Time Warner Cable 2007 Annual Report Download - page 109

Download and view the complete annual report

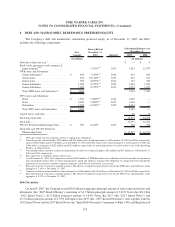

Please find page 109 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of the net proceeds was used to repay a portion of the outstanding indebtedness under the Five-Year Term Facility on

April 27, 2007, which reduced such facility from $4.0 billion to $3.045 billion.

Borrowings under the Cable Revolving Facility bear interest at a rate based on the credit rating of TWC, which

rate was LIBOR plus 0.27% per annum at December 31, 2007. In addition, TWC is required to pay a facility fee on

the aggregate commitments under the Cable Revolving Facility at a rate determined by the credit rating of TWC,

which rate was 0.08% per annum at December 31, 2007. TWC may also incur an additional usage fee of 0.10% per

annum on the outstanding loans and other extensions of credit under the Cable Revolving Facility if and when such

amounts exceed 50% of the aggregate commitments thereunder. Borrowings under the Five-Year Term Facility bear

interest at a rate based on the credit rating of TWC, which rate was LIBOR plus 0.40% per annum at December 31,

2007.

The Cable Revolving Facility provides same-day funding capability and a portion of the commitment, not to

exceed $500 million at any time, may be used for the issuance of letters of credit. The Cable Revolving Facility and

the Five-Year Term Facility contain a maximum leverage ratio covenant of 5.0 times the consolidated EBITDA of

TWC. The terms and related financial metrics associated with the leverage ratio are defined in the applicable

agreements. At December 31, 2007, TWC was in compliance with the leverage covenant, with a leverage ratio,

calculated in accordance with the agreements, of approximately 2.3 times. The Cable Revolving Facility and the

Five-Year Term Facility do not contain any credit ratings-based defaults or covenants or any ongoing covenant or

representations specifically relating to a material adverse change in the financial condition or results of operations

of Time Warner or TWC. Borrowings under the Cable Revolving Facility may be used for general corporate

purposes, and unused credit is available to support borrowings under TWC’s commercial paper program.

In addition to the Cable Revolving Facility and the Five-Year Term Facility, TWC maintains a $6.0 billion

unsecured commercial paper program (the “CP Program”) that is also guaranteed by TW NY Holding and TWE.

Commercial paper issued under the CP Program is supported by unused committed capacity under the Cable

Revolving Facility and ranks pari passu with other unsecured senior indebtedness of TWC, TWE and TW NY

Holding. As a result of recent market volatility in the U.S. debt markets, including the dislocation of the overall

commercial paper market, TWC has decreased the amount of commercial paper outstanding under the CP Program,

and has offset this decrease by increasing borrowings outstanding under the Cable Revolving Facility.

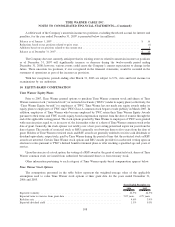

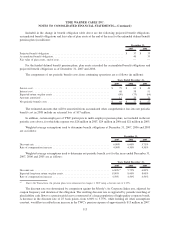

As of December 31, 2007, there were borrowings of $3.045 billion outstanding under the Five-Year Term

Facility, borrowings of $1.800 billion and letters of credit totaling $135 million outstanding under the Cable

Revolving Facility, and $416 million of commercial paper outstanding under the CP Program. TWC’s available

committed capacity under the Cable Revolving Facility as of December 31, 2007 was $3.649 billion, and TWC had

$232 million of cash and equivalents on hand.

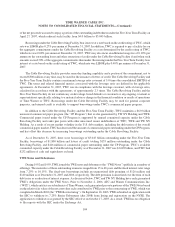

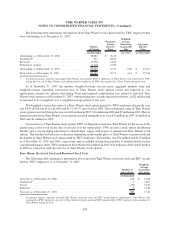

TWE Notes and Debentures

During 1992 and 1993, TWE issued the TWE notes and debentures (the “TWE Notes”) publicly in a number of

offerings. The maturities of these outstanding issuances ranged from 15 to 40 years and the fixed interest rates range

from 7.25% to 10.15%. The fixed-rate borrowings include an unamortized debt premium of $126 million and

$140 million as of December 31, 2007 and 2006, respectively. The debt premium is amortized over the term of each

debt issue as a reduction of interest expense. As discussed below, TWC and TW NY Holding have each guaranteed

TWE’s obligations under the TWE Notes. Prior to November 2, 2006, ATC and Warner Communications Inc.

(“WCI”), which entities are subsidiaries of Time Warner, each guaranteed pro rata portions of the TWE Notes based

on the relative fair value of the net assets that each contributed to TWE prior to the restructuring of TWE, which was

completed in March 2003 (the “TWE Restructuring”). On September 10, 2003, TWE submitted an application with

the SEC to withdraw its 7.25% Senior Debentures (due 2008) from listing and registration on the NYSE. The

application to withdraw was granted by the SEC effective on October 17, 2003. As a result, TWE has no obligation

to file reports with the SEC under the Exchange Act.

104

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)