhouse Partnership, TWE, TW Holding Co. and TWE-A/N (incorporated

herein by reference to Exhibit 99(c) to Historic TW’s Current Report on Form 8-K dated October 27, 1997

and filed with the SEC on November 5, 1997 (File No. 1-12259)).

10.7 Transaction Agreement No. 2, dated as of June 23, 1998, among Advance Publications, Newhouse,

Advance/Newhouse Partnership, TWE, Paragon Communications (“Paragon”) and TWE-A/N

(incorporated herein by reference to Exhibit 10.38 to Historic TW’s Annual Report on Form 10-K for

the year ended December 31, 1998 and filed with the SEC on March 26, 1999 (File No. 1-12259) (the

“Time Warner 1998 Form 10-K”)).

10.8 Transaction Agreement No. 3, dated as of September 15, 1998, among Advance Publications, Newhouse,

Advance/Newhouse Partnership, TWE, Paragon and TWE-A/N (incorporated herein by reference to

Exhibit 10.39 to the Time Warner 1998 Form 10-K).

10.9 Amended and Restated Transaction Agreement No. 4, dated as of February 1, 2001, among Advance

Publications, Newhouse, Advance/Newhouse Partnership, TWE, Paragon and TWE-A/N (incorporated

herein by reference to Exhibit 10.53 to Time Warner’s Transition Report on Form 10-K for the year ended

December 31, 2000 and filed with the SEC on March 27, 2001 (File No. 1-15062)).

10.10 Master Transaction Agreement, dated as of August 1, 2002, by and among TWE-A/N, TWE, Paragon and

Advance/Newhouse Partnership (incorporated herein by reference to Exhibit 10.1 to Time Warner’s

Quarterly Report on Form 10-Q for the quarter ended June 30, 2002 and filed with the SEC on August 14,

2002 (File No. 1-15062) (the “Time Warner June 30, 2002 Form 10-Q”)).

10.11 Agreement and Declaration of Trust, dated as of December 18, 2003, by and between Kansas City Cable

Partners and Wilmington Trust Company (incorporated herein by reference to Exhibit 10.6 to the TWC

February 13, 2007 8-K).

10.12 Reimbursement Agreement, dated as of March 31, 2003, by and among Time Warner, WCI, ATC, TWE

and the Company (incorporated herein by reference to Exhibit 10.7 to the Time Warner March 28, 2003

Form 8-K).

10.13 Brand and Trade Name License Agreement, dated as of March 31, 2003, by and between Time Warner and

the Company (incorporated herein by reference to Exhibit 10.10 to the Time Warner March 28, 2003

Form 8-K).

iv