Time Warner Cable 2007 Annual Report Download - page 56

Download and view the complete annual report

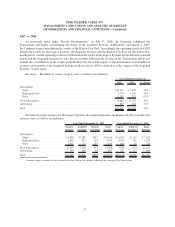

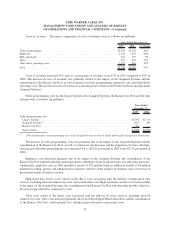

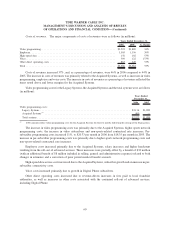

Please find page 56 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.High-speed data revenues include monthly subscriber fees from both residential and commercial subscribers,

along with related equipment rental charges, home networking fees and installation charges. High-speed data

revenues also included fees received from certain distributors of TWC’s Road Runner

TM

high-speed data service

(including a subsidiary of TWE-A/N managed by the Advance/Newhouse Partnership), which in the aggregate

totaled $132 million, $112 million and $92 million in 2007, 2006 and 2005, respectively, and fees received from

third-party internet service providers. Additionally, in 2006 and 2005, high-speed data revenues included fees

received from TKCCP.

Voice revenues include monthly subscriber fees from residential and commercial voice subscribers, including

Digital Phone subscribers and circuit-switched subscribers acquired from Comcast in the Exchange (9,000 and

106,000 subscribers as of December 31, 2007 and December 31, 2006, respectively), along with related installation

charges. TWC is in the process of discontinuing the circuit-switched offering in accordance with regulatory

requirements. In those areas where the circuit-switched offering is discontinued, Digital Phone is the only voice

service TWC provides.

Advertising revenues include the fees charged to local, regional and national advertising customers for

advertising placed on the Company’s video and high-speed data services. Nearly all Advertising revenues are

attributable to the Company’s video service.

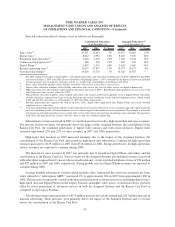

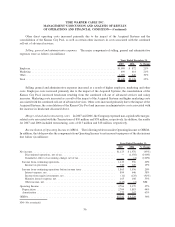

Costs and Expenses

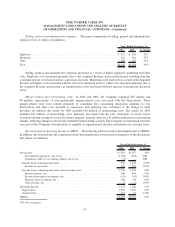

Costs of revenues include: video programming costs (including fees paid to the programming vendors net of

certain amounts received from the vendors); high-speed data connectivity costs; Digital Phone network costs; other

service-related expenses, including non-administrative labor costs directly associated with the delivery of services

to subscribers; maintenance of the Company’s delivery systems; franchise fees; and other related costs. The

Company’s programming agreements are generally multi-year agreements that provide for the Company to make

payments to the programming vendors at agreed upon rates based on the number of subscribers to which the

Company provides the service.

Selling, general and administrative expenses include amounts not directly associated with the delivery of

services to subscribers or the maintenance of the Company’s delivery systems, such as administrative labor costs,

marketing expenses, billing charges, non-plant repair and maintenance costs, fees paid to Time Warner for

reimbursement of certain administrative support functions and other administrative overhead costs. Additionally,

management fees received from TKCCP prior to August 1, 2006 were recorded as a reduction of selling, general and

administrative expenses.

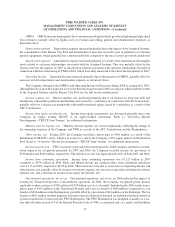

Use of Operating Income before Depreciation and Amortization and Free Cash Flow

Operating Income before Depreciation and Amortization (“OIBDA”) is a financial measure not calculated and

presented in accordance with U.S. generally accepted accounting principles (“GAAP”). The Company defines

OIBDA as Operating Income before depreciation of tangible assets and amortization of intangible assets.

Management utilizes OIBDA, among other measures, in evaluating the performance of the Company’s

business because OIBDA eliminates the uneven effect across its business of considerable amounts of

depreciation of tangible assets and amortization of intangible assets recognized in business combinations.

Additionally, management utilizes OIBDA because it believes this measure provides valuable insight into the

underlying performance of the Company’s individual cable systems by removing the effects of items that are not

within the control of local personnel charged with managing these systems such as income tax provision, other

income (expense), net, minority interest expense, net, income from equity investments, net, and interest expense,

net. In this regard, OIBDA is a significant measure used in the Company’s annual incentive compensation programs.

OIBDA also is a metric used by the Company’s parent, Time Warner, to evaluate the Company’s performance and is

an important measure in the Time Warner reportable segment disclosures. A limitation of this measure, however, is

that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating

51

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)