Time Warner Cable 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

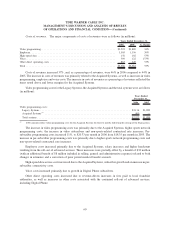

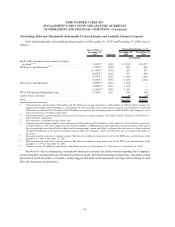

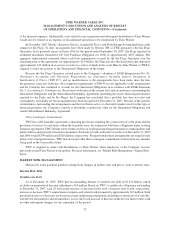

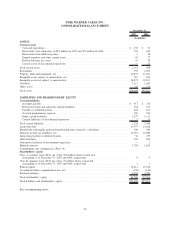

Outstanding Debt and Mandatorily Redeemable Preferred Equity and Available Financial Capacity

Debt and mandatorily redeemable preferred equity as of December 31, 2007 and December 31, 2006 were as

follows:

Interest Rate at

December 31,

2007 Maturity

December 31,

2007

December 31,

2006

Outstanding Balance as of

(in millions)

Bank credit agreements and commercial paper

program

(a)(b)

................................. 5.391%

(c)

2011 $ 5,256 $11,077

TWE notes and debentures

(d)(e)

..................... 7.250%

(f)

2008 601 602

10.150%

(f)

2012 267 271

8.875%

(f)

2012 365 369

8.375%

(f)

2023 1,040 1,043

8.375%

(f)

2033 1,053 1,055

TWC notes and debentures . . . . . . . . . . . . . . . . . . . . . . . . 5.400%

(g)

2012 1,498 —

5.850%

(g)

2017 1,996 —

6.550%

(g)

2037 1,491 —

TW NY Preferred Membership Units . . . . . . . . . . . . . . . . . 8.210% 2013 300 300

Capital leases and other . . . . . . . . . . . . . . . . . . . . . . . . . . 10

(h)

15

(h)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $13,877 $14,732

(a)

Unused capacity, which includes $232 million and $51 million in cash and equivalents as of December 31, 2007 and 2006, respectively,

equals $3.881 billion and $2.798 billion as of December 31, 2007 and 2006, respectively. Unused capacity as of December 31, 2007 and

2006 reflects a reduction of $135 million and $159 million, respectively, for outstanding letters of credit backed by the Company’s senior

unsecured five-year revolving credit facility.

(b)

Outstanding balance amounts exclude an unamortized discount on commercial paper of $5 million and $17 million as of December 31,

2007 and 2006, respectively.

(c)

Rate represents a weighted-average interest rate.

(d)

Amounts include an unamortized fair value adjustment of $126 million and $140 million as of December 31, 2007 and 2006, respectively.

(e)

As of December 31, 2007, the Company has classified $601 million of TWE debentures due within the next twelve months as long-term in

the accompanying consolidated balance sheet to reflect management’s intent and ability to refinance the obligation on a long-term basis

through the utilization of the unused committed capacity under the Company’s senior unsecured five-year revolving credit facility, if

necessary.

(f)

Rate represents the stated rate at original issuance. The effective weighted-average interest rate for the TWE notes and debentures in the

aggregate is 7.64% at December 31, 2007.

(g)

Rate represents the stated rate at original issuance. The effective weighted-average interest rate for the TWC notes and debentures in the

aggregate is 5.97% at December 31, 2007.

(h)

Amounts include $4 million of capital leases due within one year as of December 31, 2006 (none as of December 31, 2007).

See Note 8 to the accompanying consolidated financial statements for further details regarding the Company’s

outstanding debt and mandatorily redeemable preferred equity and other financing arrangements, including certain

information about maturities, covenants, rating triggers and bank credit agreement leverage ratios relating to such

debt and financing arrangements.

69

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)