Time Warner Cable 2007 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to an MDL Order transferring the case for pretrial proceedings to the U.S. District Court for the District of

Delaware. The Company intends to defend against these lawsuits vigorously.

On April 26, 2005, Acacia Media Technologies (“AMT”) filed suit against TWC in the U.S. District Court for

the Southern District of New York alleging that TWC infringes several patents held by AMT. AMT has publicly

taken the position that delivery of broadcast video (except live programming such as sporting events), pay-per-view,

VOD and ad insertion services over cable systems infringe its patents. AMT has brought similar actions regarding

the same patents against numerous other entities, and all of the previously pending litigations have been made the

subject of an MDL Order consolidating the actions for pretrial activity in the U.S. District Court for the Northern

District of California. On October 25, 2005, the TWC action was consolidated into the MDL proceedings. The

plaintiff is seeking unspecified monetary damages as well as injunctive relief. The Company intends to defend

against this lawsuit vigorously.

From time to time, the Company receives notices from third parties claiming that it infringes their intellectual

property rights. Claims of intellectual property infringement could require TWC to enter into royalty or licensing

agreements on unfavorable terms, incur substantial monetary liability or be enjoined preliminarily or permanently

from further use of the intellectual property in question. In addition, certain agreements entered may require the

Company to indemnify the other party for certain third-party intellectual property infringement claims, which could

increase the Company’s damages and its costs of defending against such claims. Even if the claims are without

merit, defending against the claims can be time consuming and costly.

As part of the TWE Restructuring, Time Warner agreed to indemnify the cable businesses of TWE from and

against any and all liabilities relating to, arising out of or resulting from specified litigation matters brought against

the TWE non-cable businesses. Although Time Warner has agreed to indemnify the cable businesses of TWE

against such liabilities, TWE remains a named party in certain litigation matters.

The costs and other effects of pending or future litigation, governmental investigations, legal and

administrative cases and proceedings (whether civil or criminal), settlements, judgments and investigations,

claims and changes in those matters (including those matters described above), and developments or assertions

by or against the Company relating to intellectual property rights and intellectual property licenses, could have a

material adverse effect on the Company’s business, financial condition and operating results.

15. ADDITIONAL FINANCIAL INFORMATION

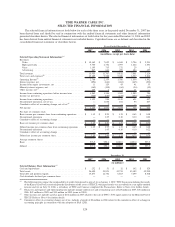

Other Cash Flow Information

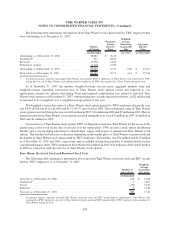

Additional financial information with respect to cash (payments) and receipts is as follows (in millions):

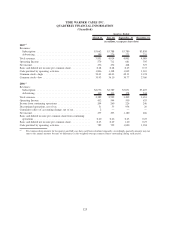

2007 2006 2005

Years Ended December 31,

Cash paid for interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (855) $ (667) $ (507)

Interest income received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 5 —

Cash paid for interest, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (845) $ (662) $ (507)

Cash paid for income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (298) $ (478) $ (541)

Cash refunds of income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 4 6

Cash paid for income taxes, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (292) $ (474) $ (535)

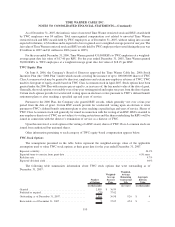

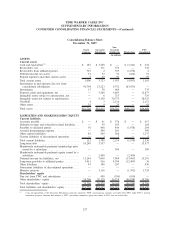

Noncash financing activities for the year ended December 31, 2007 included TWC’s 50% equity interest in the

Houston Pool of TKCCP, valued at $880 million, delivered as the purchase price for Comcast’s 50% equity interest

in the Kansas City Pool of TKCCP.

Noncash financing and investing activities for the year ended December 31, 2006 included shares of TWC’s

common stock, valued at approximately $5.5 billion, delivered as part of the purchase price for the assets acquired

in the Adelphia Acquisition, mandatorily redeemable preferred equity, valued at $2.4 billion, contributed by ATC to

119

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)