Time Warner Cable 2007 Annual Report Download - page 119

Download and view the complete annual report

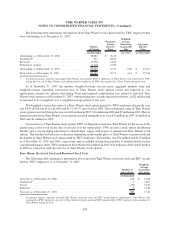

Please find page 119 of the 2007 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In developing the expected long-term rate of return on assets, the Company considered the pension portfolio’s

composition, past average rate of earnings and discussions with portfolio managers. The expected long-term rate of

return is based on an asset allocation assumption of 75% equity securities and 25% fixed-income securities, which

approximated the actual allocation as of December 31, 2007. A decrease in the expected long-term rate of return of

25 basis points, from 8.00% to 7.75%, while holding all other assumptions constant, would have resulted in an

increase in the Company’s pension expense of approximately $3 million in 2007.

As of December 31, 2006, the Company converted to the RP-2000 Mortality Table for calculating the year-end

2007 and year-end 2006 pension obligations and 2007 expense. The impact of this change increased consolidated

pension expense for 2007 by $9 million. Additional demographic assumptions such as retirement and turnover rates

were also updated to reflect recent plan experience, which increased consolidated pension expense for 2007 by

$8 million.

The pension assets are held in a master trust with plan assets of another Time Warner defined benefit pension

plan (the “Master Trust”). The Master Trust’s assets include 4.4 million shares of Time Warner common stock in the

amount of $73 million (2% of total plan assets held in the Master Trust) as of December 31, 2007 and 4.4 million

shares in the amount of $97 million (3% of total plan assets held in the Master Trust) as of December 31, 2006. The

Master Trust’s weighted-average asset allocations by asset category are as follows: 79% equity securities and 21%

fixed-income securities as of December 31, 2007 and 77% equity securities and 23% fixed-income securities as of

December 31, 2006.

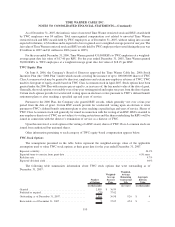

The Company’s investment policy for its pension plans is to maximize the long-term rate of return on plan

assets within an acceptable level of risk while maintaining adequate funding levels. The Company’s current broad

strategic targets are to have a pension assets portfolio comprising 75% equity securities and 25% fixed-income

securities, both within a target range of +/- five percentage points. Within equity securities, the Company’s objective

is to achieve asset diversity in order to increase return and reduce volatility. The Company has asset allocation

policy target ranges for growth and value U.S. equity securities; large, mid, and small capitalization U.S. equity

securities; international equity securities; and alternative investments. The Company’s fixed-income securities are

investment grade in aggregate. A portion of the fixed-income allocation is reserved in short-term cash investments

to provide for expected pension benefits to be paid in the short term.

The Company continuously monitors the performance of the overall pension assets portfolio, asset allocation

policies, and the performance of individual pension assets managers and makes adjustments and changes, as

required. Every five years, or more frequently if appropriate, the Company conducts a broad strategic review of its

portfolio construction and asset-allocation policies. The Company does not manage any assets internally, does not

have any passive investments in index funds, and does not utilize futures, options, or other derivative instruments or

hedging with regards to the pension plan (although the investment mandate of some pension asset managers allows

limited use of derivatives as components of their standard portfolio management strategies).

After considering the funded status of the Company’s defined benefit pension plans, movements in the

discount rate, investment performance and related tax consequences, the Company may choose to make

contributions to its pension plans in any given year. As of December 31, 2007, there were no minimum

required contributions for TWC’s funded plans. The Company expects to make discretionary cash

contributions of approximately $150 million to its funded plans during 2008, subject to market conditions and

other considerations. For the Company’s unfunded plan, contributions will continue to be made to the extent

benefits are paid. Benefit payments for the unfunded plan are expected to be $2 million in 2008.

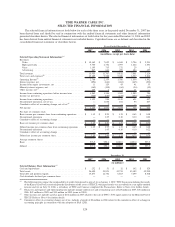

Benefit payments for the Company’s defined benefit pension plans related to continuing operations, including

the unfunded plan previously discussed, are expected to be $19 million in 2008, $22 million in 2009, $25 million in

2010, $29 million in 2011, $34 million in 2012 and $267 million in 2013 to 2017.

114

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)