Time Magazine 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

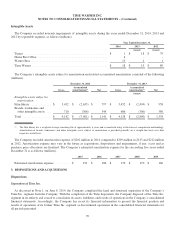

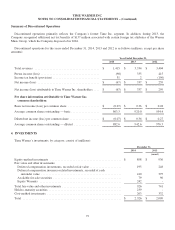

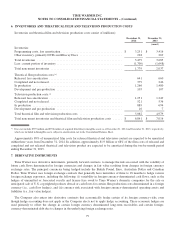

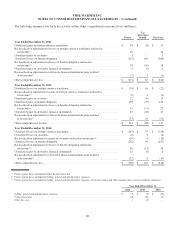

6. INVENTORIES AND THEATRICAL FILM AND TELEVISION PRODUCTION COSTS

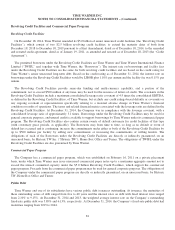

Inventories and theatrical film and television production costs consist of (millions):

December 31,

2014

December 31,

2013

(recast)

Inventories:

Programming costs, less amortization ........................................ $ 3,251 $ 3,416

Other inventory, primarily DVDs and Blu-ray Discs ............................ 228 269

Total inventories ........................................................ 3,479 3,685

Less: current portion of inventory ........................................... (1,700) (1,648)

Total noncurrent inventories ............................................... 1,779 2,037

Theatrical film production costs:(a)

Released, less amortization ................................................ 641 660

Completed and not released ................................................ 379 246

In production ........................................................... 1,266 1,480

Development and pre-production ........................................... 105 107

Television production costs:(a)

Released, less amortization ................................................ 1,251 1,249

Completed and not released ................................................ 521 536

In production ........................................................... 889 694

Development and pre-production ........................................... 10 7

Total theatrical film and television production costs ............................ 5,062 4,979

Total noncurrent inventories and theatrical film and television production costs ...... $ 6,841 $ 7,016

(a) Does not include $797 million and $958 million of acquired film library intangible assets as of December 31, 2014 and December 31, 2013, respectively,

which are included in Intangible assets subject to amortization, net in the Consolidated Balance Sheet.

Approximately 89% of unamortized film costs for released theatrical and television content are expected to be amortized

within three years from December 31, 2014. In addition, approximately $1.9 billion or 68% of the film costs of released and

completed and not released theatrical and television product are expected to be amortized during the twelve-month period

ending December 31, 2015.

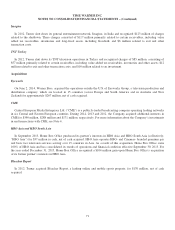

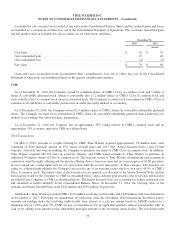

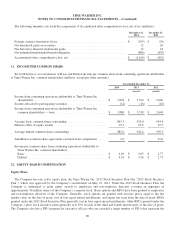

7. DERIVATIVE INSTRUMENTS

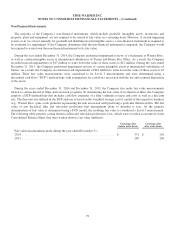

Time Warner uses derivative instruments, primarily forward contracts, to manage the risk associated with the volatility of

future cash flows denominated in foreign currencies and changes in fair value resulting from changes in foreign currency

exchange rates. The principal currencies being hedged include the British Pound, Euro, Australian Dollar and Canadian

Dollar. Time Warner uses foreign exchange contracts that generally have maturities of three to 18 months to hedge various

foreign exchange exposures, including the following: (i) variability in foreign-currency-denominated cash flows, such as the

hedges of unremitted or forecasted royalty and license fees owed to Time Warner’s domestic companies for the sale or

anticipated sale of U.S. copyrighted products abroad or cash flows for certain film production costs denominated in a foreign

currency (i.e., cash flow hedges), and (ii) currency risk associated with foreign-currency-denominated operating assets and

liabilities (i.e., fair value hedges).

The Company also enters into derivative contracts that economically hedge certain of its foreign currency risks, even

though hedge accounting does not apply or the Company elects not to apply hedge accounting. These economic hedges are

used primarily to offset the change in certain foreign currency denominated long-term receivables and certain foreign-

currency-denominated debt due to changes in the underlying foreign exchange rates.

79